Biofertilizer Market, by Product (Nitrogen Fixing, Phosphate Solubilizing, Zinc Solubilizers, Sulfur Solubilizers and Potash Mobilizers) By Application and Geography (North America, Europe, Asia Pacific, and Rest of the World) Analysis, Share, Trends, Size, & Forecast from 2014 2025

REPORT HIGHLIGHT

The biofertilizer market was valued at USD 760.8 million by 2017, growing with 15.8% CAGR during the forecast period, 2018-2025

Market Dynamics

Bio-fertilizers are used to increase the fertility of soil and crops. It comprises of micro-organisms which give nutrients to soil. These bio-fertilizers are increasingly preferred over harmful chemicals. The wide use of chemical fertilizers has contaminated flora and fauna and has accumulated toxic in soil. The deterioration of crops through chemical fertilizers has alarmed the world and has given the desired push to bio-fertilizer market. Bio-fertilizer are prepared through biological waste material, hence exhibits ability to regain soil health and boost up the quality of crop Bio-fertilizers supply nutrients through nitrogen fixation and solubilizing phosphorous and provided to plants though seeds or soil.

The global demand of biofertilizers is sky-rocketing owing to the fuelling demand from agricultural industry. Also with the rise of global population, agricultural production at large scale has become compulsion. These factors will undoubtedly give a spurring growth over the study period. Organic farming has the potential to give sustained growth to agriculture. However,

Product Takeaway

By product, the market is divided into nitrogen fixing, phosphate solubilizing, zinc solubilizers, sulfur solubilizers and potash mobilizers. Among these, nitrogen fixing retained their dominance in 2017 by grabbing over 75% of global revenue and is anticipated to lead the industry during study period. Phosphate solubilizers accounted for the second largest product segment and is anticipated to grow at a remarkable rate. Growth of this segment is attributed to its ability to hydrolyse organic and inorganic phosphate through soluble bacteria.

Application Takeaway

In terms of application, the industry is classified as soil and seed treatment. The soil treatment segment has picked the maximum share and it is projected to achieve prominent growth owing to the high demand from organic food sector in developing countries.

Seed treatment is done via two methods: root dipping and soil application. This treatment boosts up phosphorous content in soil. Increase in use of treated seeds by farmers is estimated to bolster this industry segment in near future.

Regional Takeaway

North America acquired the largest market by taking over 30% of global market revenue. Positive outlook of agriculture industry in the region like U.S. and Canada will boost up the awareness of eco-friendly farming which in turn give a significant push to the industry in next 7 years.

On the flip side, Europe market had 22% of revenue in 2017. The European Commission announced ‘Horizon 2020 strategy’ which aimed to increase the production and usage of eco-friendly products. The Commission also came up with Action Plan 2020 for accelerating organic foods production at domestic level. Such initiatives would in turn support the regional growth. Asia-Pacific will experience a steady growth because of lucrative demand from food & beverage industry.

Key Vendor Takeaway

The industry comprises of many prominent players namely AgriLife, Biomax, Lallemand Inc., Novozymes A/S, and National Fertilizers Limited. Novozymes A/S and Biomax accounted for the significant market share. Companies are engaged in strategic mergers and acquisitions to expand their market presence. For instance, in March 2016, Valent BioSciences Corporation (VBC) collaborated with Rizobacter for R&D in BioRational Rhizoshpere space. This fusion is aimed to promote VBC’s development of new microbial products for root zone with an objective to expand its seed and soil strategy.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Nitrogen Fixing

- Phosphate Solubilizing

- Others

- Zinc Solubilizers

- Sulfur Solubilizers

- Potash Mobilizers

MARKET, BY APPLICATION

- Soil Treatment

- Seed Treatment

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. BIOFERTILIZER MARKET OVERVIEW

1.1. Study Scope

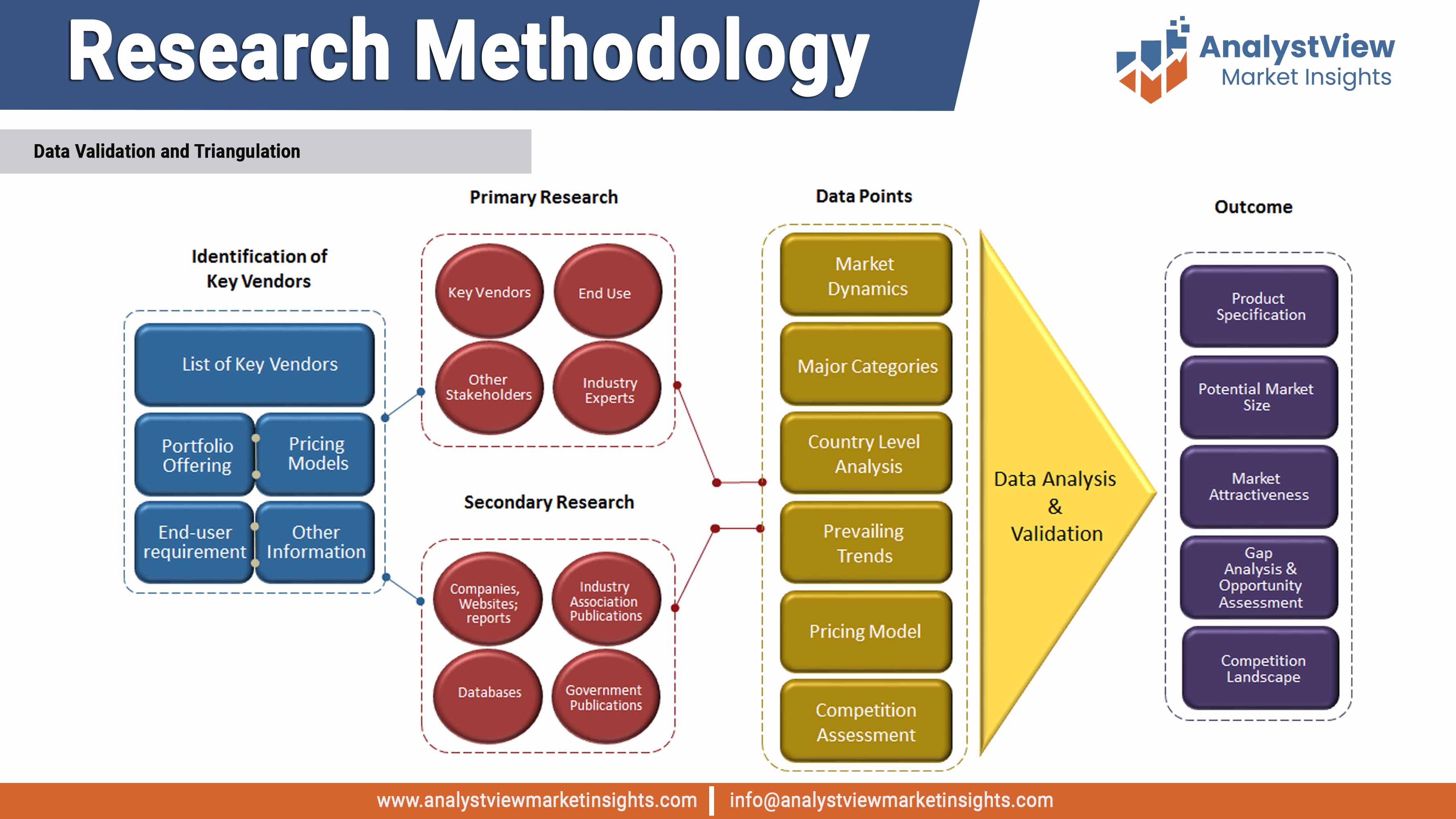

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. BIOFERTILIZER KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. BIOFERTILIZER INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Market Attractiveness Analysis

4.3. Regulatory Framework Analysis

5. BIOFERTILIZER MARKET LANDSCAPE

5.1. Market Share Analysis

6. BIOFERTILIZER MARKET – BY PRODUCT

6.1. Overview

6.2. Nitrogen Fixing

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3. Phosphate Solubilizing

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.4. Zinc Solubilizers

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.5. Sulfur Solubilizers

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.6. Potash Mobilizers

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7. BIOFERTILIZER MARKET – BY APPLICATION

7.1. Overview

7.2. Soil Treatment

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3. Seed Treatment

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8. BIOFERTILIZER MARKET– BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.3. U.S.

8.2.3.1. Overview

8.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.4. Canada

8.2.4.1. Overview

8.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3. Europe

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.3. France

8.3.3.1. Overview

8.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.4. Germany

8.3.4.1. Overview

8.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.5. Rest of Europe

8.3.5.1. Overview

8.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.3. China

8.4.3.1. Overview

8.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.4. India

8.4.4.1. Overview

8.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.5. Rest of APAC

8.4.5.1. Overview

8.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.3. Latin America

8.5.3.1. Overview

8.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.4. Middle East and Africa

8.5.4.1. Overview

8.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

9. KEY VENDOR ANALYSIS

9.1. AgriLife

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.2. Biomax

9.2.1. Company Overview

9.2.2. SWOT Analysis

9.2.3. Key Developments

9.3. Lallemand Inc.

9.3.1. Company Overview

9.3.2. SWOT Analysis

9.3.3. Key Developments

9.4. Novozymes A/S

9.4.1. Company Overview

9.4.2. SWOT Analysis

9.4.3. Key Developments

9.5. National Fertilizers Limited

9.5.1. Company Overview

9.5.2. SWOT Analysis

9.5.3. Key Developments

*Client can request additional company profiling as per specific requirements

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

11.1. Research Methodology

11.2. Abbreviations

11.3. Disclaimer

11.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Biofertilizer Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

Table 10 Biofertilizer Market, by Product, 2014 – 2025 (USD Billion)

Table 11 Biofertilizer Market, by Application, 2014 – 2025 (USD Billion)

Table 12 Biofertilizer Market, by Geography, 2014 – 2025 (USD Billion)

Table 13 North America Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 14 U.S. Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 15 Canada Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 16 Europe Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 17 France Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 18 Germany Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 19 Asia Pacific Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 20 China Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 21 India Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 22 Latin America Biofertilizer Market, 2014 – 2025 (USD Billion)

Table 23 MEA Biofertilizer Market, 2014 – 2025 (USD Billion)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Biofertilizer Market, by Product, 2014 – 2025 (USD Billion)

Figure 6 Biofertilizer Market, by Application, 2014 – 2025 (USD Billion)

Figure 7 Biofertilizer Market, by Geography, 2014 – 2025 (USD Billion)