Portland Cement Market, By Product (Ordinary and White Portland Cement), By Application (Construction, Cement Bricks, Infrastructure, Plasters, and Screeds) and Geography (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) Analysis, Share, Trends, Size, & Forecast from 2014 2025

|

Report ID

AV421

|

Published Date

October 2020

|

Pages

138

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The Portland Cement Market was valued at USD 4.59 billion tons by 2018, growing with 4.1% CAGR during the forecast period, 2019-2025.

Market Dynamics

Portland cement also termed as hydraulic binding material, is a finely gray ground powder, consisting of limestone, portland cement clinker, gypsum, and granulated blast furnace slag. It is manufactured through grinding and burning a mixture of these products. The global Portland cement market is witnessing a considerable growth on account of its increasing demand from the infrastructure sector, especially in the residential & commercial construction sector. Increasing government investments for the development and manufacture of chemical free Portland cement is also expected to encourage various manufacturers to enter the market. Other factors such as rising demand for concrete, stucco, mortar & grout, low cost & easy availability of the materials (such as limestone, and shale) support the industry growth. On the other hand, side effects such as chemical burns & lung cancer owing to increased exposure to Portland cement above minimum level is likely to hamper the industry growth over the projected period. Further, manufacturing, mining, and transporting cement causes heavy air pollution which is expected to cause a downward trend in the global Portland cement market.

Product Takeaway

The Portland cement industry, by-product segment is broadly divided into Ordinary Portland Cement and White Portland Cement. Ordinary Portland cement is sub segmented into type I, II, III, IV, and V on the basis of their durability, rate of hydration, strength, and ability to resist attack. Type I is a general purpose cement driven by constructions of bridges, pavements, and precast units.

Increasing demand for construction structures that are resistant to sulfate ions is expected to drive the demand for type II and V. It is expected that type IV Portland cement will witness a downward trend in the market on account of reduced utilization of this cement in the construction of massive structures such as dams.

White Portland Cement segment is expected to witness considerable growth on account of increased utilization in decorative items and general construction. Growing utilization of white Portland cement in undertaking research and development activities is also expected to cause an upward trend in the industry owing to improved nuclear magnetic resonance (NMR) resolutions due to the absence of iron in the cement.

Application Takeaway

Depending upon the application, the Portland cement market is segmented into construction, cement bricks, infrastructure, plasters, and screeds. Concrete, being a main component in construction industry, is expected to drive the market on account of its increasing demand for construction of various structures such as panels and road furniture. Increasing demand from the infrastructure sector is anticipated to contribute substantially towards market growth owing to the rising construction of roads, dams and foundations.

Regional Takeaway

Developed regions such as North America and Europe accounted for significant revenue share. Regulations have been implemented by the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH) pertaining legal limit of Portland cement used in workplaces. OSHA has set a permissible exposure limit of 50mppcf over an 8-hour workday. The National Institute for Occupational Safety and Health (NIOSH) has set a total recommended exposure limit (REL) of 10 mg/m3 and respiratory exposure of 5 mg/m3 over an 8-hour workday. Such initiatives support these regional growths to a great extent.

Europe dominated the Portland cement market and it is likely that this region will witness a decent trend owing to increasing demand for blended cement. Germany’s Heidelberg Cement successfully merged with three companies of the Carpet Group so as to gain a competitive edge in the market. Carpat Cement, Carpat Beton and Carpat Agregate merged to form Heidelberg Cement so as to gain a dominant share in the overall market over the projected period.

The Asia Pacific is likely to grow with a promising growth rate owing to the rising demand from the construction and infrastructure sector. Countries such as India, China, and Japan are expected to drive the demand for Portland cement on account of globalization, industrialization, and urbanization. Additionally, an increasing number of airport construction projects monitored by the Centre for Aviation (CAPA) is also anticipated to augment market growth. Countries such as Saudi Arabia, UAE, and Qatar are expected to spur the market growth owing to increased investments in the infrastructure sector of these countries.

Latin America is expected to witness low growth owing to slow development of construction and infrastructure industries. Countries such as Russia and Brazil are also expected to drive demand for Portland cement owing to the global events such as FIFA World Cup 2018 and Olympic Games 2016 respectively.

Key Vendors Takeaway

Key industry players are Lafarge, Alamo Cement Company, Heidelberg Cement, Martin Marietta Materials, National Cement Company of California, Tanzania Portland Cement Company, Argos USA Corporation, Holcim, CNBM, Salt River Materials Group, ESSROC Cement Corporation, Anhui Conch, American Cement Company, QUIKRETE, Ash Grove Cement Company, Capitol Aggregates Limited, CalPortland Company, CEMEX USA, Drake Cement, Federal White Cement, and GCC of America, Inc.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 to 2017

- Base Year – 2018

- Estimated Year – 2019

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Ordinary Portland Cement

- Type I

- Type II

- Type III

- Type IV

- Type V

- White Portland Cement

MARKET, BY APPLICATION

- Construction

- Cement Bricks

- Infrastructure

- Plasters

- Screeds

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. PORTLAND CEMENT MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. PORTLAND CEMENT KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. PORTLAND CEMENT INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. PORTLAND CEMENT MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key Manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. PORTLAND CEMENT MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2018 & 2025 (%)

6.2. Ordinary Portland Cement

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.3. Type I

6.2.3.1. Overview

6.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.4. Type II

6.2.4.1. Overview

6.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.5. Type III

6.2.5.1. Overview

6.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.6. Type IV

6.2.6.1. Overview

6.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.7. Type V

6.2.7.1. Overview

6.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. White Portland Cement

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. PORTLAND CEMENT MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2018 & 2025 (%)

7.2. Construction

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Cement Bricks

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Infrastructure

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Plasters

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Screeds

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.7. Others

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. PORTLAND CEMENT MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2018 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Lafarge

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Alamo Cement Company

9.3. Heidelberg Cement

9.4. Martin Marietta Materials

9.5. National Cement Company of California

9.6. Tanzania Portland Cement Company

9.7. Argos USA Corporation

9.8. Holcim

9.9. CNBM

9.10. Salt River Materials Group

9.11. ESSROC Cement Corporation

9.12. Anhui Conch

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

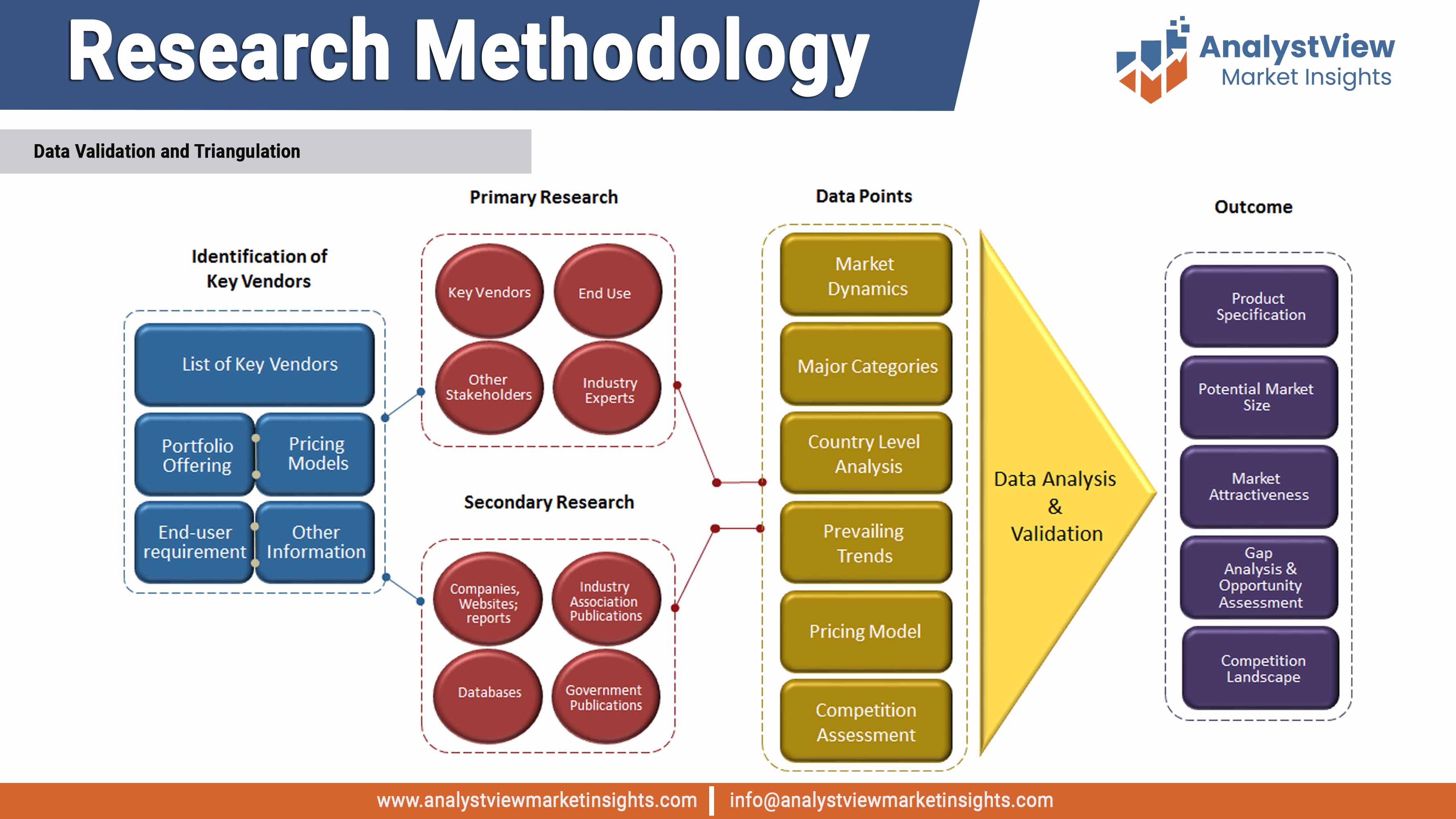

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Portland Cement market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Portland Cement market, by Product 2014-2025 (USD Million)

TABLE Portland Cement market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Portland Cement market, by Application 2014-2025 (USD Million)

TABLE Portland Cement market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Portland Cement market, by Region 2014-2025 (USD Million)

TABLE North America Portland Cement market, by Country, 2014-2025 (USD Million)

TABLE North America Portland Cement market, by Product, 2014-2025 (USD Million)

TABLE North America Portland Cement market, by Application, 2014-2025 (USD Million)

TABLE Europe Portland Cement market, by country, 2014-2025 (USD Million)

TABLE Europe Portland Cement market, by Product, 2014-2025 (USD Million)

TABLE Europe Portland Cement market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Portland Cement market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Portland Cement market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Portland Cement market, by Application, 2014-2025 (USD Million)

TABLE Latin America Portland Cement market, by country, 2014-2025 (USD Million)

TABLE Latin America Portland Cement market, by Product, 2014-2025 (USD Million)

TABLE Latin America Portland Cement market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Portland Cement market, by country, 2014-2025 (USD Million)

TABLE Middle East and Africa Portland Cement market, by Product, 2014-2025 (USD Million)

TABLE Middle East and Africa Portland Cement market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Portland Cement market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2018 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Ordinary Portland Cement market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Type I market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Type II market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Type III market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Type IV market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Type V market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE White Portland Cement market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2018 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Construction market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cement Bricks market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Infrastructure market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Plasters market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Screeds market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2018 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Portland Cement market share and leading players, 2018

FIGURE Europe Portland Cement market share and leading players, 2018

FIGURE Asia Pacific Portland Cement market share and leading players, 2018

FIGURE Latin America Portland Cement market share and leading players, 2018

FIGURE Middle East and Africa Portland Cement market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Spain market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Italy market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE UK market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE France market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Japan market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE South Korea market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Singapore market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of APAC market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market share analysis by country, 2018

FIGURE Brazil market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mexico market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Argentina market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of LATAM market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market share analysis by country, 2018

FIGURE Saudi Arabia market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE United Arab Emirates market size, forecast and trend analysis, 2014 to 2025 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS