Silicon Carbide Market, By Product (Green SiC and Black SiC), By Device, By Crystal Structure, ByEnd-Use (Steel, Aerospace and Automotive) and Geography (North America, Europe, Asia Pacific and Rest of the World) Analysis, Share, Trends, Size, & Forecast from 2014 2025

REPORT HIGHLIGHT

The Silicon Carbide Market was valued at USD 2.06 billion by 2017, growing with 17.2% CAGR during the forecast period, 2019-2025

Silicon compound is an abrasive compound used largely in semiconductors and automobiles along with the energy sector. Physical and chemical properties of the compound include colorless, lustrous surface, high temperature of sublimation and chemically inert. Possessing a high temperature for sublimation enables it to be used for the production of the furnace and bearing parts in the automobiles. The compound has a low coefficient of thermal expansion and also does not experience any transition phase changes which cause thermal expansion discontinuities.

Silicon carbide is basically a type of semiconductor which is usually n-type doped by phosphorus or nitrogen and p-type doped by boron, aluminum, gallium or beryllium. However, its heavy doping properties are achieved by doping it with nitrogen, boron or aluminum.

Market Dynamics

The extensive use of this material in steel and energy application sectors is expected to drive the global market. Silicon carbide is used for a number of applications including abrasives & cutting tools, structural materials, automobile parts, electric systems, electronic circuit elements like power electronic devices & LEDs, astronomy, thin filament pyrometry, heating elements, nuclear fuel particles, nuclear fuel cladding, jewelry, steel production, catalyst support, carborundum printmaking and graphene production. Vulnerability to mechanical and chemical shocks being a hard substance is expected to be a hindrance and is expected to restrain the growth of the global silicon carbide industry.

Regional Takeaway

The worldwide market is growing significantly in the Asia Pacific region on account of its usage in the heavy-duty industries and automobiles. The Asia Pacific forms a platform for the fastest and significant growth in the automobile sector along with the energy sector which provides a growth opportunity for the compound silicon carbide. Countries like China and India are expected to be the dominant powers for growth of the silicon carbide market owing to large numbers of heavy-duty projects being carried on in that region along with the huge capital investments of big players and their presence in those regions driving the growth of the product in the near future.

The market is also expected to grow significantly in the region of North America with countries like the U.S. expected to play a dominating factor in the growth. The growth of the electronics and energy sector in that region is expected to drive the expansion of the product in that region in the near future.

Key Vendors Takeaway

Some of the key players in the global silicon carbide market are Grindwell Norton Limited, ESK-SIC GmbH, Gaddis Engineered Materials, Snam Abrasives, AGSCO, Dow Chemical Company, Entegris Incorporation, ESD-SIC, and Saint-Gobain Ceramics Materials.

The players have invested in their research & development centers across the globe and are expected to invest in R&D to lower down the negative effects of the compound and improve the usage of the compound.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2017

- Base Year – 2018

- Estimated Year – 2019

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Black SiC,

- Green SiC

BY DEVICE

- SiC Bare Die

- SiC Discrete Devices

- SiC Diode

- SiC Module

- SiC MOSFET

- Thyristors

- Others

BY CRYSTAL STRUCTURE

- Wurtzite (6H-SIC)

- Wurtzite (4H-SIC)

- Zinc Blende (3C-SIC)

- Rhombohedral (15R-SIC)

MARKET, BY END USE

- Steel

- Aerospace

- Automotive

- Electronics

- Healthcare

- Military

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. SILICON CARBIDE MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by End Use

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. SILICON CARBIDE KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. SILICON CARBIDE INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. SILICON CARBIDE MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. SILICON CARBIDE MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

6.2. Black SiC

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Green SiC

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. SILICON CARBIDE MARKET – BY DEVICE

7.1. Overview

7.1.1. Segment Share Analysis, By Device, 2017 & 2025 (%)

7.2. SiC Bare Die

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. SiC Discrete Devices

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3.3. SiC Diode

7.3.3.1. Overview

7.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3.4. SiC Module

7.3.4.1. Overview

7.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3.5. SiC MOSFET

7.3.5.1. Overview

7.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3.6. Thyristors

7.3.6.1. Overview

7.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3.7. Others

7.3.7.1. Overview

7.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. SILICON CARBIDE MARKET – BY CRYSTAL STRUCTURE

8.1. Overview

8.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

8.2. Wurtzite (6H-SIC)

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Wurtzite (4H-SIC)

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Zinc Blende (3C-SIC)

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Rhombohedral (15R-SIC)

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. SILICON CARBIDE MARKET – BY END USE

9.1. Overview

9.1.1. Segment Share Analysis, By End Use, 2017 & 2025 (%)

9.2. Steel

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Aerospace

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Automotive

9.4.1. Overview

9.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5. Electronics

9.5.1. Overview

9.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.6. Healthcare

9.6.1. Overview

9.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.7. Military

9.7.1. Overview

9.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.8. Others

9.8.1. Overview

9.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. SILICON CARBIDE MARKET– BY GEOGRAPHY

10.1. Introduction

10.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

10.2. North America

10.2.1. Overview

10.2.2. Key Manufacturers in North America

10.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

10.2.5. North America Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

10.2.6. U.S.

10.2.6.1. Overview

10.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.2.7. Canada

10.2.7.1. Overview

10.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3. Europe

10.3.1. Overview

10.3.2. Key Manufacturers in Europe

10.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

10.3.5. Europe Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

10.3.6. France

10.3.6.1. Overview

10.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.7. Germany

10.3.7.1. Overview

10.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.8. Rest of Europe

10.3.8.1. Overview

10.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4. Asia Pacific (APAC)

10.4.1. Overview

10.4.2. Key Manufacturers in Asia Pacific

10.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

10.4.5. Asia Pacific Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

10.4.6. China

10.4.6.1. Overview

10.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.7. India

10.4.7.1. Overview

10.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.8. Rest of APAC

10.4.8.1. Overview

10.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5. Rest of the World

10.5.1. Overview

10.5.2. Key Manufacturers in Rest of the World

10.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.5.4. Rest of the World Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

10.5.5. Rest of the World Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

10.5.6. Latin America

10.5.6.1. Overview

10.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5.7. Middle East and Africa

10.5.7.1. Overview

10.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11. KEY VENDOR ANALYSIS

11.1. ESK-SIC GmbH

11.1.1. Company Snapshot

11.1.2. Financial Performance

11.1.3. Product Benchmarking

11.1.4. Strategic Initiatives

11.2. Grindwell Norton Limited

11.3. Snam Abrasives

11.4. AGSCO

11.5. Gaddis Engineered Materials

11.6. Dow Chemical Company

11.7. Entegris Inc.

11.8. ESD-SIC

11.9. Saint-Gobain Ceramics Materials

12. 360 DEGREE ANALYSTVIEW

13. APPENDIX

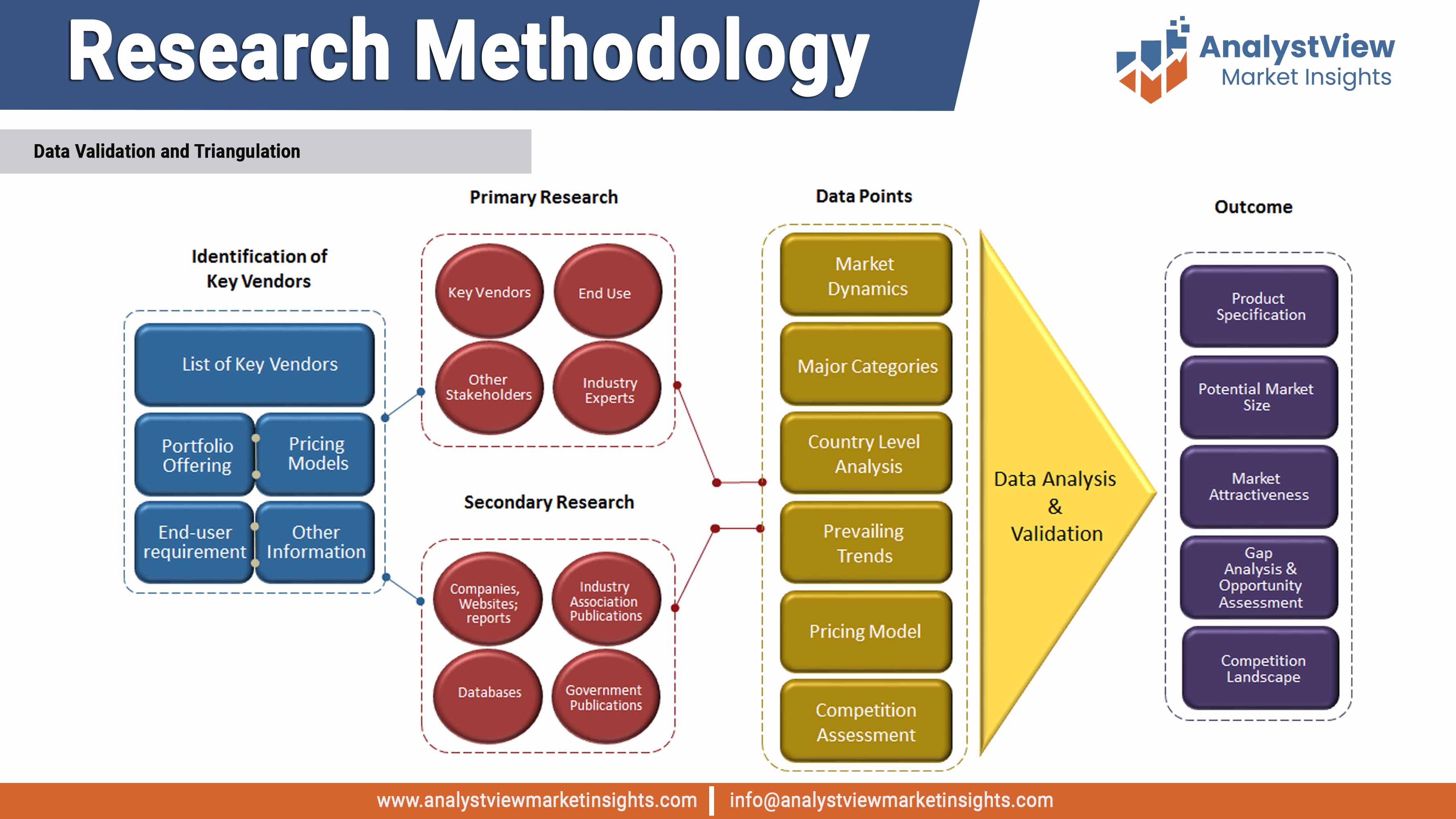

13.1. Research Methodology

13.2. References

13.3. Abbreviations

13.4. Disclaimer

13.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Silicon Carbide market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Silicon Carbide market, by Product 2014-2025 (USD Million)

TABLE Silicon Carbide market: Device snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Device

TABLE Global Silicon Carbide market, by Device 2014-2025 (USD Million)

TABLE Silicon Carbide market: Crystal Structure snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Crystal Structure

TABLE Global Silicon Carbide market, by Crystal Structure 2014-2025 (USD Million)

TABLE Silicon Carbide market: End Use snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by End Use

TABLE Global Silicon Carbide market, by End Use 2014-2025 (USD Million)

TABLE Silicon Carbide market: regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by region

TABLE Global Silicon Carbide market, by region 2014-2025 (USD Million)

TABLE North America Silicon Carbide market, by country, 2014-2025 (USD Million)

TABLE North America Silicon Carbide market, by Product, 2014-2025 (USD Million)

TABLE North America Silicon Carbide market, by End Use, 2014-2025 (USD Million)

TABLE Europe Silicon Carbide market, by country, 2014-2025 (USD Million)

TABLE Europe Silicon Carbide market, by Product, 2014-2025 (USD Million)

TABLE Europe Silicon Carbide market, by End Use, 2014-2025 (USD Million)

TABLE Asia Pacific Silicon Carbide market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Silicon Carbide market, by Product, 2014-2025 (USD Million)

TABLE Rest of the World Silicon Carbide market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Silicon Carbide market, by Product, 2014-2025 (USD Million)

TABLE Rest of the World Silicon Carbide market, by End Use, 2014-2025 (USD Million)

List of Figures

FIGURE Silicon Carbide market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2017 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Green SiC market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Black SiC market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Device segment market share analysis, 2017 & 2025

FIGURE Device segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE SiC Bare Die market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE SiC Discrete Devices market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE SiC Diode market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE SiC Module market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE SiC MOSFET market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Thyristors market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Crysta Structure segment market share analysis, 2017 & 2025

FIGURE Crystal Structure segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Wurtzite (6H-SIC) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Wurtzite (4H-SIC) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Zinc Blende (3C-SIC) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rhombohedral (15R-SIC) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE End Use segment market share analysis, 2017 & 2025

FIGURE End Use segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Steel market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Aerospace market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Automotive market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Electronics market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Healthcare market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Military market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Silicon Carbide market share and leading players, 2018

FIGURE Europe Silicon Carbide market share and leading players, 2018

FIGURE Asia Pacific Silicon Carbide market share and leading players, 2018

FIGURE Latin America Silicon Carbide market share and leading players, 2018

FIGURE Middle East and Africa Silicon Carbide market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)