U.S. Bakery & Cereals Market, By Products (Breakfast Cereals, Cakes, Pastries & Sweet Pies, Morning Goods, Bread & Rolls, Cookies, and Savory Biscuits), By End Use, and Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The U.S. bakery & cereals market was valued at USD 106.4 billion by 2017, growing with 2.8% CAGR during the forecast period, 2018-2025.

The bakery and cereals market comprises baking mixes, baking ingredients, breakfast cereals, bread and rolls, cakes, cereal bars, cookies, dough products, energy bars, and savory biscuits. The trend toward growing demand for healthier food choices is considered to be the primary driver in the bakery and cereal products in the U.S. The consumption behaviours and attitudes of the U.S. population makes this country significant mature from those of other North American and global countries. Consumers are increasingly demanding a diverse variety of bakery foods that have superior nutritious taste and are safe. In addition, the country’s population is willing to pay a premium price for high-quality bakery products, driving the industry growth to great extent.

It is analysed that Canada is a major exporter of bakery and cereal foods to the U.S. Key exports include biscuits, dough mixes, breads, pastries/desserts, cookies, waffles, pies, gingerbread, and cereals. New product development is one of the important driving factor for this industry growth. For instance, many new bakery products being introduced into the market feature health claims or higher quality. Several key players are introducing products with lower amounts of sodium and high-fructose corn syrup but higher amounts of fibre. Such factors would in turn further boost the product demand significantly.

Products Takeaway

- Breakfast Cereals

- Cakes, Pastries & Sweet Pies

- Morning Goods

- Bread & Rolls

- Cookies

- Savory Biscuits

- Other

Among which, cakes, pastries and sweet pies accounted for the significant revenue share, accounted for over 25% revenue share.

End Use Takeaway

- Hypermarkets & Supermarkets

- Convenience Stores

- Food & drinks specialists

- eRetailers

- Other

Hypermarkets & Supermarkets accounted for the highest revenue share, accounting for over 65% share of the total market’s value. This distribution channel have been increasing their share of the industry by selling wrapped bread made by plant bakeries at a low cost and introducing in-store bakeries producing specialty breads, rolls and pastries.

Key Vendors Takeaway

- Artisanal Producers

- General Mills, Inc.

- Grupo Bimbo, S.A.B. de C.V.

- The Kellogg Company

- Other

The bakery & cereals market will be analyzed taking manufacturers of bakery and cereals as players. Of the all key players, General Mills, Inc. emerged as the leading player in the U.S. bakery & cereals market, captured over 9% share of the market’s value. High fixed costs and exit barriers intensify rivalry in the market. In addition, the US market is fragmented, which further increases the competition.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCTS

- Breakfast Cereals

- Cakes, Pastries & Sweet Pies

- Morning Goods

- Bread & Rolls

- Cookies

- Savory Biscuits

- Other

MARKET, BY END USE

- Hypermarkets & Supermarkets

- Convenience Stores

- Food & drinks specialists

- eRetailers

- Other

TABLE OF CONTENT

1. U.S. BAKERY & CEREALS MARKET OVERVIEW

1.1. Study Scope

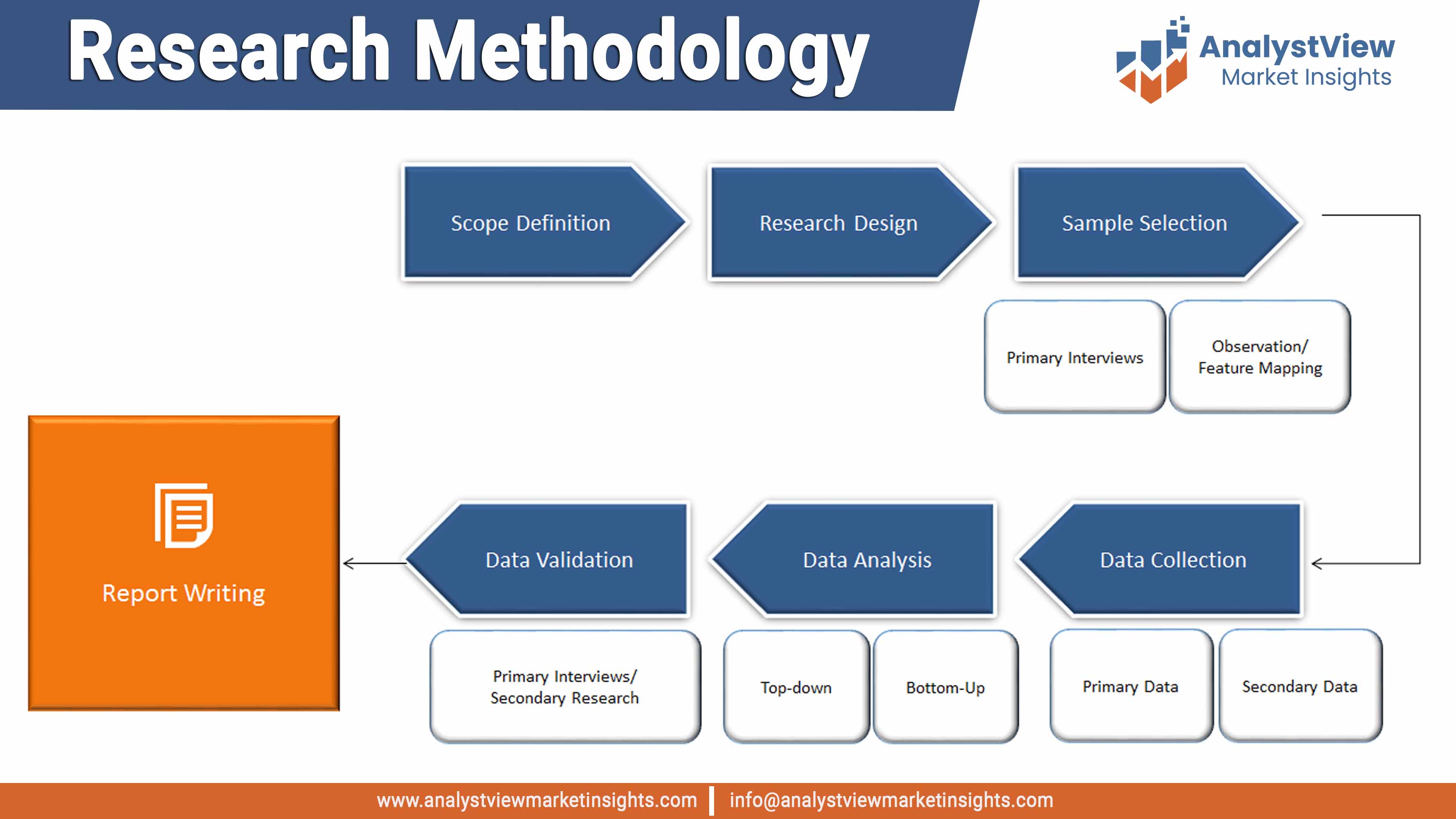

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by End Use

2.2. Competitive Insights

3. U.S. BAKERY & CEREALS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. U.S. BAKERY & CEREALS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. U.S. BAKERY & CEREALS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. U.S. BAKERY & CEREALS MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

6.2. Breakfast Cereals

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Cakes, Pastries & Sweet Pies

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Morning Goods

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Bread & Rolls

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6. Cookies

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.7. Savory Biscuits

6.7.1. Overview

6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.8. Other

6.8.1. Overview

6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. U.S. BAKERY & CEREALS MARKET – BY END USE

7.1. Overview

7.1.1. Segment Share Analysis, By End Use, 2017 & 2025 (%)

7.2. Hypermarkets & Supermarkets

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Convenience Stores

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Food & drinks specialists

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. eRetailers

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Other

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. KEY VENDOR ANALYSIS

8.1. Artisanal Producers

8.1.1. Company Snapshot

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.1.4. Strategic Initiatives

8.2. General Mills, Inc.

8.2.1. Company Snapshot

8.2.2. Financial Performance

8.2.3. Product Benchmarking

8.2.4. Strategic Initiatives

8.3. Grupo Bimbo, S.A.B. de C.V.

8.3.1. Company Snapshot

8.3.2. Financial Performance

8.3.3. Product Benchmarking

8.3.4. Strategic Initiatives

8.4. The Kellogg Company

8.4.1. Company Snapshot

8.4.2. Financial Performance

8.4.3. Product Benchmarking

8.4.4. Strategic Initiatives

9. 360 DEGREE ANALYSTVIEW

10. APPENDIX

10.1. Research Methodology

10.2. References

10.3. Abbreviations

10.4. Disclaimer

10.5. Contact Us

List of Tables

TABLE List of data Products

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE U.S. Bakery & Cereals market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE U.S. Bakery & Cereals market, by Product, 2014-2025 (USD Million)

TABLE U.S. Bakery & Cereals market: End Use snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by End Use

TABLE U.S. Bakery & Cereals market, by End Use 2014-2025 (USD Million)

List of Figures

FIGURE U.S. Bakery & Cereals market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2017 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Breakfast Cereals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cakes, Pastries & Sweet Pies market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Morning Goods market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Bread & Rolls market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cookies market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Savory Biscuits market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE End Use segment market share analysis, 2017 & 2025

FIGURE End Use segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Hypermarkets & Supermarkets market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Convenience Stores market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Food & drinks specialists market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE eRetailers market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)