Biopreservation Market by Type (Media (Sera), Equipment (Thawing Equipment, Alarms, Freezers)), Biospecimen (Human Tissue, Stem Cells, Organs), Application (Therapeutic, Research, Clinical Trials), End User (Hospitals, Biobank) and By Geography (EU, NA, APAC, LATAM, and MEA) – Analysis, Size, Share, Trends, & Forecast from 2021-2027

REPORT HIGHLIGHT

The global biopreservation market was valued at USD 3.23 billion by 2020, growing with 10.6% CAGR during the forecast period, 2021-2027.

Biopreservation is the usage of controlled or natural antimicrobials or macrobiotics to conserve a product and extend its shelf life. The fermentation products or good bacteria formed by bacteria are employed in biopreservation to control decomposition and deactivate pathogens. The fermentation products and beneficial bacteria are primarily designated to make pathogen inactive and lessen spoilage. The central organism or organism utilized for this purpose is lactic acid bacteria and its metabolites. These are capable of exhibiting antimicrobial properties and helpful in imparting exceptional texture and flavor to the products.

Market Dynamics

Rising healthcare spending is a significant growth contributory factor for the biopreservation market. This increase in healthcare expenditure is the significance of rapid financial development across the world.

The growing incidence of chronic diseases such as diabetes, renal diseases, cardiac, and obesity is the foremost factor that will foster the biopreservation market growth during the prediction period. According to the Centers for Disease Control and Prevention 2020, the incidence of obesity was 44.8% among middle-aged adults aged 40 to 59 years, 40.0% among young adults aged 21 to 39 years, and 42.9% among adults aged 60 and older.

Mounting research and development investment in drug detection will impact biopreservation market growth. An increase in the number of biobanks to stockpile biological products employed in diverse medical research types will hasten the market growth.

Type Takeaway

Depending on the type, the global business is categorized into biopreservation media (nutrient media, sera. growth factors & supplements), biospecimen equipment, temperature control systems, freezers, cryogenic storage systems, thawing equipment, refrigerators (accessories, alarms & monitoring systems, incubators, centrifuges, and other equipment). The biospecimen equipment category occupied the lion's share in 2019 and anticipated remarkable growth during the analysis period. The growing need for biobanking over the decade and its wide-ranging usage in tissue research, plasma, DNA, and stem cell is likely to drive market growth. Widespread adoption can also be accredited to benefits such as high cost-efficiency, adequate storage capacity, and low maintenance.

Media is expected to exhibit stable growth in the forthcoming years as it is an essential part of the biopreservation procedure. Snowballing need for biobanks of tissues and stem cells to support life sciences research is predictable to deliver the segment with lucrative growth opportunities. Moreover, homebrew media accounted for the notable share of the media segment in 2019.

Biospecimen Takeaway

In terms of Biospecimen, the worldwide industry is categorized into human tissue, Stem cells, organs, and other biospecimens. Stem cells are likely to witness noteworthy progression in the upcoming years. High growth can be accounted for the growing preference for tumor cells in healing several types of cancers, including breast, colon, and prostate cancer. Also, cancer cells' usage to recognize rare cells in body fluid will raise its need for validation of chemotherapy and a primary diagnosis of cancer reappearance, thus nurturing the segment's growth.

Application Takeaway

By Application, the biopreservation market is classified into a Therapeutic application, Research applications, Clinical trials, and other applications. Therapeutic applications dominated the biopreservation market in 2019 due to the technological advancements in personalized medicine, regenerative medicine, and the growing inclination of cord blood banking. This segment's huge share can be accredited to technological advancements in treatment methods and the high frequency of chronic disorders across the world.

End-user Takeaway

In terms of end-user, the worldwide industry is categorized into biobanks, gene banks, hospitals, and other end users. The biobanks segment held the largest share and is forecasted to retain its supremacy throughout the forecast period due to rising awareness among scientists concerning stem cell conservation benefits. Similarly, a growing number of egg and sperm banks and higher adoption of assisted reproductive technology (AST) are foreseen to be the foremost growth contributing factors. Around 55.0% of biopharmaceutical firms have partnerships with tissue preservation centers and national biobanks at hospitals, supporting biopreservation market growth.

Regional Takeaway

Regionally, the overall industry is divided into North America, Middle East & Africa, Asia Pacific, Latin America, and Europe. North America held the lion's share in 2019 owing to the growing prevalence of lifestyle diseases such as obesity, diabetes, and kidney disorders leading to organ impairment will raise demand for organ or tissue transplantation. According to the U.S. Department of Health & Human Services, more than 154,740 individuals were on the national transplant waiting list as of 2019. Such features upsurge acceptance of regenerative medicine in treating the disease, thereby propelling biopreservation market size in North America.

APAC is projected to witness the fastest growth due to the significant factors driving this market's growth, including the increasing number of biobanks, growing private and public investments in life sciences research and research centers, and the huge prevalence of incurable disorders.

COVID-19 Impact

The growth of the COVID-19 pandemic brought the world together to a standstill. Nevertheless, the market for biopreservation has seen a surge across the world. Extensive population investigations such as the UK Biobank present exceptional opportunities for experiencing the pathophysiology, health influence, and prognostic constituents associated with coronavirus a condition that has had a notable impact on almost everyone across the world.

Key Vendor Takeaway

Merck KGaA (Germany), Avantor, Inc. (the US), Thermo Fisher Scientific Inc. (US), ThermoGenesis Holdings, Inc. (US), Exact Sciences Corporation (US), Bio-Techne Corporation (US), BioLife Solutions, Inc. (US), Worthington Industries, Inc. (the US), So-Low Environmental Equipment Co., Inc. (US) Chart Industries, Inc. (US), and Princeton CryoTech, Inc. (the US) among others.

The principal players are actively adopting various strategies such as acquisition, geographical expansion, development of new and efficient therapeutics, etc., to maintain their position in the market. In 2018, Thermo Fisher introduced the Gibco BenchStable Media, which offers more sustainable packaging for cell culture when equated to sustainable media.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2016 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2021 to 2027

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

GLOBAL BIOPRESERVATION MARKET KEY PLAYERS

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantor, Inc.

- ThermoGenesis Holdings, Inc.

- Bio-Techne Corporation

- BioLife Solutions, Inc.

- Exact Sciences Corporation

- Worthington Industries, Inc.

- Chart Industries, Inc.

- So-Low Environmental Equipment Co., Inc.

- Princeton CryoTech, Inc.

GLOBAL BIOPRESERVATION MARKET BY PRODUCTS AND SERVICES

- Biopreservation Media

- Nutrient Media

- Sera

- Growth Factors & Supplements

- Biospecimen Equipment

- Temperature Control Systems

- Freezers

- Cryogenic Storage Systems

- Thawing Equipment

- Refrigerators

- Accessories

- Alarms & Monitoring systems

- Incubators

- Centrifuges

- Other Equipment

GLOBAL BIOPRESERVATION MARKET BY BIOSPECIMEN

- Human Tissue Samples

- Organs

- Stem Cells

- Other Biospecimens

GLOBAL BIOPRESERVATION MARKET BY APPLICATION

- Therapeutic Applications

- Research Applications

- Clinical Trials

- Other Applications

GLOBAL BIOPRESERVATION MARKET BY END-USER

- Biobanks

- Gene Banks

- Hospitals

- Other End Users

GLOBAL BIOPRESERVATION MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. BIOPRESERVATION MARKET OVERVIEW

1.1. Study Scope

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Type

2.1.2. Market Snippet by Biospecimen

2.1.3. Market Snippet by Application

2.1.4. Market Snippet by End-user

2.1.5. Market Snippet by Region

2.2. Competitive Insights

3. BIOPRESERVATION KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. BIOPRESERVATION INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. BIOPRESERVATION MARKET: COVID-19 IMPACT ANALYSIS

5.1. Pre-COVID-19 Impact Analysis

5.2. Post-COVID-19 Impact Analysis

5.2.1. Top Performing Segments

5.2.2. Marginal Growth Segments

5.2.3. Top Looser Segments

5.2.4. Marginal Loss Segments

6. BIOPRESERVATION MARKET LANDSCAPE

6.1. Market Share Analysis, 2019

6.2. Key Innovators Analysis

6.3. Breakdown Data, by Key Manufacturer

6.3.1. Established Players’ Analysis

6.3.2. Emerging Players’ Analysis

7. BIOPRESERVATION MARKET – BY TYPE

7.1. Overview

7.1.1. Segment Share Analysis, By Type, 2020 & 2027 (%)

7.2. Biopreservation Media

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.2.3. Nutrient Media

7.2.3.1. Overview

7.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.2.4. Sera

7.2.4.1. Overview

7.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.2.5. Growth Factors & Supplements

7.2.5.1. Overview

7.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.3. Biospecimen Equipment

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.3.3. Temperature Control Systems

7.3.3.1. Overview

7.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.4. Freezers

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.5. Cryogenic Storage Systems

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.6. Thawing Equipment

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.7. Refrigerators

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.7.3. Accessories

7.7.3.1. Overview

7.7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.7.4. Alarms & Monitoring systems

7.7.4.1. Overview

7.7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.7.5. Incubators

7.7.5.1. Overview

7.7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.7.6. Centrifuges

7.7.6.1. Overview

7.7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

7.7.7. Other Equipment

7.7.7.1. Overview

7.7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

8. BIOPRESERVATION MARKET – BY BIOSPECIMEN

8.1. Overview

8.1.1. Segment Share Analysis, By Biospecimen, 2020 & 2027 (%)

8.2. Human Tissue Samples

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

8.3. Organs

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

8.4. Stem cells

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

8.5. Others

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

9. BIOPRESERVATION MARKET – BY APPLICATION

9.1. Overview

9.1.1. Segment Share Analysis, By Application, 2020 & 2027 (%)

9.2. Therapeutic Applications

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

9.3. Research Applications

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

9.4. Clinical Trials

9.4.1. Overview

9.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

9.5. Other Applications

9.5.1. Overview

9.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

10. BIOPRESERVATION MARKET – BY END-USER

10.1. Overview

10.1.1. Segment Share Analysis, By End-User, 2020 & 2027 (%)

10.2. Biobanks

10.2.1. Overview

10.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

10.3. Gene Banks

10.3.1. Overview

10.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

10.4. Hospitals

10.4.1. Overview

10.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

10.5. Others

10.5.1. Overview

10.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11. BIOPRESERVATION MARKET– BY GEOGRAPHY

11.1. Introduction

11.1.1. Segment Share Analysis, By Geography, 2020 & 2027 (%)

11.2. North America

11.2.1. Overview

11.2.2. Key Manufacturers in North America

11.2.3. North America Market Size and Forecast, By Country, 2016 - 2027 (US$ Million)

11.2.4. North America Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.2.5. North America Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.2.6. North America Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.2.7. North America Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.2.8. U.S.

11.2.8.1. Overview

11.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.2.8.3. U.S. Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.2.8.4. U.S. Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.2.8.5. U.S. Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.2.8.6. U.S. Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.2.9. Canada

11.2.9.1. Overview

11.2.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.2.9.3. Canada Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.2.9.4. Canada Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.2.9.5. Canada Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.2.9.6. Canada Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.3. Europe

11.3.1. Overview

11.3.2. Key Manufacturers in North America

11.3.3. Europe Market Size and Forecast, By Country, 2016 - 2027 (US$ Million)

11.3.4. Europe Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.3.5. Europe Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.3.6. Europe Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.3.7. Europe Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.3.8. Germany

11.3.8.1. Overview

11.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.3.8.3. Germany Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.3.8.4. Germany Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.3.8.5. Germany Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.3.8.6. Germany Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.3.9. Italy

11.3.9.1. Overview

11.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.3.9.3. Italy Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.3.9.4. Italy Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.3.9.5. Italy Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.3.9.6. Italy Market Size and Forecast, By Mode of Delivery, 2016 - 2027 (US$ Million)

11.3.10. United Kingdom

11.3.10.1. Overview

11.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.3.10.3. United Kingdom Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.3.10.4. United Kingdom Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.3.10.5. United Kingdom Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.3.10.6. United Kingdom Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.3.11. France

11.3.11.1. Overview

11.3.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.3.11.3. France Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.3.11.4. France Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.3.11.5. France Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.3.11.6. France Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.3.12. Rest of Europe

11.3.12.1. Overview

11.3.12.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.3.12.3. Rest of Europe Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.3.12.4. Rest of Europe Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.3.12.5. Rest of Europe Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.3.12.6. Rest of Europe Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.4. Asia Pacific (APAC)

11.4.1. Overview

11.4.2. Key Manufacturers in Asia Pacific

11.4.3. Asia Pacific Market Size and Forecast, By Country, 2016 - 2027 (US$ Million)

11.4.4. Asia Pacific Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.4.5. Asia Pacific Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.4.6. Asia Pacific Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.4.7. Asia Pacific Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.4.8. India

11.4.8.1. Overview

11.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.4.8.3. India Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.4.8.4. India Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.4.8.5. India Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.4.8.6. India Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.4.9. China

11.4.9.1. Overview

11.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.4.9.3. China Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.4.9.4. China Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.4.9.5. China Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.4.9.6. China Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.4.10. Japan

11.4.10.1. Overview

11.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.4.10.3. Japan Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.4.10.4. Japan Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.4.10.5. Japan Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.4.10.6. Japan Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.4.11. South Korea

11.4.11.1. Overview

11.4.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.4.11.3. South Korea Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.4.11.4. South Korea Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.4.11.5. South Korea Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.4.11.6. South Korea Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.4.12. Rest of APAC

11.4.12.1. Overview

11.4.12.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.4.12.3. Rest of APAC Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.4.12.4. Rest of APAC Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.4.12.5. Rest of APAC Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.4.12.6. Rest of APAC Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.5. Latin America

11.5.1. Overview

11.5.2. Key Manufacturers in Latin America

11.5.3. Latin America Market Size and Forecast, By Country, 2016 - 2027 (US$ Million)

11.5.4. Latin America Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.5.5. Latin America Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.5.6. Latin America Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.5.7. Latin America Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.5.8. Brazil

11.5.8.1. Overview

11.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.5.8.3. Brazil Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.5.8.4. Brazil Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.5.8.5. Brazil Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.5.8.6. Brazil Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.5.9. Mexico

11.5.9.1. Overview

11.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.5.9.3. Mexico Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.5.9.4. Mexico Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.5.9.5. Mexico Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.5.9.6. Mexico Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.5.10. Argentina

11.5.10.1. Overview

11.5.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.5.10.3. Argentina Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.5.10.4. Argentina Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.5.10.5. Argentina Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.5.10.6. Argentina Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.5.11. Rest of LATAM

11.5.11.1. Overview

11.5.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.5.11.3. Rest of LATAM Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.5.11.4. Rest of LATAM Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.5.11.5. Rest of LATAM Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.5.11.6. Rest of LATAM Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.6. Middle East and Africa

11.6.1. Overview

11.6.2. Key Manufacturers in Middle East and Africa

11.6.3. Middle East and Africa Market Size and Forecast, By Country, 2016 - 2027 (US$ Million)

11.6.4. Middle East and Africa Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.6.5. Middle East and Africa Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.6.6. Middle East and Africa Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.6.7. Middle East and Africa Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.6.8. Saudi Arabia

11.6.8.1. Overview

11.6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.6.8.3. Saudi Arabia Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.6.8.4. Saudi Arabia Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.6.8.5. Saudi Arabia Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.6.8.6. Saudi Arabia Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

11.6.9. United Arab Emirates

11.6.9.1. Overview

11.6.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2016 - 2027, (US$ Million)

11.6.9.3. United Arab Emirates Market Size and Forecast, By Type, 2016 - 2027 (US$ Million)

11.6.9.4. United Arab Emirates Market Size and Forecast, By Application, 2016 - 2027 (US$ Million)

11.6.9.5. United Arab Emirates Market Size and Forecast, By Biospecimen, 2016 - 2027 (US$ Million)

11.6.9.6. United Arab Emirates Market Size and Forecast, By End-User, 2016 - 2027 (US$ Million)

12. KEY VENDOR ANALYSIS

12.1. Competitive Dashboard

12.2. Company Profiles

12.2.1. Thermo Fisher Scientific Inc.

12.2.1.1. Company Snapshot

12.2.1.2. Financial Performance

12.2.1.3. Type Benchmarking

12.2.1.4. Strategic Initiatives

12.2.2. Merck KGaA

12.2.3. Avantor, Inc.

12.2.4. ThermoGenesis Holdings, Inc.

12.2.5. Bio-Techne Corporation

12.2.6. BioLife Solutions, Inc.

12.2.7. Exact Sciences Corporation

12.2.8. Worthington Industries, Inc.

12.2.9. Chart Industries, Inc.

12.2.10. So-Low Environmental Equipment Co., Inc.

12.2.11. Princeton CryoTech, Inc.

13. 360 DEGREE ANALYSTVIEW

14. APPENDIX

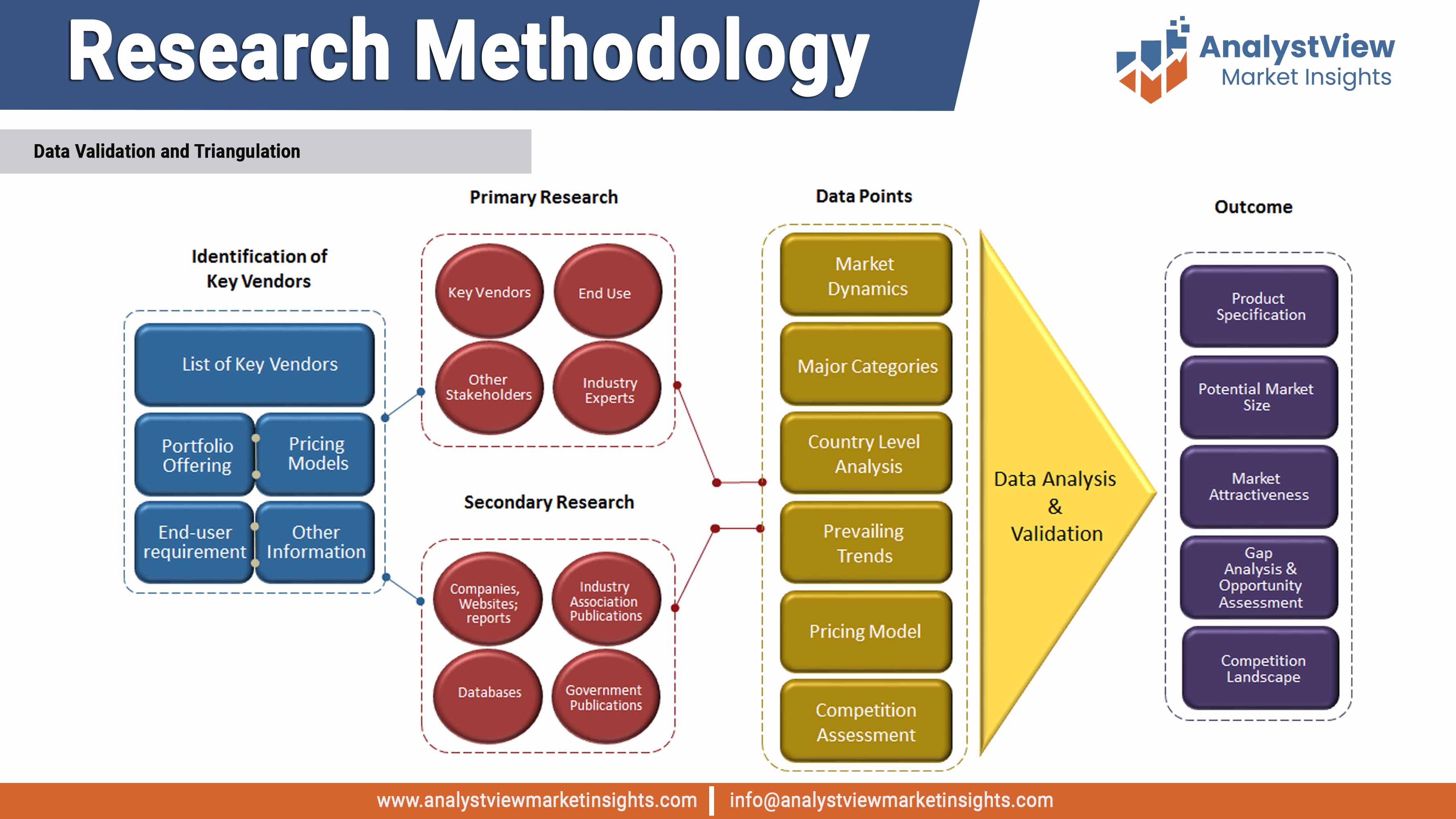

14.1. Research Methodology

14.2. References

14.3. Abbreviations

14.4. Disclaimer

14.5. Contact Us