Automotive Hydroformed Parts Market: By Material Type (Aluminium, Brass, Carbon composites, Stainless Steel), By Process (Tube Hydroforming, Sheet Hydroforming), By Vehicle Type (Passenger vehicle, Commercial vehicles), by Regions (North America, Europe, Asia Pacific, MEA, Latin America) - Analysis, Share, Trends, Size, & Forecast From 2021-2027

|

Report ID

AV1002

|

Published Date

August 2021

|

Pages

322

|

Industry

Automotive and Transport

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The worldwide automotive hydroformed components market was valued at US$ 3.45 billion in 2020 and is anticipated to grow at a CAGR of 10.4% to achieve US$ 7.17 billion by 2027.

Hydroforming is a component manufacturing method in which ductile materials such as brass, aluminum, low alloy steel, and stainless steel are formed into desired component forms using fluid pressure. This technique aids in the production of complicated components with a high strength-to-weight ratio. Instead of welding components together, a unibody component structure is built with the aid of specifications in this method. Metal tubes and pre-form molds are enlarged from the inside out in a closed die during the hydroforming process. The traditional stamping technique employs welded connections, rivets, and other methods to produce specific components, whereas the hydroforming approach aids in the production of unibody components.

MARKET DYNAMICS

Vehicle weight has a significant impact on fuel economy. Government rules relating to vehicle economy are pressuring automakers to come up with novel ways to reduce vehicle weight. According to the Corporate Average Fuel Efficiency standard, the average light vehicle fuel economy in the United States should be 54.5 mpg by 2025. Furthermore, OEMs and component manufacturers throughout the world are concentrating on using diverse production techniques and innovative technologies to minimize vehicle weight while maintaining structural integrity. In addition, because hydroforming may be performed on any metal or alloy, it enables versatility in component manufacture. Steel, copper, aluminum, brass, and alloys, for example, can be formed into pieces using the hydroforming method. It also improves the manufacturing process quality and accuracy. Over the projected period, these factors are likely to propel the worldwide automotive hydroformed parts market forward.

Over the forecast period, the light commercial vehicles sector of the automotive hydroformed parts market is anticipated to rise due to increased demand for high-strength and cost-effective components. For the automobile industry, hydroforming is one of the most cost-effective methods for producing asymmetrical components. Furthermore, due to varied NVH design standards, the bulk of the components utilized in cars have irregular forms. When opposed to the hydroforming process, manufacturing similar components via the standard stamping approach is time-consuming and costly. These considerations have resulted in a recent surge in the use of hydroformed components in light commercial vehicles. Ford, for example, debuted a hydroforming-based structural cage in its F-150 pickup trucks in 2015. The structural cage's connections and seams are riveted and bonded rather than welded.

High tool prices, on the other hand, are likely to limit the process's adoption. This is due to the high expense of purchasing, maintaining, and upgrading the equipment that is used to carry out the hydroforming processes. Furthermore, some hydroforming processes might take a long time to complete. Over the projected period, these factors are likely to stifle market expansion.

MARKET SEGMENTATION

The global market can be bifurcated mainly based on material type and vehicle type.

Based on material Type:

The Automotive Hydroformed Parts market has been segmented into Aluminium Type, Brass Type, Carbon Type, Stainless Steel Type, Others, etc. Aluminum and Brass types are major segments as per the current market trends. This demand is due to the feasibility of these metals for manufacturing processes and cost-effective operations. Increasing demand for passenger vehicles demand aluminum, brass, and steel products is increasing. Carbon fiber materials are used for high range and durable needs for special purpose applications. It has high durability and long product life compared to other metals.

Based on the process:

There are different kinds of hydroforming methods such as tube hydroforming and sheet hydroforming. One die and a sheet of metal are used in sheet hydroforming. On one side of the sheet, high-pressure water is used to push the raw sheet into the die. This high-pressure water molds a sheet into the required shape in the die. Tube hydroforming, on the other hand, uses two die halves to inflate metal tubes into the required shape. Tube hydroforming is widely used in the automobile sector, where it is used to replace stamped and spot-welded steel components in the production of light cars. Furthermore, businesses are concentrating on producing whole body panels for their automobiles. For example, starting in 2006, General Motors began employing the hydroforming technique to manufacture complete body panels for its various cars.

Based on Application:

Automotive Hydroformed Parts has been segmented into Passenger Vehicle and Commercial Vehicles. Because of their increased production and sales, passenger vehicles are expected to contribute more to the hydroformed part manufacturing industry. The rise in passenger vehicle sales can be linked to higher disposable incomes as well as increased demand for smaller automobiles. Both the segments can be bifurcated further in subcomponents like mid-size, sedans, compact hatchback, SUVs, performance vehicles, and so on. Demand for seamless products with high application efficiency is increasing across the segments which are expected to fuel the growth of part manufacturing industries.

Regional Takeaways

These nations are enacting rigorous fuel economy regulations, which is likely to boost demand for hydroformed components in the area. For example, in 2017, the Indian government enacted Corporate Average Fuel Economy (CAFÉ) standards for passenger cars powered by gasoline, diesel, LPG, and CNG. In 2019, Europe dominated the worldwide automotive hydroformed components market, with the Asia Pacific and North America following closely after. Germany, France, Italy, Spain, and the United Kingdom are among the region's key growth engines for automobile hydroformed components. Government rules for vehicle efficiency are becoming more stringent, creating a favorable climate for industry growth in the area. For example, the EU declared in April 2019 that by 2021, the average fuel efficiency across manufacturer fleets should be about 57 US miles per gallon mpg.

By 2030, the EU aims to raise it to 92 miles per US gallon. Over the forecast period, the Asia Pacific automotive hydroformed parts market is anticipated to grow at the fastest rate. The automotive hydroformed components market in the area is primarily driven by India, China, and Japan. India and China are two of the world's fastest-growing automobile markets. These nations are enacting rigorous fuel economy regulations, which is likely to boost demand for hydroformed components in the area. For example, in 2017, the Indian government enacted Corporate Average Fuel Economy (CAFÉ) standards for passenger cars powered by gasoline, diesel, LPG, and CNG.

COVID-19 IMPACT

The automobile sector has demonstrated incredible resiliency in recent months. It has recovered from the economic lows of spring 2020, delivering a year-over-year increase in new-vehicle sales in China, Europe, and the United States in recent months. Despite positive news on vaccine progress, several dangers remain, and we continue to estimate that sales in Europe and the United States will not recover to pre-COVID levels until at least 2023.

Meanwhile, China's recovery is accelerating, with sales of new automobiles on track to reach 30 million by 2025. Recovery for the hydroformed part market is highly dependent on global automobile market recovery. Based on the recent recovery trajectory from the pandemic, the hydroformed market is expected to rebound for the remaining part of the forecast period.

KEY PLAYERS

The Automotive Hydroformed parts industry includes many prominent industry players such as Magna International, Matalsa, Tenneco, Yorozu, SANGO, F-TECH, KLT Auto, Right Way, Nissin Kogyo, Showa Rasenk, TATA Precision Tubes, Pliant Bellows, Alf Engineering, Pliant Bellows, and Salzgitter Hydroforming.

Due to the increasing complexities of automotive parts and increasing customer demand for customized components, industry players are collaborating with other companies such as vehicle manufacturers and component makers to improve product performance and lock in future supply to improve their share in the market. Vehicle manufactures are outsourcing the manufacturing of specific components to reduce the overall cost of vehicles due to the core competencies of component makers.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2016 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2021 to 2027

TARGET AUDIENCE

- Manufacturers

- Raw Material Suppliers

- Distributors

- Original Equipment Manufacturers

- Consulting Firms

- Government and Regional Agencies

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

GLOBAL AUTOMOBILE HYDROFORMED PART MARKET KEY PLAYERS

- Magna International

- Matalsa

- Tenneco

- Yorozu

- SANGO

- F-TECH

- KLT Auto

- Right Way

- Nissin Kogyo

- Showa Rasenk

- TATA Precision Tubes

- Pliant Bellows

- Alf Engineering

- Pliant Bellows

- Salzgitter Hydroforming

GLOBAL AUTOMOBILE HYDROFORMED PART MARKET, BY MATERIAL TYPE

- Aluminum

- Brass

- Carbon composites

- Stainless Steel

GLOBAL AUTOMOBILE HYDROFORMED PART MARKET, BY PROCESS

- Sheet Molding

- Tube Molding

GLOBAL AUTOMOBILE HYDROFORMED PART MARKET, BY VEHICLE TYPE

- Passenger Vehicle

- Commercial vehicles

GLOBAL AUTOMOBILE HYDROFORMED PART MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. AUTOMOTIVE HYDROFORMED PARTS MARKET OVERVIEW

1.1. Study Scope

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Process Type

2.1.2. Market Snippet by Material

2.1.3. Market Snippet by Vehicle Type

2.1.4. Market Snippet by Region

2.2. Competitive Insights

3. AUTOMOTIVE HYDROFORMED PARTS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. AUTOMOTIVE HYDROFORMED PARTS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. AUTOMOTIVE HYDROFORMED PARTS MARKET: COVID-19 IMPACT ANALYSIS

5.1. Pre-COVID-19 Impact Analysis

5.2. Post-COVID-19 Impact Analysis

5.2.1. Top Performing Segments

5.2.2. Marginal Growth Segments

5.2.3. Top Looser Segments

5.2.4. Marginal Loss Segments

6. AUTOMOTIVE HYDROFORMED PARTS MARKET LANDSCAPE

6.1. Market Share Analysis, 2019

6.2. Key Innovators Analysis

6.3. Breakdown Data, by Key Manufacturer

6.3.1. Established Players’ Analysis

6.3.2. Emerging Players’ Analysis

7. AUTOMOTIVE HYDROFORMED PARTS MARKET – BY PROCESS TYPE

7.1. Overview

7.1.1. Segment Share Analysis, By Type, 2020 & 2027 (%)

7.2. Sheet Molding

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

7.3. Tube Molding

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion

8. AUTOMOTIVE HYDROFORMED PARTS MARKET – BY MATERIAL

8.1. Overview

8.1.1. Segment Share Analysis, By Material, 2020 & 2027 (%)

8.2. Aluminium

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.3. Brass

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.4. Carbon Composites

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

8.5. Stainless Steel

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

9. AUTOMOTIVE HYDROFORMED PARTS – BY VEHICLE TYPE

9.1. Overview

9.1.1. Segment Share Analysis, By Type, 2020 & 2027 (%)

9.2. Passenger Vehicle

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

9.3. Commercial Vehicle

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10. AUTOMOTIVE HYDROFORMED PARTS MARKET– BY GEOGRAPHY

10.1. Introduction

10.1.1. Segment Share Analysis, By Geography, 2020 & 2027 (%)

10.2. North America

10.2.1. Overview

10.2.2. Key Manufacturers in North America

10.2.3. North America Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.2.4. North America Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.2.5. North America Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.2.6. North America Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.2.7. U.S.

10.2.7.1. Overview

10.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.2.7.3. U.S. Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.2.7.4. U.S. Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.2.7.5. U.S. Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.2.8. Canada

10.2.8.1. Overview

10.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.2.8.3. Canada Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.2.8.4. Canada Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.2.8.5. Canada Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3. Europe

10.3.1. Overview

10.3.2. Key Manufacturers in Europe

10.3.3. Europe Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.3.4. Europe Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.3.5. Europe Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.3.6. Europe Market Size and Forecast, By Vehicle Type, 2016 - 2027 (US Billion)

10.3.7. Germany

10.3.7.1. Overview

10.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.7.3. Germany Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.3.7.4. Germany Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.3.7.5. Germany Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.8. Italy

10.3.8.1. Overview

10.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.8.3. Italy Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.3.8.4. Italy Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.3.8.5. Italy Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.9. United Kingdom

10.3.9.1. Overview

10.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.9.3. U.K. Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.3.9.4. U.K. Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.3.9.5. U.K. Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.10. France

10.3.10.1. Overview

10.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.10.3. France Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.3.10.4. France Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.3.10.5. France Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.3.11. Rest of Europe

10.3.11.1. Overview

10.3.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.3.11.3. Rest of Europe Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.3.11.4. Rest of Europe Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.4. Asia Pacific

10.4.1. Overview

10.4.2. Key Manufacturers in Asia Pacific

10.4.3. Asia Pacific Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.4.4. Asia Pacific Market Size and Forecast, By type, 2016 - 2027 (US$ Billion)

10.4.5. Asia Pacific Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.4.6. Asia Pacific Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4.7. India

10.4.7.1. Overview

10.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.7.3. India Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.4.7.4. India Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.4.7.5. India Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4.8. China

10.4.8.1. Overview

10.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.8.3. China Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.4.8.4. China Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.4.8.5. China Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.4.9. Japan

10.4.9.1. Overview

10.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.9.3. Japan Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.4.9.4. Japan Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.4.9.5. Japan Market Size and Forecast, By Vehicle type, 2016 - 2027 (US billion)

10.4.10. Rest of APAC

10.4.10.1. Overview

10.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.4.10.3. Rest of APAC Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.4.10.4. Rest of APAC Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.4.10.5. Rest of APAC Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5. Latin America

10.5.1. Overview

10.5.2. Key Manufacturers in Latin America

10.5.3. Latin America Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.5.4. Latin America Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.5.5. Latin America Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.5.6. Latin America Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.7. Brazil

10.5.7.1. Overview

10.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.7.3. Brazil Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.5.7.4. Brazil Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.5.7.5. Brazil Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.8. Mexico

10.5.8.1. Overview

10.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.8.3. Mexico Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.5.8.4. Mexico Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.5.8.5. Mexico Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.9. Argentina

10.5.9.1. Overview

10.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.9.3. Argentina Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.5.9.4. Argentina Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.5.9.5. Argentina Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.5.10. Rest of LATAM

10.5.10.1. Overview

10.5.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.5.10.3. Rest of LATAM Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.5.10.4. Rest of LATAM Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.5.10.5. Rest of LATAM Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.6. Middle East and Africa

10.6.1. Overview

10.6.2. Key Manufacturers in Middle East and Africa

10.6.3. Middle East and Africa Market Size and Forecast, By Country, 2016 - 2027 (US$ Billion)

10.6.4. Middle East and Africa Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.6.5. Middle East and Africa Market Size and Forecast, By Material, 2016 - 2027 (US$ Billion)

10.6.6. Middle East and Africa Market Size and Forecast, By Vehicle type, 2016 - 2027 (US$ Billion)

10.6.7. Saudi Arabia

10.6.7.1. Overview

10.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.6.7.3. Saudi Arabia Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.6.7.4. Saudi Arabia Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.6.7.5. Saudi Arabia Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.6.8. United Arab Emirates

10.6.8.1. Overview

10.6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.6.8.3. U.A.E. Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.6.8.4. U.A.E. Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.6.8.5. U.A.E. Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

10.6.9. Rest of MEA

10.6.9.1. Overview

10.6.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Billion)

10.6.9.3. Rest of MEA Market Size and Forecast, By Process type, 2016 - 2027 (US$ Billion)

10.6.9.4. Rest of MEA Market Size and Forecast, By Material, 2016 - 2027 (US Billion)

10.6.9.5. Rest of MEA Market Size and Forecast, By Vehicle type, 2016 - 2027 (US Billion)

11. KEY VENDOR ANALYSIS

11.1. Competitive Dashboard

11.2. Company Profiles

11.2.1. Magna International

11.2.1.1. Financial Performance

11.2.1.2. Product Benchmarking

11.2.1.3. Strategic Initiatives

11.2.2. Matalsa

11.2.3. Tenneco

11.2.4. Yorozu

11.2.5. SANGO

11.2.6. F-TECH

11.2.7. KLT Auto

11.2.8. Right Way

11.2.9. Nissin Kogyo

11.2.10. Showa Rasenk

11.2.11. TATA Precision Tubes

11.2.12. Pliant Bellows

11.2.13. Alf Engineering

11.2.14. Pliant Bellows

11.2.15. Salzgitter Hydroforming.

12. 360 DEGREE ANALYST VIEW

13. APPENDIX

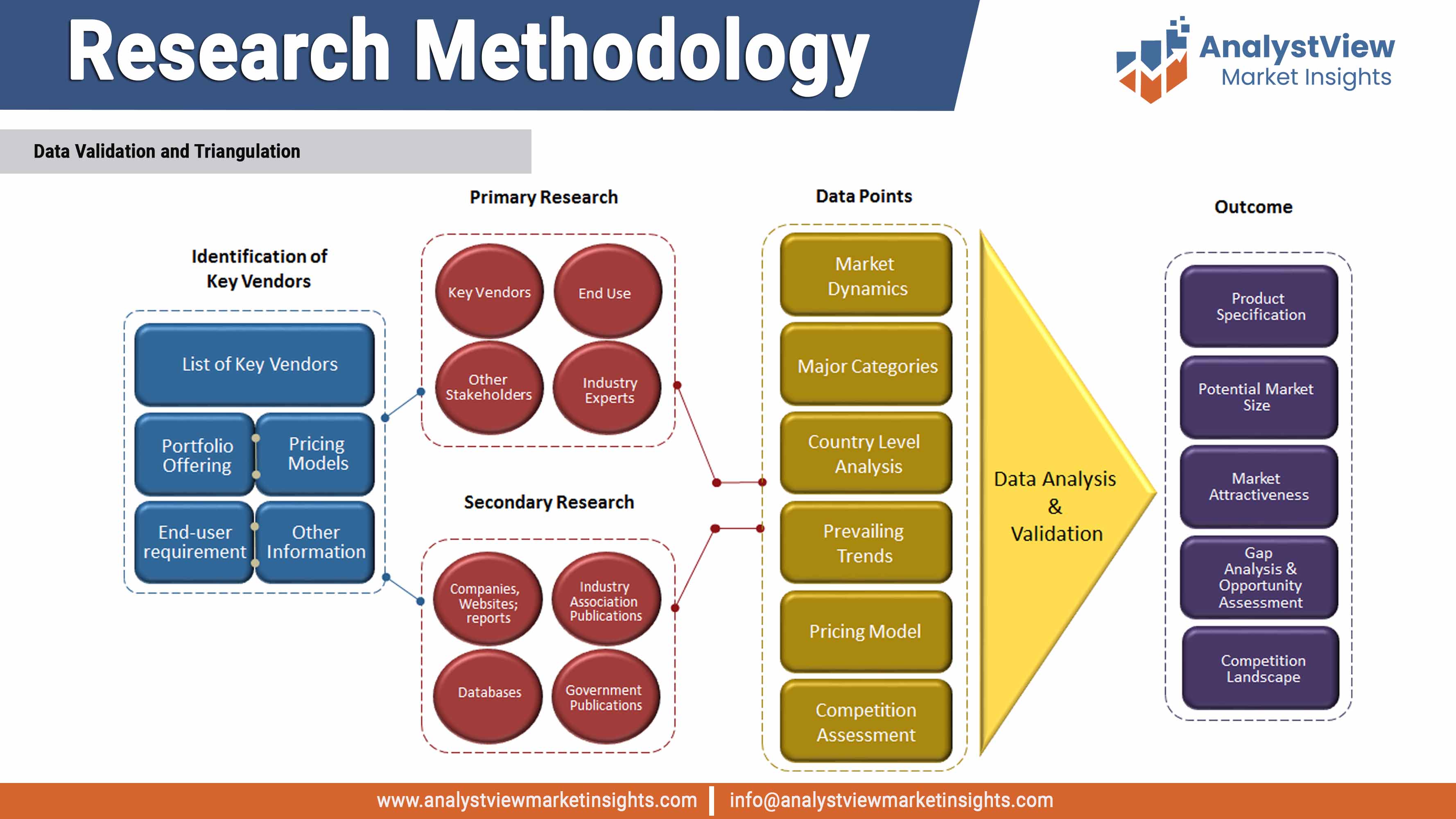

13.1. Research Methodology

13.2. References

13.3. Abbreviations

13.4. Disclaimer

13.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Automotive Hydroformed Parts market: Process type Snapshot (2019)

TABLE Segment Dashboard; Definition and Scope, by Process type

TABLE Global Automotive Hydroformed Parts market, by Process type 2016-2027 (USD Billion)

TABLE Automotive Hydroformed Parts Market: Material Snapshot (2019)

TABLE Segment Dashboard; Definition and Scope, by Material

TABLE Global Automotive Hydroformed Parts Market, by Material 2016-2027 (USD Billion)

TABLE Automotive HYdroformed Parts Market: Vehicle Type Snapshot (2019)

TABLE Segment Dashboard; Definition and Scope, by Vehicle Type

TABLE Global Automotive Hydroformed Parts Market, by Vehicle Type 2016-2027 (USD Billion)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Automotive Hydroformed Parts market, by Region 2016-2027 (USD Billion)

TABLE North America Automotive Hydroformed Parts Market, by Country, 2016-2027 (USD Billion)

TABLE North America Automotive Hydroformed Parts Market, by Process type, 2016-2027 (USD Billion)

TABLE North America Automotive Hydroformed Parts Market, by Material, 2016-2027 (USD Billion)

TABLE North America Automotive Hydroformed Parts Market, by Vehice Type, 2016-2027 (USD Billion)

TABLE Europe Automotive Hydroformed Parts Market, by Country, 2016-2027 (USD Billion)

TABLE Europe Automotive Hydroformed Parts Market, by Process type, 2016-2027 (USD Billion)

TABLE Europe Automotive Hydroformed Parts Market, by Material, 2016-2027 (USD Billion)

TABLE Europe Automotive Hydroformed Parts Market, by Vehicle Type, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Hydroformed Parts Market, by Country, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Hydroformed Parts Market, by Process type, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Hydroformed PARTS Market, by Material, 2016-2027 (USD Billion)

TABLE Asia Pacific Automotive Hydroformed Parts Market, by Vehicle Type, 2016-2027 (USD Billion)

TABLE Latin America Automotive Hydroformed Parts Market, by Country, 2016-2027 (USD Billion)

TABLE Latin America Automotive Hydroformed Parts Market, by Process type, 2016-2027 (USD Billion)

TABLE Latin America Automotive Hydroformed Parts Market, by Material, 2016-2027 (USD Billion)

TABLE Latin America Automotive Hydroformed Parts Market, by Vehicle Type, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Hydroformed Parts Market, by Country, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Hydroformed Parts Market, by Process type, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Hydroformed Parts Market, by Material, 2016-2027 (USD Billion)

TABLE Middle East & Africa Automotive Hydroformed Parts Market, by vehicle type, 2016-2027 (USD Billion)

List of Figures

FIGURE Automotive Hydroformed Parts Market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2019

FIGURE Process type segment market share analysis, 2020 & 2027

FIGURE Process type segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Sheet Molding type market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Tube Molding type market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Material segment market share analysis, 2020 & 2027

FIGURE Material segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Aluminium market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Brass market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Carbon Composites market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Stainless Steel market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Vehicle type segment market share analysis, 2020 & 2027

FIGURE Vehicle type segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Passenger vehicle market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Commercial Vehicle market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Regional segment market share analysis, 2020 & 2027

FIGURE Regional segment market size forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE North America Automotive Hydroformed Parts Market share and leading players, 2019

FIGURE Europe Automotive Hydroformed Parts Market Share and leading players, 2019

FIGURE Asia Pacific Automotive Hydroformed Parts Market share and leading players, 2019

FIGURE Latin America Automotive Hydroformed Parts Market share and leading players, 2019

FIGURE Middle East and Africa Automotive Hydroformed Parts Market share and leading players, 2019

FIGURE North America market share analysis by country, 2019

FIGURE U.S. Automotive Hydroformed Parts Market Size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Canada Automotive Hydroformed Parts Market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Europe Automotive Hydroformed Parts market share analysis by country, 2019

FIGURE Germany Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Spain Automotive Hydroformed Parts market size, forecast, and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Italy Automotive Hydroformed Parts market size, forecast, and trend analysis, 2016 to 2027 (USD Billion)

FIGURE UK Automotive Hydroformed Partsrket size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE France Automotive Hydroformed Partsrket size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Rest of the Europe Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Asia Pacific Automotive Hydroformed Parts Market share analysis by country, 2019

FIGURE India Automotive Hydroformed Parts Market Size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE China Automotive Hydroformed Parts Market Size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Japan Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE South Korea Automotivehydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Singapore Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Rest of APAC Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Latin America Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Latin America Automotive Hydroformed Parts market share analysis by country, 2019

FIGURE Brazil Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Mexico Automotive Hydroformed Parts Market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Argentina Automotive Hydroformed PartS market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Rest of LATAM Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Middle East and Africa Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE Middle East and Africa Automotive Hydroformed Parts market share analysis by country, 2019

FIGURE Saudi Arabia Automotive Hydroformed Parts Market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

FIGURE United Arab Emirates Automotive Hydroformed Parts market size, forecast and trend analysis, 2016 to 2027 (USD Billion)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS