Scaffolding Market, by type (Supported, Suspended, and Rolling), By Application (Residential and Commercial) and Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast from 2014 2025

REPORT HIGHLIGHT

The scaffolding market was valued at USD 29.6 billion by 2017, growing with 4.8% CAGR during the forecast period, 2018-2025

Market Dynamics

Scaffolding is the creation of a makeshift structure or support structure that is used in the construction of more buildings or redevelopment of older ones. It is used as a working platform and also a support structure to the existing framework of the building. A scaffolder is an individual that works on the scaffold, this comes with its own set of risk involved. This industry is directly dependent on the construction industry. Growth of construction sector coupled with growing number of home renovation projects across the globe drives the scaffold industry significantly. Furthermore, advancement in technologies, increasing number of key players entering in this market and favourable government initiatives act as a catalyst for growth of this industry. Besides this, globally the lack of skilled manpower and reduction in construction maintenance cost will hamper the market development.

Product Takeaway

This industry can be broadly categorized into three segments namely supported, suspended and rolling scaffolding. Supported segment is the most common type used among the end-users, accounted for the significant revenue share. It is designed by a network for beams, posts, framework, legs and brackets that support the firm base. This is most common considering it is used in real estate based construction. The ideal application for this is elevated working platforms.

Rolling scaffolding segment is growing with promising CAGR during the study period. Rolling scaffolding is wherein a base is built first, then the entire structure is firm but movable around the work area. This type of scaffolding is beneficial for large construction projects. Whereas, suspended technique is preferred when the creation of a base platform is not feasible. This is when the product is suspended from the roof due to the non –feasibility of having a firm base.

Application Takeaway

Application segment is bifurcated as residential, commercial and others. In terms of revenue generation, residential sectors posted highest share owing to the strong growth of real estate industry across the globe.

Based on the structure of the construction and assembly or disassembly expected, commercial sector comprises of governmental, educational, corporate, industrial and transport structures. The United States Department of Labour introduced the Occupation safety & Health (OSHA) compliance which suggested various safety provisions for construction. There is an entire ‘OSHA’s scaffolding standard several key provisions’ in place for ensuring safety. Such initiatives would in turn support the growth of commercial scaffolding segment over the study period.

Regional Takeaway

Developed regions such as North America and Europe is witnessing a notable development in construction and residential sector which is establishing a healthy platform for this industry growth. Based on the data published by the Associated General Contractors of America, the gross domestic product (GDP) produced in the country—totaled US$19.5 trillion in 2017; of which, construction contributed US$ 781 billion (4.0%). Additionally, Parliament of UK, 2017, stated that ‘In 2017, the construction contributed £113 billion to the UK economy, 6% of the total.’ Thus throwing some light on the expected growth of this industry in these regions.

From a regional perspective, the Asia Pacific market is forecasted to grow exponential based. Growth in the real estate segment in the Asia Pacific region has impacted consequential development of the market. Based on a report by the Price water company in 2018, around 6% rise in the commercial real estate investment in Asia Pacific will offset a decline in the U.S., the world’s largest commercial real estate place. Thus, reaffirming the above statement.

In addition, consistent urbanization in newer market’s like Latin America & Middle East are now flaunting great scope of potential in the near future. Steep rise in the economies of the Asian markets, urbanization and industrialization is an evident outcome. This has been an impetus to boost the scaffolding market in Asia Pacific region.

Key Vendor Takeaway

Some of the prominent players operating in this market are Layher North America, Peri-USA, BETCO Scaffolds, Brock Group, Safway Group Holding, Seaway Scaffold & Equipment Co, Brand Energy and Infrastructure Services Pty Ltd., American Scaffolding, Inc. and others. The notable aspects of most vendors is that prominent players are trying to create product specific USP to create a niche. R&D oriented approach is going to impact the growth of the industry significantly.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

MARKET, BY APPLICATION

- Residential

- Commercial

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. SCAFFOLDING MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. SCAFFOLDING KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. SCAFFOLDING INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Market Attractiveness Analysis

4.3. Regulatory Framework Analysis

5. SCAFFOLDING MARKET LANDSCAPE

5.1. Market Share Analysis

6. SCAFFOLDING MARKET – BY PRODUCT

6.1. Overview

6.2. Supported Scaffolding

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3. Suspended Scaffolding

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.4. Rolling Scaffolding

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7. SCAFFOLDING MARKET – BY APPLICATION

7.1. Overview

7.2. Residential

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3. Commercial

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4. Others

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8. SCAFFOLDING MARKET– BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.3. U.S.

8.2.3.1. Overview

8.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.4. Canada

8.2.4.1. Overview

8.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3. Europe

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.3. France

8.3.3.1. Overview

8.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.4. Germany

8.3.4.1. Overview

8.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.5. Rest of Europe

8.3.5.1. Overview

8.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.3. China

8.4.3.1. Overview

8.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.4. India

8.4.4.1. Overview

8.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.5. Rest of APAC

8.4.5.1. Overview

8.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.3. Latin America

8.5.3.1. Overview

8.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.4. Middle East and Africa

8.5.4.1. Overview

8.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

9. KEY VENDOR ANALYSIS

9.1. Layher North America

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.2. Peri-USA

9.2.1. Company Overview

9.2.2. SWOT Analysis

9.2.3. Key Developments

9.3. BETCO Scaffolds

9.3.1. Company Overview

9.3.2. SWOT Analysis

9.3.3. Key Developments

9.4. Brock Group

9.4.1. Company Overview

9.4.2. SWOT Analysis

9.4.3. Key Developments

9.5. Safway Group Holding

9.5.1. Company Overview

9.5.2. SWOT Analysis

9.5.3. Key Developments

9.6. Seaway Scaffold & Equipment Company

9.6.1. Company Overview

9.6.2. SWOT Analysis

9.6.3. Key Developments

9.7. Brand Energy and Infrastructure Services Pty Ltd.

9.7.1. Company Overview

9.7.2. SWOT Analysis

9.7.3. Key Developments

9.8. American Scaffolding, Inc.

9.8.1. Company Overview

9.8.2. SWOT Analysis

9.8.3. Key Developments

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

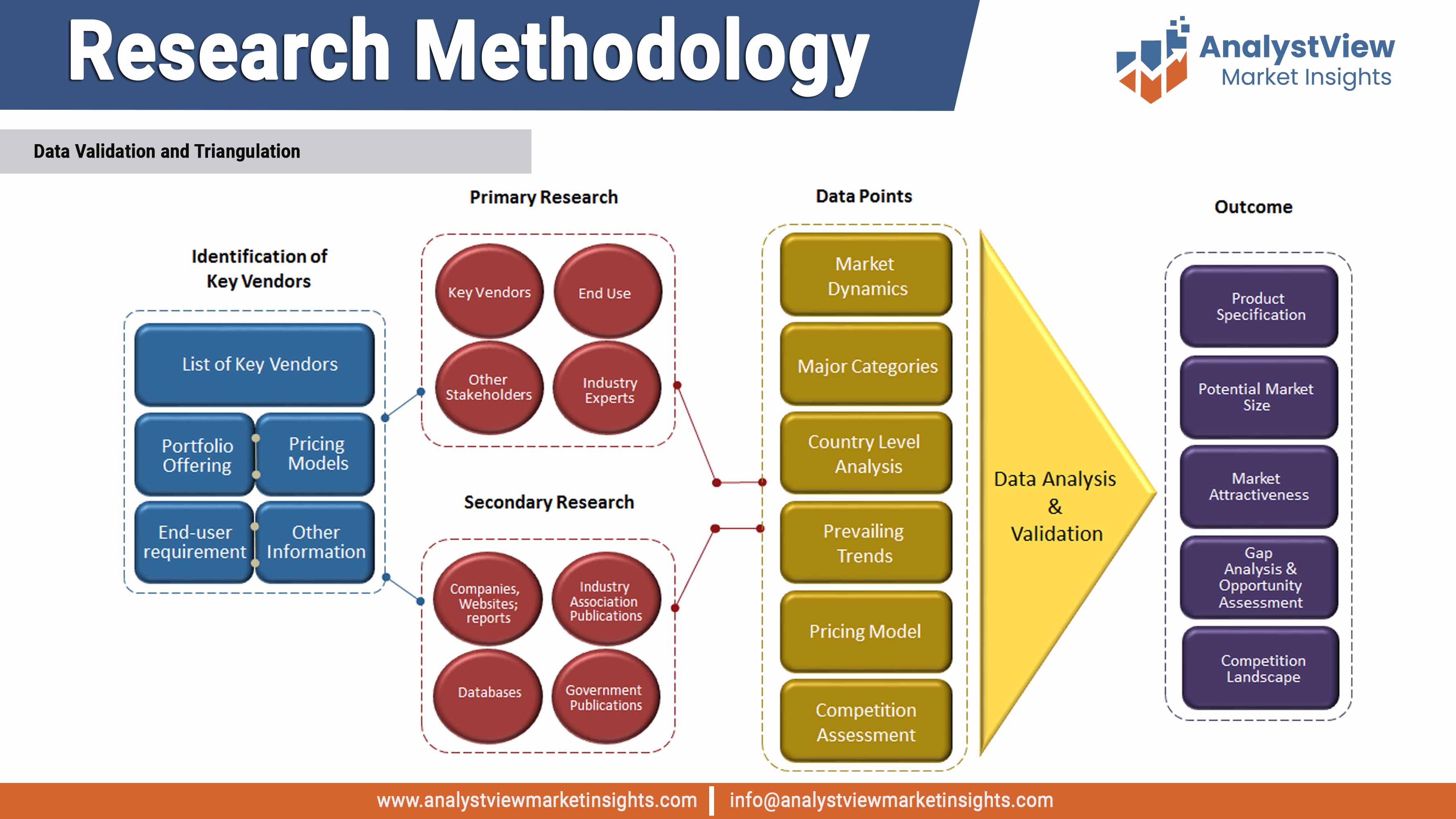

11.1. Research Methodology

11.2. Abbreviations

11.3. Disclaimer

11.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Scaffolding Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

Table 10 Scaffolding Market, by Product, 2014 – 2025 (USD Billion)

Table 11 Scaffolding Market, by Application, 2014 – 2025 (USD Billion)

Table 12 Scaffolding Market, by Geography, 2014 – 2025 (USD Billion)

Table 13 North America Scaffolding Market, 2014 – 2025 (USD Billion)

Table 14 U.S. Scaffolding Market, 2014 – 2025 (USD Billion)

Table 15 Canada Scaffolding Market, 2014 – 2025 (USD Billion)

Table 16 Europe Scaffolding Market, 2014 – 2025 (USD Billion)

Table 17 France Scaffolding Market, 2014 – 2025 (USD Billion)

Table 18 Germany Scaffolding Market, 2014 – 2025 (USD Billion)

Table 19 Asia Pacific Scaffolding Market, 2014 – 2025 (USD Billion)

Table 20 China Scaffolding Market, 2014 – 2025 (USD Billion)

Table 21 India Scaffolding Market, 2014 – 2025 (USD Billion)

Table 22 Latin America Scaffolding Market, 2014 – 2025 (USD Billion)

Table 23 MEA Scaffolding Market, 2014 – 2025 (USD Billion)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Scaffolding Market, by Product, 2014 – 2025 (USD Billion)

Figure 6 Scaffolding Market, by Application, 2014 – 2025 (USD Billion)

Figure 7 Scaffolding Market, by Geography, 2014 – 2025 (USD Billion)