Automotive Wiring Harness Market: By Application (Ignition System, Charging System, Drivetrain and Powertrain System, Infotainment System, Vehicle Control and Safety System), by components (electric wires, terminals, connectors), by Vehicle Type (Passenger Cars and Commercial Vehicles), and by Geography (North America, Europe, Asia-Pacific, South America, and Africa) - Analysis, Share, Trends, Size, & Forecast From 2021-2027

REPORT HIGHLIGHT

The Automotive Wiring Harness market was worth USD 43.9 billion in 2020 and is anticipated to grow to USD 55.8 billion by 2027, with a CAGR of more than 4.9% during the forecast period. Growing emphasis on safety solutions, increasing demand for the use of hybrid & electric vehicles, and increasing electrification of vehicles are some of the key drivers propelling the market's growth.

Wire harnesses are the central framework of a vehicle, consisting of compactly bundled wires and data circuits. Automobiles are fitted with numerous electronics and electrical systems that work utilizing control signals running on electrical power supplied from the battery to assure safety and fundamental operations (such as moving, turning, and stopping), as well as offering comfort and convenience. The wire harness is the conduit via which these messages and electrical power are transmitted.

MARKET DYNAMICS

Compliance with difficulties such as vibration, friction, and hardware protection has long been a top priority for automakers. For safety, dependability, and minimal downtime, selecting the right solution is crucial. The need for more durable, high-performance systems is likely to rise as the automobile sector pushes its tools to ever higher boundaries in order to explore new applications. Leading automotive wire harness manufacturers are concentrating on producing technologically sophisticated products as well as improving vehicle quality in terms of safety, dependability, and downtime. Previously, the harness was a commodity product driven by pricing; now, autonomous driving and electrification are causing a paradigm shift in the sector. The harness has become not only the most expensive purchased element in the car, but also one of the most quality important since it increasingly allows safety-critical tasks like steering, braking, and lane change.

A battery, engine control units, and motors coupled in the driveline/transmission system all have connectors, terminals, and cables in the powertrain system of a vehicle. The operating voltage across the above-mentioned powertrain components grew from 48V to 800V in response to the growing demand for high-performance cars. As a result, with the electrification of a vehicle's powertrain system, the requirement for high voltage connections, robust terminals, and strong wire insulation grew. Manufacturers are always trying to improve vehicle high voltage connectors in terms of compact design and connection with a solid locking mechanism, as well as an increase in their power handling capabilities, in order to keep up with rising automotive trends.

The governments of the United States, China, France, and Germany have already enacted rules and regulations governing vehicular emissions, and have ordered automakers to employ innovative technology to battle excessive vehicle emissions. The amount of pollution produced is mostly determined by the vehicle's overall weight. Automobile manufacturers are increasingly required to equip even their entry-level vehicles with many safeties and driver-assistance technologies, as worries about driver and passenger safety, as well as pedestrian safety, rise. As a result, sophisticated driver safety technologies such as forward collision warning systems, blind-spot recognition, and other similar systems are in high demand.

The market's growth may be hampered by concerns like dependability and durability. With the constant rise in accidents caused by automation mistakes, both customers and governments are exhibiting increased interest in sophisticated safety features and are concentrating on upgrading their vehicle's safety systems, which is likely to drive the wire harness market.

MARKET SEGMENTATION

The market for wiring harnesses can be segmented on the basis of components, application & vehicle type.

Base on components:

The market has been segmented into electric wires, terminals, connectors, and others, with protectors, grommets, clamps, convoluted tubes, and sheaths included in the others category. Over the projected period, the widespread use of sophisticated vehicle technologies such as self-driving vehicles and connected vehicles will be a major driver boosting sales of automotive terminals. Vehicles equipped with modern safety systems such as airbags, anti-lock brake systems (ABS), and vehicle immobilizers utilize connectors found in wire harnesses. As the number of vehicle thefts rises, the necessity to integrate safety systems into cars is likely to rise, creating demand for connections.

Based on application:

Wiring harness is used in major electric systems such as Charging System, Ignition System, Infotainment System, Drivetrain and Powertrain System, Vehicle Control and Safety System. An ignition system is a leading segment due to its importance and presence in all ranges of combustion & hybrid vehicles. Charging and drivetrain segments are expected to boost demand due to the increasing demand for electric and hybrid vehicles. Vehicle control, Infotainment, and safety systems are also major contributors due to rising customer demand and increasing technological advancements in vehicle amenities.

By electric vehicle type:

Because of their capacity to provide various environmental, social, and health advantages, BEVs have gained popularity. During the projection period, BEVs are expected to expand at a substantial rate. HEV sales are anticipated to decline by 32% by 2027. HEVs are expected to account for 62 percent of all-electric vehicle sales in 2019. Increased gasoline prices, monetary and other government incentives, and the construction of charging infrastructure are all anticipated to boost demand for BEVs.

Regional Takeaways

North America and Europe are the leading regions in terms of product development and research. Electronics solution suppliers in the United States have stated that demand for electrical wire harnesses and cable assembly is outstripping production capacity. Customers are seeking alternative contract manufacturers to assist fulfil current electrical cable design and assembly demands, which is contributing to this trend. Germany is by far the largest importer of automotive wire harnesses in the EU. Several of the largest harness businesses, on the other hand, have headquarters, design and testing laboratories, and logistics hubs in Germany, despite the fact that it is not a low-cost labor market.

Since 2009, China has developed to be the world's largest carmaker. In 2018, China accounted for more than 30% of global car manufacturing. This capability dwarfs that of the European Union, the United States, and Japan put together. The Indian automobile sector is undergoing significant transition and expansion, owing to sustained economic growth and infrastructure development. The Indian car industry has risen to become the world's seventh biggest, and the auto components business is preparing to keep up with the expansion of the vehicle sector. Such developing economies have the potential to contribute significantly to grow the demand in the Asia Pacific region.

COVID-19 IMPACT

The stoppage of several OEM manufacturing lines as a result of the Covid-19 epidemic has had an indirect impact on the Automotive Wiring Harness Market. While the research and development of various technologies and schematics may be done remotely, the manufacture of these devices and harnesses necessitated the use of separate facilities. However, due to the lockdown and social distancing standards, the development facilities were shut down, and production was put on hold. The market's future prospects are bright, thanks to worldwide customer preferences for private transportation, rising demand for autonomous cars, and increased safety. More autonomous cars will be deployed to combat the economic downturn and stabilize revenue as a result of the Covid-19 epidemic impacting the global transport industry.

KEY PLAYERS

Major players in automotive wiring harness systems are Leoni AG, Yazaki Group, Fujikura Ltd., Motherson Sumi Systems, Lear Corporation, BorgWarner inc., Sumimoto Electric, Furukawa Electric Company, Nexans, YURA Tech Corporation, PKC Group, Delphi Technologies, THB Group, Aptiv PLC and AmWINS group.

BorgWarner Inc. announced the completion of its acquisition of Delphi Technologies in October 2020. BorgWarner and Delphi Technologies' merger is intended to improve BorgWarner's electronics and power electronics products, capabilities, and scale, resulting in a leader in electrified propulsion systems that BorgWarner thinks is well-positioned to take advantage of future opportunities.

In September 2020, Motherson Sumi Systems Limited would pay USD 65.7 million for the wire harness business of Stoneridge Inc, located in the United States. The purchased company has a revenue of around USD 300 million.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2016 to 2019

- Base Year – 2020

- Projected Year – 2021 to 2027

TARGET AUDIENCE

- Manufacturers

- Raw Material Suppliers

- Distributors

- Original Equipment Manufacturers

- Consulting Firms

- Government and Regional Agencies

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

GLOBAL AUTOMOTIVE INTERIOR LEATHER MARKET KEY PLAYERS

- Leoni AG

- Lear Corporation

- Motherson Sumi Systems

- Furukawa Electric Co. Ltd.

- BordWarner Inc.

- Sumimoto Electric

- Yazaki Group

- YURA Tech Corporation

- Nexans

- Fujikura Ltd.

- PKC Group

- Delphi Technologies

- THB Group

- Aptiv PLC

- AmWINS Group

GLOBAL AUTOMOTIVE INTERIOR LEATHER MARKET, BY COMPONENTS

- Electric wires

- Terminals

- Connectors

GLOBAL AUTOMOTIVE INTERIOR LEATHER MARKET, BY APPLICATION

- Ignition System

- Charging System

- Drivetrain and Powertrain System

- Infotainment System

- Vehicle Control and Safety System

GLOBAL AUTOMOTIVE INTERIOR LEATHER MARKET, BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

GLOBAL AUTOMOTIVE INTERIOR LEATHER MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. AUTOMOTIVE WIRING HARNESS MARKET OVERVIEW

1.1. Study Scope

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Components

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Vehicle Type

2.1.4. Market Snippet by Region

2.2. Competitive Insights

3. AUTOMOTIVE WIRING HARNESS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. AUTOMOTIVE WIRING HARNESS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. AUTOMOTIVE WIRING HARNESS MARKET: COVID-19 IMPACT ANALYSIS

5.1. Pre-COVID-19 Impact Analysis

5.2. Post-COVID-19 Impact Analysis

5.2.1. Top Performing Segments

5.2.2. Marginal Growth Segments

5.2.3. Top Looser Segments

5.2.4. Marginal Loss Segments

6. AUTOMOTIVE WIRING HARNESS MARKET LANDSCAPE

6.1. Market Share Analysis, 2019

6.2. Key Innovators Analysis

6.3. Breakdown Data, by Key Manufacturer

6.3.1. Established Players’ Analysis

6.3.2. Emerging Players’ Analysis

7. AUTOMOTIVE WIRING HARNESS MARKET – BY COMPONENTS

7.1. Overview

7.1.1. Segment Share Analysis, By Type, 2020 & 2027 (%)

7.2. Electric Wires

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

7.3. Terminals

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

7.4. Connectors

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8. AUTOMOTIVE WIRING HARNESS MARKET – BY APPLICATION

8.1. Overview

8.1.1. Segment Share Analysis, By Application, 2020 & 2027 (%)

8.2. Ignition System

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.3. Charging system

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.4. Drivetrain and powertrain system

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.5. Infotainment system

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.6. Vehicle Control & Safety system

8.6.1. Overview

8.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

9. AUTOMOTIVE WIRING HARNESS – BY VEHICLE TYPE

9.1. Overview

9.1.1. Segment Share Analysis, By Type, 2020 & 2027 (%)

9.2. Passenger Cars

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

9.3. Commercial Vehicles

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10. AUTOMOTIVE WIRING HARNESS MARKET– BY GEOGRAPHY

10.1. Introduction

10.1.1. Segment Share Analysis, By Geography, 2020 & 2027 (%)

10.2. North America

10.2.1. Overview

10.2.2. Key Manufacturers in North America

10.2.3. North America Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.2.4. North America Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.2.5. North America Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.2.6. North America Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.2.7. U.S.

10.2.7.1. Overview

10.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.2.7.3. U.S. Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.2.7.4. U.S. Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.2.7.5. U.S. Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.2.8. Canada

10.2.8.1. Overview

10.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.2.8.3. Canada Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.2.8.4. Canada Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.2.8.5. Canada Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3. Europe

10.3.1. Overview

10.3.2. Key Manufacturers in Europe

10.3.3. Europe Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.3.4. Europe Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.3.5. Europe Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.3.6. Europe Market Size and Forecast, By Vehicle Type, 2016 - 2027 (US Billion)

10.3.7. Germany

10.3.7.1. Overview

10.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.7.3. Germany Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.3.7.4. Germany Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.3.7.5. Germany Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.8. Italy

10.3.8.1. Overview

10.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.8.3. Italy Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.3.8.4. Italy Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.3.8.5. Italy Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.9. United Kingdom

10.3.9.1. Overview

10.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.9.3. U.K. Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.3.9.4. U.K. Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.3.9.5. U.K. Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.10. France

10.3.10.1. Overview

10.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.10.3. France Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.3.10.4. France Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.3.10.5. France Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.11. Rest of Europe

10.3.11.1. Overview

10.3.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.11.3. Rest of Europe Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.3.11.4. Rest of Europe Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.3.11.5. Rest of Europe Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4. Asia Pacific

10.4.1. Overview

10.4.2. Key Manufacturers in Asia Pacific

10.4.3. Asia Pacific Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.4.4. Asia Pacific Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.4.5. Asia Pacific Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.4.6. Asia Pacific Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4.7. India

10.4.7.1. Overview

10.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.7.3. India Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.4.7.4. India Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.4.7.5. India Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4.8. China

10.4.8.1. Overview

10.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.8.3. China Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.4.8.4. China Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.4.8.5. China Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4.9. Japan

10.4.9.1. Overview

10.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.9.3. Japan Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.4.9.4. Japan Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.4.9.5. Japan Market Size and Forecast, By Vehicle type, 2016 - 2027 (US

10.4.10. Rest of APAC

10.4.10.1. Overview

10.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.10.3. Rest of APAC Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.4.10.4. Rest of APAC Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.4.10.5. Rest of APAC Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5. Latin America

10.5.1. Overview

10.5.2. Key Manufacturers in Latin America

10.5.3. Latin America Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.5.4. Latin America Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.5.5. Latin America Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.5.6. Latin America Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.7. Brazil

10.5.7.1. Overview

10.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.7.3. Brazil Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.5.7.4. Brazil Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.5.7.5. Brazil Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.8. Mexico

10.5.8.1. Overview

10.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.8.3. Mexico Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.5.8.4. Mexico Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.5.8.5. Mexico Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.9. Argentina

10.5.9.1. Overview

10.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.9.3. Argentina Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.5.9.4. Argentina Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.5.9.5. Argentina Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.10. Rest of LATAM

10.5.10.1. Overview

10.5.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.10.3. Rest of LATAM Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.5.10.4. Rest of LATAM Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.5.10.5. Rest of LATAM Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.6. Middle East and Africa

10.6.1. Overview

10.6.2. Key Manufacturers in Middle East and Africa

10.6.3. Middle East and Africa Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.6.4. Middle East and Africa Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.6.5. Middle East and Africa Market Size and Forecast, By Application, 2016 - 2027 (US$ Billion)

10.6.6. Middle East and Africa Market Size and Forecast, By Vehicle type, 2016 - 2027 (US$ Billion)

10.6.7. Saudi Arabia

10.6.7.1. Overview

10.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.6.7.3. Saudi Arabia Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.6.7.4. Saudi Arabia Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.6.7.5. Saudi Arabia Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.6.8. United Arab Emirates

10.6.8.1. Overview

10.6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.6.8.3. U.A.E. Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.6.8.4. U.A.E. Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.6.8.5. U.A.E. Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.6.9. Rest of MEA

10.6.9.1. Overview

10.6.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.6.9.3. Rest of MEA Market Size and Forecast, By Components, 2016 - 2027 (US$ Billion)

10.6.9.4. Rest of MEA Market Size and Forecast, By Application, 2016 - 2027 (US Billion)

10.6.9.5. Rest of MEA Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

11. KEY VENDOR ANALYSIS

11.1. Competitive Dashboard

11.2. Company Profiles

11.2.1. Leoni AG

11.2.1.1. Company Snapshot

11.2.1.2. Financial Performance

11.2.1.3. Product Benchmarking

11.2.1.4. Strategic Initiatives

11.2.2. Lear Corporation

11.2.3. Motherson Sumi Systems

11.2.4. Furukawa Electric Co. Ltd.

11.2.5. BorgWarner Inc.

11.2.6. Sumimoto Electric

11.2.7. Yazaki Group

11.2.8. YURA Tech Corporation

11.2.9. Nexans

11.2.10. Fujikura Ltd.

11.2.11. PKC Group

11.2.12. Delphi Technologies

11.2.13. THB Group

11.2.14. Aptiv PLC and

11.2.15. AmWINS Group

12. 360 DEGREE ANALYST VIEW

13. APPENDIX

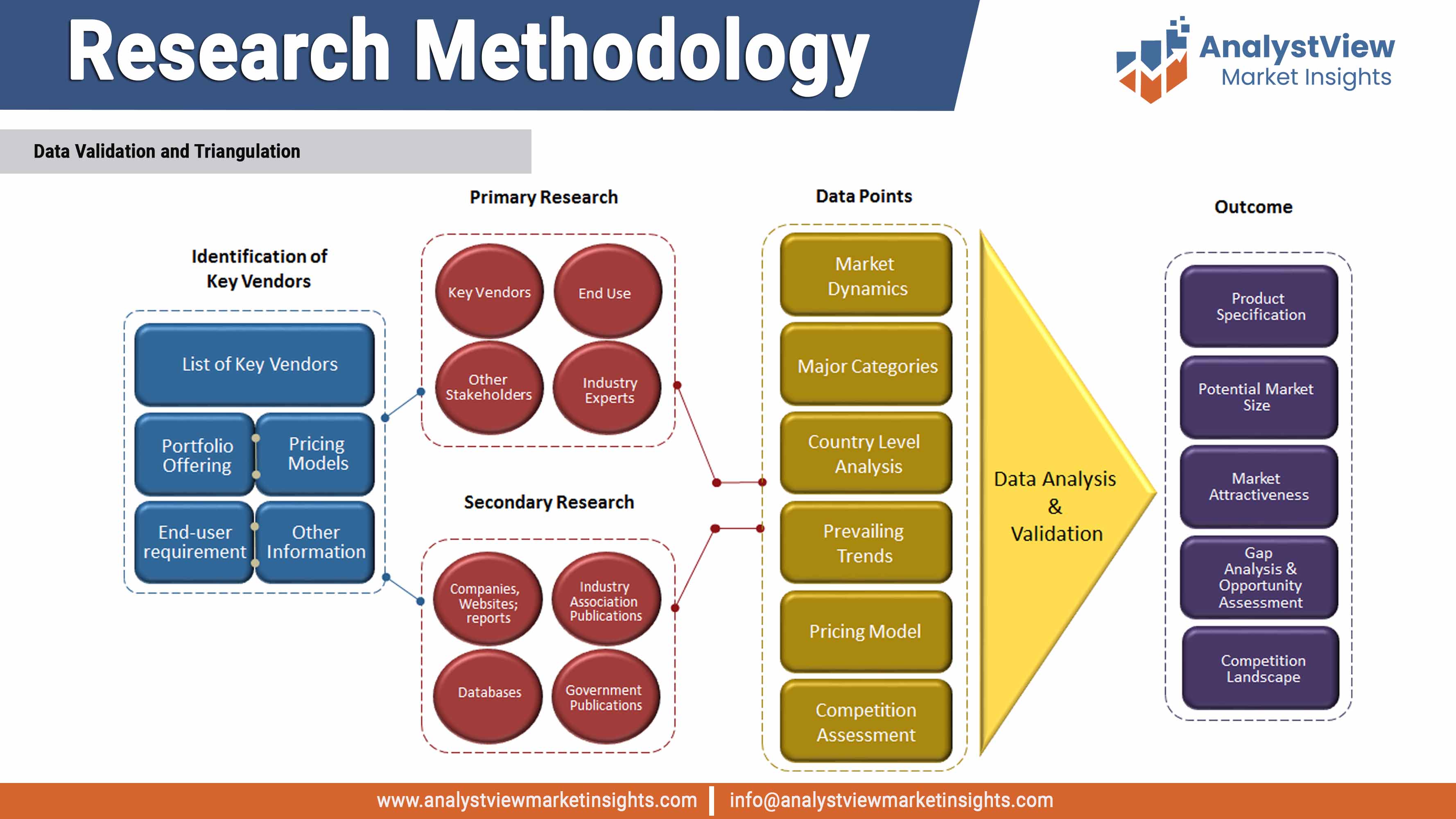

13.1. Research Methodology

13.2. References

13.3. Abbreviations

13.4. Disclaimer

13.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Automotive Wire Harness market: Components Snapshot (2019)

TABLE Segment Dashboard; Definition and Scope, by Components

TABLE Global Automotive Wiring Harness Market, by Components 2016-2027 (USD Billion)

TABLE Automotive Wire Harness market: Application Snapshot (2019)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Automotive Wiring Harness Market, by Application 2016-2027 (USD Billion)

TABLE Automotive Wire Harness market: Vehicle Type Snapshot (2019)

TABLE Segment Dashboard; Definition and Scope, by Vehicle Type

TABLE Global Automotive Wiring Harness Market, by Vehicle Type 2016-2027 (USD Billion)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Automotive Wiring Harness Market, by Region 2016-2027 (USD Billion)

TABLE North America Automotive Wiring Harness Market, by Country, 2016-2027 (USD Billion)

TABLE North America Automotive Wiring Harness Market, by Components, 2016-2027 (USD Billion)

TABLE North America Automotive Wiring Harness Market, by Application, 2016-2027 (USD Billion)

TABLE North America Automotive Wiring Harness Market, by Vehice Type, 2016-2027 (USD Billion)

TABLE Europe Automotive Wiring Harness Market, by Country, 2016-2027 (USD Billion)

TABLE Europe Automotive Wiring Harness Market, by Components, 2016-2027 (USD Billion)

TABLE Europe Automotive Wiring Harness Market, by Application, 2016-2027 (USD Billion)

TABLE Europe Automotive Wire Harnessmarket, by Vehicle Type, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Wiring Harness Market, by Country, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Wiring Harness Market, by Components, 2016-2027 (USD Billion)

TABLE Asia Pacific AutomotiveWire Harness market, by Application, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Wire Harnessmarket, by Vehicle Type, 2016-2027 (USD Billion)

TABLE Latin America Automotive Wiring Harness Market, by Country, 2016-2027 (USD Billion)

TABLE Latin America Automotive Wiring Harness Market, by Components, 2016-2027 (USD Billion)

TABLE Latin America AutomotiveWire Harnessmarket, by Application, 2016-2027 (USD Billion)

TABLE Latin America Automotive Wiring Harness Market, by Vehicle Type, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Wiring Harness Market, by Country, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Wiring Harness Market, by Components, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Wiring Harness Market, by Application, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Wiring Harness Market, by vehicle type, 2016-2027 (USD Billion)

List of Figures

FIGURE Automotive Wiring Harness market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2019

FIGURE Components segment market share analysis, 2020 & 2027

FIGURE Components segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Electric wires market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Terminals market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Connectors market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Application segment market share analysis, 2020 & 2027

FIGURE Application segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Ignition system market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Charging system market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Drivetrain & Powertrain market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Infotainment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Vehicle Control & Sagety system market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Vehicle type segment market share analysis, 2020 & 2027

FIGURE Vehicle type segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Passenger Cars market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Commercial vehicles market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Regional segment market share analysis, 2020 & 2027

FIGURE Regional segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE North America Automotive Wiring Harness market share and leading players, 2019

FIGURE Europe Automotive Wiring Harness market share and leading players, 2019

FIGURE Asia Pacific Automotive Wiring Harness market share and leading players, 2019

FIGURE Latin America Automotive Wiring Harness market share and leading players, 2019

FIGURE Middle East and Africa Automotive Wiring Harness market share and leading players, 2019

FIGURE North America market share analysis by country, 2019

FIGURE U.S. Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Canada Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Europe Automotive Wiring Harness market share analysis by country, 2019

FIGURE Germany Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Spain Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Italy Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE UK Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE France Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Rest of the Europe AutomotiveWiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Asia Pacific Automotive Wiring Harness market share analysis by country, 2019

FIGURE India Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE China AutomotiveWiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Japan Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE South Korea AutomotiveWiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Singapore Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Rest of APAC Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Latin America Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Latin America Automotive Wiring Harness market share analysis by country, 2019

FIGURE Brazil Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Mexico Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Argentina Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Rest of LATAM Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Middle East and Africa Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Middle East and Africa Automotive Wiring Harness market share analysis by country, 2019

FIGURE Saudi Arabia Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE United Arab Emirates Automotive Wiring Harness market size, forecast and trend analysis, 2016 to 2027 (USD Billion)