Phycocyanin Market, By Product (Lyophilized Powder and Natural Colour Pigment), By Extraction Type (Ion-Exchange Chromatography, Ammonium Sulphate Precipitation and Gel Filtration Chromatography) and By Application and By Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The phycocyanin market was valued at USD 108.6 million by 2017, growing with 7.5% CAGR during the forecast period, 2018-2025.

Market Dynamics

Phycocyanin is a pigment that is produced by a micro-organism group called as Cyanobacteria. Cyanobacteria is also identified as blue green algae owing to the pigment it produces. This pigment produced by the bacteria is further processed to produce a natural colorant known as Lina Blue. It is used in a variety of food and cosmetic material. An increase in demand for cleaner products i.e. without additives or artificial components are in demand. This product is a cleaner, natural alternative to artificial colours. As per an article in the National Public Radio website, 2013, caramel colour grade 150d had carcinogenic effect. Therefore, in order to avoid regulatory hassle Coke and Pepsi reformulated their recipe. Therefore, companies, especially MNC’s are shifting towards all natural and healthier alternative. One of the market restraints is typically the high cost in comparison to artificial colours, thus companies do not prefer switching unless there is a regulatory pressure. Another restraint is the supply, since this is a natural material, there is always a slight variation in the end product. Production also is heavily dependent upon climatic conditions.

Product Takeaway

Product segment is categorized as lyophilized powder and natural colour pigment. Also, the major grades available are food, cosmetic and analytical grades. Based on purity, the food grade is the purest and hence demands a premium with respect to price followed by cosmetic grade and then analytical grade. Food grade shows maximum revenue generation owing to the shift in regulatory status towards cleaner labels across the world. Some of the major categories in food where the product can be used is the confectionary, ice cream, sweets and cereals segments. Cosmetic grade is showing an increase in demand for the same reasons i.e. cleaner products, natural ingredients and mild processing needs.

Application Takeaway

Application wise the major categories are food & beverages, cosmetics, and healthcare. While Food and beverages is the dominating segment with respect to colours i.e. juices or drinks with varied colours is preferred. This is followed by an increased demand for natural products in the cosmetic industry. Cosmetic companies are now keen on developing entire range that is all natural only. Phycocyanin can find major applications in the entire colour cosmetics category. A rather new yet fast developing category is the healthcare segment. Healthcare industries are constantly formulating and researching on powdered mixed of for sports drinks that are targeted to a specific health category. In such a case, it is important to have clean and natural labels product, therefore Phycocyanin finds major applications in this category.

Regional Takeaway

The major regions that include in this research scope are North America, Europe, Asia Pacific, and Rest of the World. Europe is one of the largest consumers of phycocyanin, this is because Europe generally has stricter food laws and the people are more aware and conscious towards consuming products that have a cleaner label. Besides this, the Asia Pacific market maybe one of fastest growing owing to its awareness towards healthier foods. An overall growth in population and increased income capacities in developing countries could increase the growth of this product.

Key Vendor Takeaway

The key market players identified for this category are Nan Pao International Biotech, Ozone Naturals, Sigma-Aldrich Co. LLC, Parry Nutraceuticals, DIC Corporation, Zhejiang Binmel Biotechnology, EcoFuel Laboratories, Prozyme, Fuqing King Dnarmsa Spirulina Co., Ltd, Wuli Lvqi, Xian Sonwu Biotech Co., Limited and Tianjin Norland Biotech Co. Ltd. As per an article in the Business Standard website, 2018 stated a joint venture between the Parry group and Synthite industries in India to expand product of Spirulina and phycocyanin.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Lyophilized Powder

- Natural Colour Pigment

MARKET, BY EXTRACTION TYPE

- Ion-Exchange Chromatography

- Ammonium Sulphate Precipitation

- Gel Filtration Chromatography

MARKET, BY APPLICATION

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Dietary Supplements

- Chemicals

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. PHYCOCYANIN MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Products

2.1.2. Market Snippet by Extraction Type

2.1.3. Market Snippet by Application

2.1.4. Market Snippet by Region

2.2. Competitive Insights

3. PHYCOCYANIN KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. PHYCOCYANIN INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. PHYCOCYANIN MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. PHYCOCYANIN MARKET – BY PRODUCTS

6.1. Overview

6.1.1. Segment Share Analysis, By Products, 2017 & 2025 (%)

6.2. Lyophilized powder

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Natural colour pigment

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. PHYCOCYANIN MARKET – BY EXTRACTION TYPE

7.1. Overview

7.1.1. Segment Share Analysis, By Extraction Type, 2017 & 2025 (%)

7.2. Ion-exchange chromatography

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Ammonium sulphate precipitation

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Gel filtration chromatography

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. PHYCOCYANIN MARKET – BY APPLICATION

8.1. Overview

8.1.1. Segment Share Analysis, By Extraction Type, 2017 & 2025 (%)

8.2. Food Industry

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Pharmaceutical Industry

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Cosmetic Industry

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Dietary supplements

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6. Chemicals

8.6.1. Overview

8.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. PHYCOCYANIN MARKET– BY GEOGRAPHY

9.1. Introduction

9.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

9.2. North America

9.2.1. Overview

9.2.2. Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.2.4. North America Market Size and Forecast, By Products, 2014 – 2025 (US$ Million)

9.2.5. North America Market Size and Forecast, By Extraction Type, 2014 – 2025 (US$ Million)

9.2.6. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

9.2.7. U.S.

9.2.7.1. Overview

9.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.2.8. Canada

9.2.8.1. Overview

9.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Europe

9.3.1. Overview

9.3.2. Key Manufacturers in Europe

9.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.3.4. Europe Market Size and Forecast, By Products, 2014 – 2025 (US$ Million)

9.3.5. Europe Market Size and Forecast, By Extraction Type, 2014 – 2025 (US$ Million)

9.3.6. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

9.3.7. France

9.3.7.1. Overview

9.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.8. Germany

9.3.8.1. Overview

9.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.9. Rest of Europe

9.3.9.1. Overview

9.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Asia Pacific (APAC)

9.4.1. Overview

9.4.2. Key Manufacturers in Asia Pacific

9.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.4.4. Asia Pacific Market Size and Forecast, By Products, 2014 – 2025 (US$ Million)

9.4.5. Asia Pacific Market Size and Forecast, By Extraction Type, 2014 – 2025 (US$ Million)

9.4.6. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

9.4.7. China

9.4.7.1. Overview

9.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.8. India

9.4.8.1. Overview

9.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.9. Rest of APAC

9.4.9.1. Overview

9.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5. Rest of the World

9.5.1. Overview

9.5.2. Key Manufacturers in Rest of the World

9.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.5.4. Rest of the World Market Size and Forecast, By Products, 2014 – 2025 (US$ Million)

9.5.5. Rest of the World Market Size and Forecast, By Extraction Type, 2014 – 2025 (US$ Million)

9.5.6. Rest of the World Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

9.5.7. Latin America

9.5.7.1. Overview

9.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.8. Middle East and Africa

9.5.8.1. Overview

9.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. KEY VENDOR ANALYSIS

10.1. NAN PAO International Biotech

10.1.1. Company Snapshot

10.1.2. Financial Performance

10.1.3. Product Benchmarking

10.1.4. Strategic Initiatives

10.2. Ozone Naturals

10.3. Sigma-Aldrich Co. LLC

10.4. Parry Nutraceuticals

10.5. DIC Corporation

10.6. Zhejiang Binmel Biotechnology

10.7. EcoFuel Laboratories

10.8. Prozyme

10.9. Fuqing King Dnarmsa Spirulina Co., Ltd.

10.10. Wuli Lvqi

10.11. Xian Sonwu Biotech Co. Limited

10.12. Tianjin Norland Biotech Co. Ltd

11. 360 DEGREE ANALYSTVIEW

12. APPENDIX

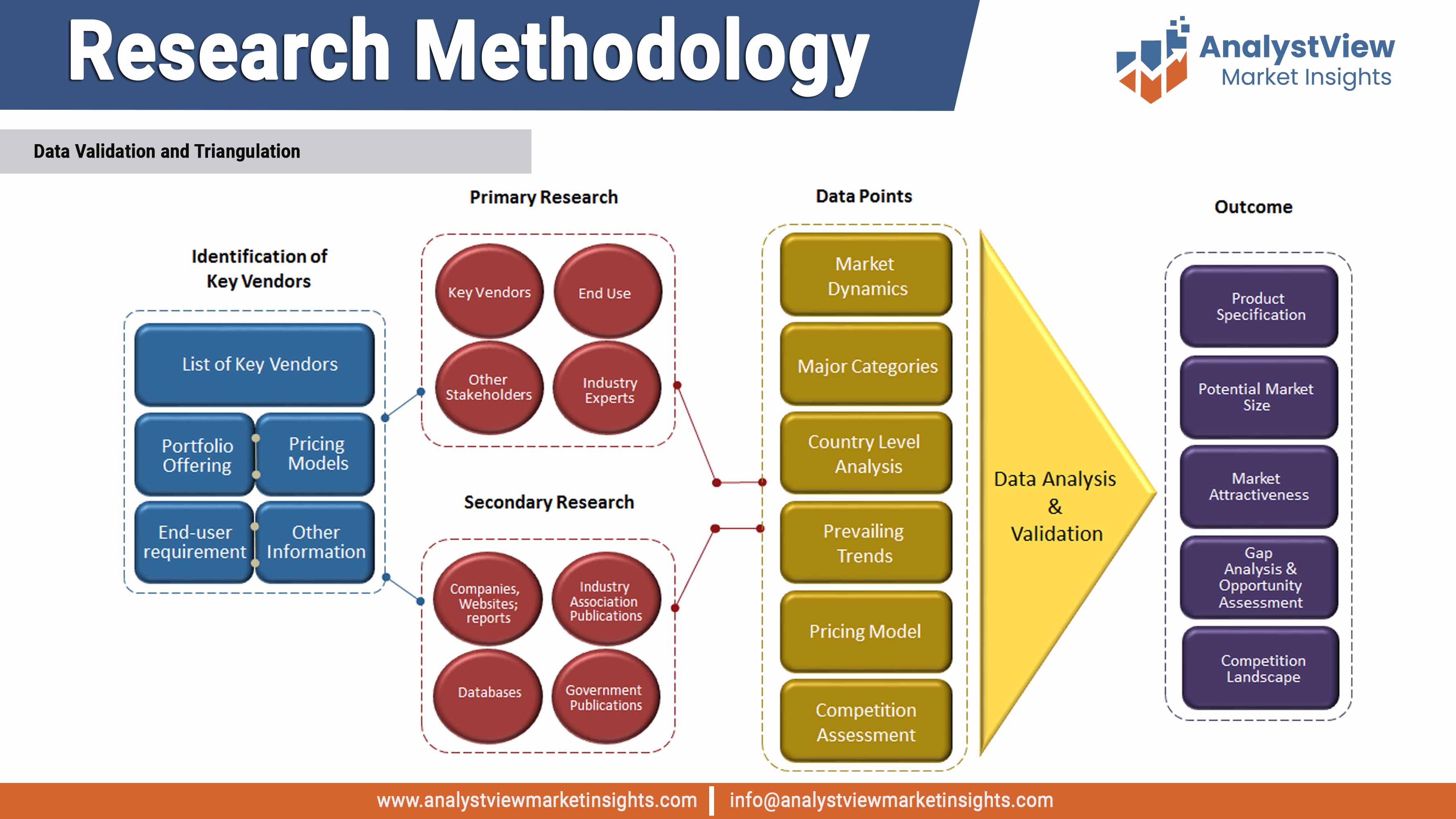

12.1. Research Methodology

12.2. References

12.3. Abbreviations

12.4. Disclaimer

12.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Phycocyanin market: Products snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Products

TABLE Global Phycocyanin market, by Products 2014-2025 (USD Million)

TABLE Phycocyanin market: Extraction Type snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Extraction Type

TABLE Global Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Phycocyanin market: Application snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Phycocyanin market, by Application 2014-2025 (USD Million)

TABLE Phycocyanin market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Phycocyanin market, by Region 2014-2025 (USD Million)

TABLE North America Phycocyanin market, by Country, 2014-2025 (USD Million)

TABLE North America Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE North America Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE North America Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE U.S. Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE U.S. Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE U.S. Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Canada Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Canada Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Canada Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Europe Phycocyanin market, by country, 2014-2025 (USD Million)

TABLE Europe Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Europe Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Europe Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Germany Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Germany Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Germany Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE U.K. Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE U.K. Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE U.K. Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Rest of the Europe Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Rest of the Europe Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Rest of the Europe Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Phycocyanin market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Asia Pacific Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Asia Pacific Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Japan Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Japan Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Japan Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE China Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE China Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE China Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Rest of the World Phycocyanin market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Rest of the World Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Rest of the World Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Latin America Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Latin America Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Latin America Phycocyanin market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Phycocyanin market, by Products, 2014-2025 (USD Million)

TABLE Middle East and Africa Phycocyanin market, by Extraction Type, 2014-2025 (USD Million)

TABLE Middle East and Africa Phycocyanin market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Phycocyanin market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Products segment market share analysis, 2017 & 2025

FIGURE Products segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Lyophilized powder market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Natural colour pigment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Extraction Type segment market share analysis, 2017 & 2025

FIGURE Extraction Type segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Ion-exchange chromatography market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Ammonium sulphate precipitation market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Gel filtration chromatography market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2017 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Food Industry market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Pharmaceutical Industry market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cosmetic Industry market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Dietary supplements market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Chemicals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Phycocyanin market share and leading players, 2018

FIGURE Europe Phycocyanin market share and leading players, 2018

FIGURE Asia Pacific Phycocyanin market share and leading players, 2018

FIGURE Latin America Phycocyanin market share and leading players, 2018

FIGURE Middle East and Africa Phycocyanin market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)