Recycled Polyethylene Terephthalate (rPET) Market, By Product (Clear, and Coloured), By Application (Fibre, Sheet & Film, Food & Beverage, Strapping, and Non-Food Containers), and By Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The Recycled Polyethylene Terephthalate (rPET) market was valued at USD 6.23 billion by 2017, growing with 6.8% CAGR during the forecast period, 2018-2025. In terms of volume, the market reached 8,890.2 KiloTons during the same year.

Market Dynamics

Recycled Polyethylene Terephthalate (rPET) is a highly recyclable product that is currently a part of the plastics category. The key highlight of the product is the fact that it can be recycled and leaves less of an impact on the environment as compared to the general non-recyclable plastic or single-use plastic. Inherent product characteristics include lightweight, recyclable, re-sealable and inexpensive. The highlight in terms of growth driver remains the dependency on plastic material for various types of packaging due to its ease and benefits. Plastic is durable and excellent in terms of strength, therefore, the dependency is not unfound.

The ban on non-recyclable plastic in various countries such as a few states in India makes improves the market share of recyclable plastic here. Based on an article in the Global Citizen website, each year approximately 8 million metric tons of plastic enters in the water bodies globally. However, in the long run, there could be a complete plastic ban, various environmental groups, country laws, and overall awareness may lead to a plastic ban. Plastic replacements such as wooden or paper material research will pose a threat to the rPET bottles market. Global Citizen Website suggests that over 15 countries globally have taken serious action against the menace of plastic consumption.

Product Takeaway

rPET encompasses two major product categories, clear and colored PET. With regards to the market revenue, clear rPET single-handedly dominates the market. Clear PET bottles are most commonly used in the food and non-food industry contributing to this growth.

With respect to the colored segment, it is observed that this material due to its high strength and durability are used in various food and non-food items. The benefit of this material is that it can withstand transportation and storage conditions over longs periods of time, therefore, reducing product damage costs as opposed to other material. With the food industry thriving and increased demand for processed packaged food, the need for rPET bottles will be significant.

Application Takeaway

Application wise the categories could be divided into fiber, Sheet & Film, Strapping, Food & Beverage, Non-food containers and bottles. Majority of this segment share is captured by the fiber market. This one dominates the rPET segment owing to high demand to its applications in segments such as mattresses, car seats, insulation products, and cushions.

Besides that, some of the other applications where it finds use is in automobiles, clothing and accessories, technology and furnishing sector. Followed by this, the fastest growing segment in the rPET bottles. In areas such as the Asia Pacific and Latin America growth in population automatically increases the demand on PET bottle production owing to its product characteristics.

Regional Takeaway

The largest user of rPET bottles remains the Asia Pacific. The large population of this region is one of the major contributing factors for the growth of this segment. China and India are the fastest growing economies in the world, therefore this significantly improves the need for such material. Increased production capabilities will enhance the need for this specific material positively.

In Latin America as well, increased demand for food and the non-food bottle is responsible for an increased revenue share region wise. An increase in disposable income, improvement in the FMCG market are all reasons this industry continues to thrive.

Key Vendor Takeaway

The major players within these categories include Placon, Libolon, Polyquest, Clear Path, Phoenix Technologies, Recycling Llc, Zhejiang Anshun Pettechs Fibre Co., Ltd, and Indorama Ventures Public Ltd. Phoenix Technologies in 2018 stated in Plastic news that if 50% use of rPET in bottles will significantly impact companies to meet the environmental needs.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Clear

- Colored

MARKET, BY APPLICATION

- Fiber

- Sheet and Film

- Strapping

- Food & Beverage Containers and Bottles

- Non-Food Containers and Bottles

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

6.2. Clear

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Coloured

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2017 & 2025 (%)

7.2. Fiber

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Sheet and Film

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Strapping

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Food & Beverage Containers and Bottles

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Non-Food Containers and Bottles

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.7. Others

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. RECYCLED POLYETHYLENE TEREPHTHALATE (RPET) MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.6. France

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Germany

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. Rest of Europe

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.4.6. China

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. India

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. Rest of APAC

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Key Manufacturers in Rest of the World

8.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Rest of the World Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.5.5. Rest of the World Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.6. Latin America

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Middle East and Africa

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Placon

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Libolon

9.2.1. Company Snapshot

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. Polyquest

9.3.1. Company Snapshot

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. Clear Path

9.4.1. Company Snapshot

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. Phoenix Technologies

9.5.1. Company Snapshot

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. Recycling LLC

9.6.1. Company Snapshot

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. Zhejiang Anshun Pettechs Fibre Co., Ltd

9.7.1. Company Snapshot

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. Indorama Ventures Public Ltd.

9.8.1. Company Snapshot

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

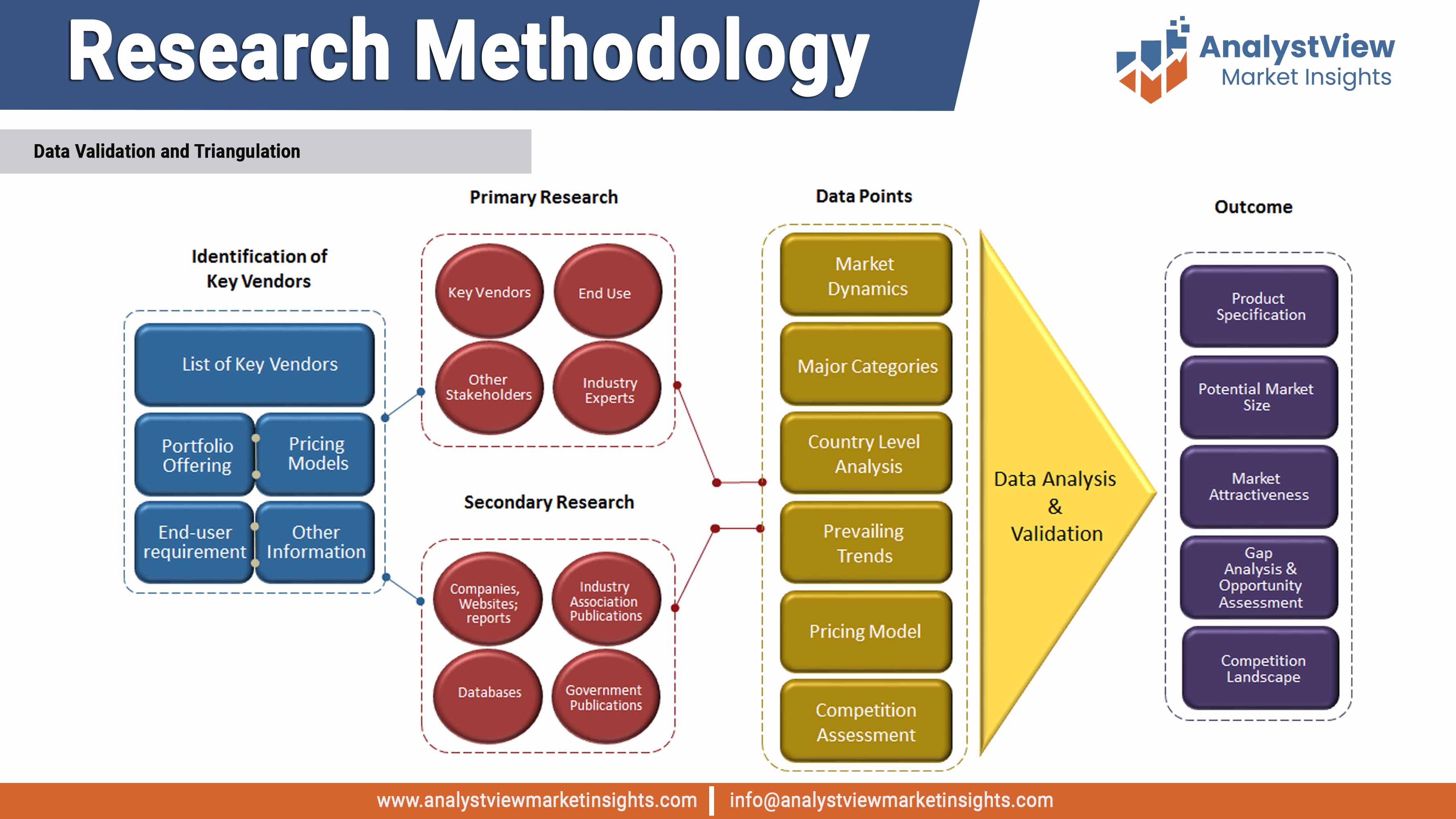

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data Products

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Recycled Polyethylene Terephthalate (rPET) market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Recycled Polyethylene Terephthalate (rPET) market: Application snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Recycled Polyethylene Terephthalate (rPET) market, by Application 2014-2025 (USD Million)

TABLE Recycled Polyethylene Terephthalate (rPET) market: regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by region

TABLE Global Recycled Polyethylene Terephthalate (rPET) market, by region 2014-2025 (USD Million)

TABLE North America Recycled Polyethylene Terephthalate (rPET) market, by country, 2014-2025 (USD Million)

TABLE North America Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE North America Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE U.S. Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE U.S. Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Canada Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Canada Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Europe Recycled Polyethylene Terephthalate (rPET) market, by country, 2014-2025 (USD Million)

TABLE Europe Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Europe Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Germany Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Germany Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE U.K. Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE U.K. Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Rest of the Europe Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Rest of the Europe Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Recycled Polyethylene Terephthalate (rPET) market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Japan Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Japan Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE China Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE China Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Rest of the World Recycled Polyethylene Terephthalate (rPET) market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Rest of the World Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Latin America Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Latin America Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Recycled Polyethylene Terephthalate (rPET) market, by Product, 2014-2025 (USD Million)

TABLE Middle East and Africa Recycled Polyethylene Terephthalate (rPET) market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Recycled Polyethylene Terephthalate (rPET) market segmentation

FIGURE Market research Methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2017 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Clear market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Coloured market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2017 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Fiber market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Sheet and Film market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Strapping market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Food & Beverage Containers and Bottles market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Non-Food Containers and Bottles market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Recycled Polyethylene Terephthalate (rPET) market share and leading players, 2018

FIGURE Europe Recycled Polyethylene Terephthalate (rPET) market share and leading players, 2018

FIGURE Asia Pacific Recycled Polyethylene Terephthalate (rPET) market share and leading players, 2018

FIGURE Latin America Recycled Polyethylene Terephthalate (rPET) market share and leading players, 2018

FIGURE Middle East and Africa Recycled Polyethylene Terephthalate (rPET) market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)