Liquid Sodium Silicate Market, By Product (LSS A, LSS B, LSS C), By Application (Detergents, Catalysts, Pulp & Paper, Elastomers, Food & Healthcare) and by Geography (NA, EU, APAC, LATAM and MEA) Analysis, Share, Trends, Size, & Forecast from 2019 2025

|

Report ID

AV426

|

Published Date

October 2020

|

Pages

149

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The Liquid Sodium Silicate Market was valued at USD 823.1 million by 2018, growing with 7.3% CAGR during the forecast period, 2019-2025.

Liquid Sodium silicate is a chemical that is non-hazardous in nature. It finds application in a number of products across varies industries. This product, which is also commonly known as water glass, is high in functionality and uses. The biggest advantage being the deliverables its offers despite being a low-cost product makes it ideal for manufacturing processes. Sodium Meta-silicate is its most common variant that is applied across industries globally. This product is an excellent humectant, emulsifier, deflocculating, anti-re-deposition and more. Therefore, liquid sodium silicate uses are cross-functional and multipurpose in nature.

Market Dynamics

The key driver that fuels this industry is the increasing demand for products that are derived from sodium silicate. Besides this, sodium silicate is also found to be useful in a number of niche application that pushes the trigger for its increased demand. Raw material, manufacturing, and transportation costs are the three determining factors that decide the liquid Sodium silicate price. Due to growing technological and scientific pursuits, there is always scope for improvement. The restraint, therefore, remains the substitutes that are being used to replace this product and the high transportation cost affects the liquid sodium silicate market.

Product Takeaway

The product categorization is segmented into three basic categories or grades, these include (Liquid Sodium Silicate – LSS) i.e. LSS A, LSS B, and LSS C. When it comes to LSS A, it dominates 70% of the market share, the Sio2/NO2O ratio ranges from 3.22 to 3.5 for this grade The demand for this grade lies in acid-proof cement, coating formulations, adhesive formulations, etc. due to its porosity functionality. This is followed by LSS B and LSS C, the market shares of which are near about 20% & 10% respectively

Application Takeaway

Liquid sodium silicate uses are across varied industries. Detergents, Catalysts, Pulp & Paper, Elastomers, and Food & Healthcare are the core applications of the product. Due to its high functional properties like emulsification, reduction in surface tension, deflocculating and wetting this product is ideal for the manufacturing of detergents. Thus, this application holds the major market share with respect to the uses of liquid sodium silicate. Besides this, the precipitates or by-product of this is predicted silica and zeolite both of which are witnessing a boost in demand due to their application as a biocatalyst. Liquid sodium silicate is also used in the rubber industry as a filler material during manufacturing. It is also used in the manufacture of fiber drums, the core of paper towels and paperboard industry.

Regional Takeaway

China is the key slice of the liquid sodium silicate market by dominating as much as 45% of the entire global consumption. In terms of manufacturing, the U.S leads as it is the primary producer of liquid sodium silicate. Historical data suggested that over 13 million tons were produced in the year 2018. In general, Asia Pacific is expected to be the fastest-growing industry for the global market for liquid sodium silicate. Demand-wise, North America tops the charts for the manufacturing of detergents.

Key Vendor Takeaway

Key companies involved in the liquid sodium silicate market are a W.R. Grace & Company, J.M. Huber Corporation, R. Grace & Company Occidental Petroleum Corporation, PQ Corporation, OxyChem Corporation, PPG Industries, Inc., Malpro Silica Private Limited, BASF SE, M. Huber Corporation, Glassven C.A., Aromachimie Company Ltd., and Agrigenic Chemicals, Inc.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 to 2017

- Base Year – 2018

- Estimated Year – 2019

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Liquid Sodium Silicate A

- Liquid Sodium Silicate B

- Liquid Sodium Silicate C

MARKET, BY APPLICATION

- Detergents

- Pulp & Paper

- Elastomers

- Catalysts

- Food

- Healthcare

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. LIQUID SODIUM SILICATE MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. LIQUID SODIUM SILICATE KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. LIQUID SODIUM SILICATE INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. LIQUID SODIUM SILICATE MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. LIQUID SODIUM SILICATE MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2018 & 2025 (%)

6.2. Liquid Sodium Silicate A

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Liquid Sodium Silicate B

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Liquid Sodium Silicate C

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. LIQUID SODIUM SILICATE MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2018 & 2025 (%)

7.2. Detergents

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Pulp & Paper

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Elastomers

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Catalysts

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Food & Healthcare

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. LIQUID SODIUM SILICATE MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2018 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. W.R. Grace & Company

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. J.M. Huber Corporation

9.3. R. Grace & Company Occidental Petroleum Corporation

9.4. PQ Corporation

9.5. OxyChem Corporation

9.6. PPG Industries, Inc.

9.7. Malpro Silica Private Limited

9.8. BASF SE

9.9. M. Huber Corporation

9.10. Glassven C.A.

9.11. Aromachimie Company Ltd.

9.12. Agrigenic Chemicals, Inc.

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

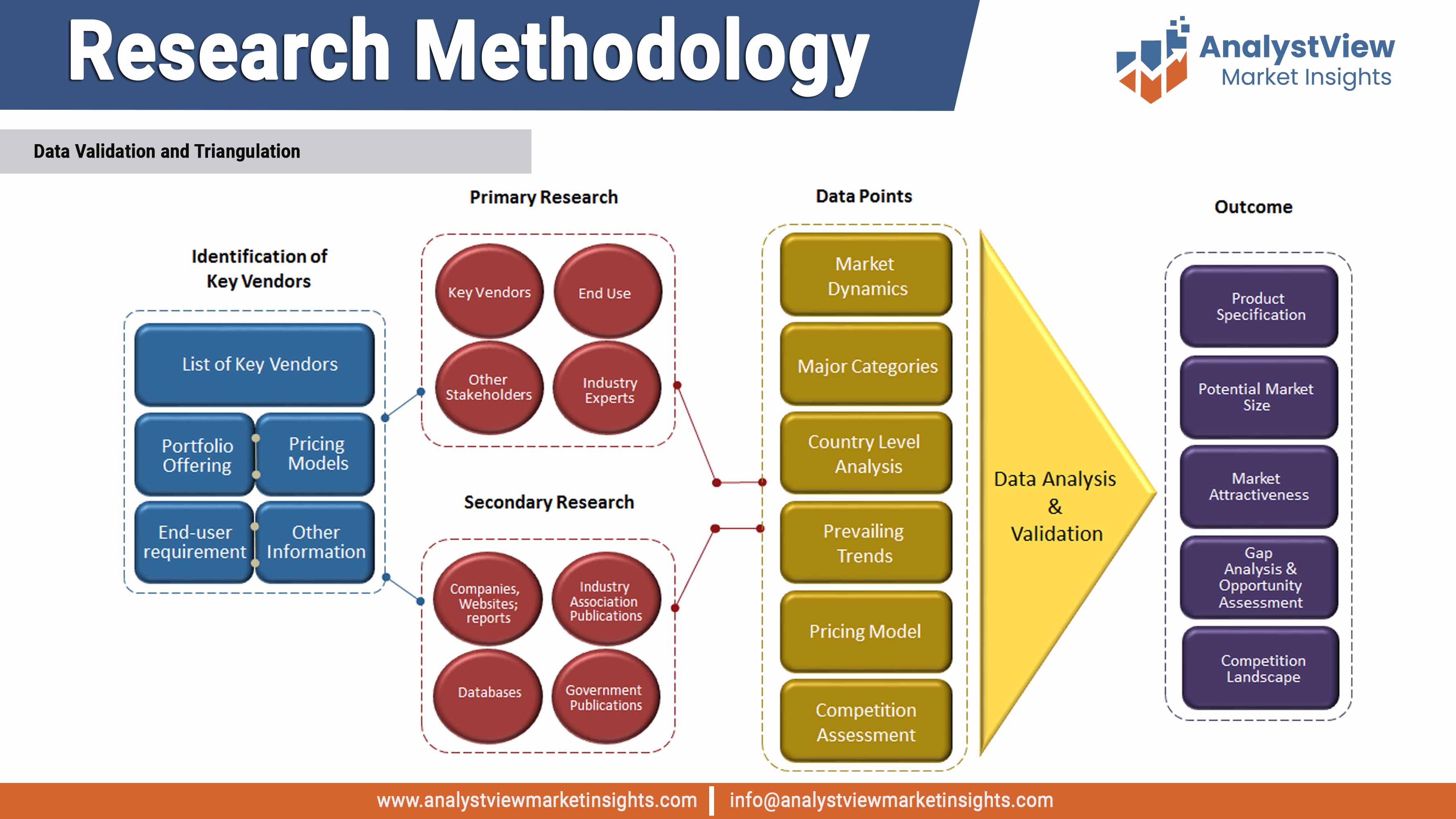

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Liquid Sodium Silicate market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Liquid Sodium Silicate market, by Product 2014-2025 (USD Million)

TABLE Liquid Sodium Silicate market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Liquid Sodium Silicate market, by Application 2014-2025 (USD Million)

fTABLE Liquid Sodium Silicate market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Liquid Sodium Silicate market, by Region 2014-2025 (USD Million)

TABLE North America Liquid Sodium Silicate market, by Country, 2014-2025 (USD Million)

TABLE North America Liquid Sodium Silicate market, by Product, 2014-2025 (USD Million)

TABLE North America Liquid Sodium Silicate market, by Application, 2014-2025 (USD Million)

TABLE Europe Liquid Sodium Silicate market, by country, 2014-2025 (USD Million)

TABLE Europe Liquid Sodium Silicate market, by Product, 2014-2025 (USD Million)

TABLE Europe Liquid Sodium Silicate market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Liquid Sodium Silicate market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Liquid Sodium Silicate market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Liquid Sodium Silicate market, by Application, 2014-2025 (USD Million)

TABLE Latin America Liquid Sodium Silicate market, by country, 2014-2025 (USD Million)

TABLE Latin America Liquid Sodium Silicate market, by Product, 2014-2025 (USD Million)

TABLE Latin America Liquid Sodium Silicate market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Liquid Sodium Silicate market, by country, 2014-2025 (USD Million)

TABLE Middle East and Africa Liquid Sodium Silicate market, by Product, 2014-2025 (USD Million)

TABLE Middle East and Africa Liquid Sodium Silicate market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Liquid Sodium Silicate market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2018 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Liquid Sodium Silicate A market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Liquid Sodium Silicate B market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Liquid Sodium Silicate C market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2018 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Detergents Application market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Pulp & Paper Application market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Elastomers Application market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Catalysts Application market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Food Application market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Healthcare Application market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2018 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Liquid Sodium Silicate market share and leading players, 2018

FIGURE Europe Liquid Sodium Silicate market share and leading players, 2018

FIGURE Asia Pacific Liquid Sodium Silicate market share and leading players, 2018

FIGURE Latin America Liquid Sodium Silicate market share and leading players, 2018

FIGURE Middle East and Africa Liquid Sodium Silicate market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Spain market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Italy market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE UK market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE France market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Japan market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE South Korea market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Singapore market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of APAC market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market share analysis by country, 2018

FIGURE Brazil market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mexico market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Argentina market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of LATAM market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market share analysis by country, 2018

FIGURE Saudi Arabia market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE United Arab Emirates market size, forecast and trend analysis, 2014 to 2025 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS