Negative Photoresist Chemicals Market, By Types (Thinner, Developer, Rinse and Stripper), By Coating Type (Spray, Spin and Dip), By End Use (Silicon Wafers, Printed Writing Boards and Photolithography) and by Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The negative photoresist chemicals market was valued at USD XX billion by 2017, growing with XX% CAGR during the forecast period, 2018-2025.

Market Dynamics

The global negative photoresist chemicals market is anticipated to exhibit a decent growth during the forecast period owing to the increase in research and development activities. Furthermore, rising demand for dynamic display technology is likely to stimulate the product demand. In addition, the industry is prophesied to improve owing to its growing applications in key end-use industries. Application of negative photoresist chemicals as effective rinses for the unexposed type of negative photoresists is projected to create opportunities in the worldwide market. Some of the popular application areas for negative photoresist chemicals are photolithography and photoengraving. The use of negative photoresist chemicals in stripping negative photoresists from chrome, gallium arsenide, silicon, and other substrates is predicted to highlight the global market. Strong growth of the electronic industry gaining from the technological advancements is further attracting the industry growth. The overall industry is foreseen to witness a new trend with the introduction of negative photoresist chemicals with proprietary solvent blends.

Regional Takeaway

Asia Pacific accounted for significant revenue share. The industry is foretold to witness substantial growth in this region owing to the strong demand of electronic products in countries such as India and China. Rise in the number of photovoltaic installations could be another factor augmenting the demand for negative photoresist chemicals in the region.

Key Vendor Takeaway

The global negative photoresist chemicals market is fragmented in nature. Companies namely Mitsui Chemicals America, Fujifilm Holdings America Corporation, Shiny Chemical Industrial Company, The Dow Chemical Company, MicroChem Corporation, Transene Company, Inc., JSR Corporation, Sumitomo Chemical Advance Technologies, and Tokyo Ohka Kogyo America, Inc. are actively operating in this industry.

Of these players, Fujifilm Holdings America Corporation captured significant revenue share. The company is engaged in manufacturing products for a range of industries including regenerative medicine, biopharmaceutical contract manufacturing, pharmaceutical, medical imaging and informatics, and photographic. Fujifilm’s industrial segments include graphic arts services and products. During the year 2019, May, the company announced marketing alliance with the US software development company, Skylum, for providing photographers with interactive opportunities, premium tools and education that the two companies have to offer.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY TYPE

- Thinner

- Developer

- Rinse

- Stripper

MARKET, BY COATING TYPE

- Spray

- Spin

- Dip

BY END USE

- Silicon Wafers

- Printed Writing Boards

- Photolithography

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. NEGATIVE PHOTORESIST CHEMICALS MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Type

2.1.2. Market Snippet by Coating Type

2.1.3. Market Snippet by End Use

2.1.4. Market Snippet by Region

2.2. Competitive Insights

3. NEGATIVE PHOTORESIST CHEMICALS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. NEGATIVE PHOTORESIST CHEMICALS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. NEGATIVE PHOTORESIST CHEMICALS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. NEGATIVE PHOTORESIST CHEMICALS MARKET – BY TYPE

6.1. Overview

6.1.1. Segment Share Analysis, By Type, 2017 & 2025 (%)

6.2. Thinner

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Developer

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Rinse

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Stripper

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. NEGATIVE PHOTORESIST CHEMICALS MARKET – BY COATING TYPE

7.1. Overview

7.1.1. Segment Share Analysis, By Coating Type, 2017 & 2025 (%)

7.2. Spray

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Spin

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Dip

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. NEGATIVE PHOTORESIST CHEMICALS MARKET – BY END USE

8.1. Overview

8.1.1. Segment Share Analysis, By End Use, 2017 & 2025 (%)

8.2. Silicon Wafers

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Printed Writing Boards

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Photolithography

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. NEGATIVE PHOTORESIST CHEMICALS MARKET– BY GEOGRAPHY

9.1. Introduction

9.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

9.2. North America

9.2.1. Overview

9.2.2. Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.2.4. North America Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

9.2.5. North America Market Size and Forecast, By Coating Type, 2014 – 2025 (US$ Million)

9.2.6. North America Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

9.2.7. U.S.

9.2.7.1. Overview

9.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.2.8. Canada

9.2.8.1. Overview

9.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Europe

9.3.1. Overview

9.3.2. Key Manufacturers in Europe

9.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.3.4. Europe Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

9.3.5. Europe Market Size and Forecast, By Coating Type, 2014 – 2025 (US$ Million)

9.3.6. Europe Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

9.3.7. France

9.3.7.1. Overview

9.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.8. Germany

9.3.8.1. Overview

9.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.9. Rest of Europe

9.3.9.1. Overview

9.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Asia Pacific (APAC)

9.4.1. Overview

9.4.2. Key Manufacturers in Asia Pacific

9.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.4.4. Asia Pacific Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

9.4.5. Asia Pacific Market Size and Forecast, By Coating Type, 2014 – 2025 (US$ Million)

9.4.6. Asia Pacific Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

9.4.7. China

9.4.7.1. Overview

9.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.8. India

9.4.8.1. Overview

9.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.9. Rest of APAC

9.4.9.1. Overview

9.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5. Rest of the World

9.5.1. Overview

9.5.2. Key Manufacturers in Rest of the World

9.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.5.4. Rest of the World Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

9.5.5. Rest of the World Market Size and Forecast, By Coating Type, 2014 – 2025 (US$ Million)

9.5.6. Rest of the World Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

9.5.7. Latin America

9.5.7.1. Overview

9.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.8. Middle East and Africa

9.5.8.1. Overview

9.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. KEY VENDOR ANALYSIS

10.1. Mitsui Chemicals America, Inc.

10.1.1. Company Snapshot

10.1.2. Financial Performance

10.1.3. Type Benchmarking

10.1.4. Strategic Initiatives

10.2. Shiny Chemical Industrial Co., Ltd.

10.3. The Dow Chemical Company

10.4. Sumitomo Chemical Advance Technologies

10.5. Transene Company, Inc.

10.6. MicroChem Corporation

10.7. JSR Corporation

10.8. Fujifilm Holdings America Corporation

10.9. Tokyo Ohka Kogyo America, Inc.

11. 360 DEGREE ANALYSTVIEW

12. APPENDIX

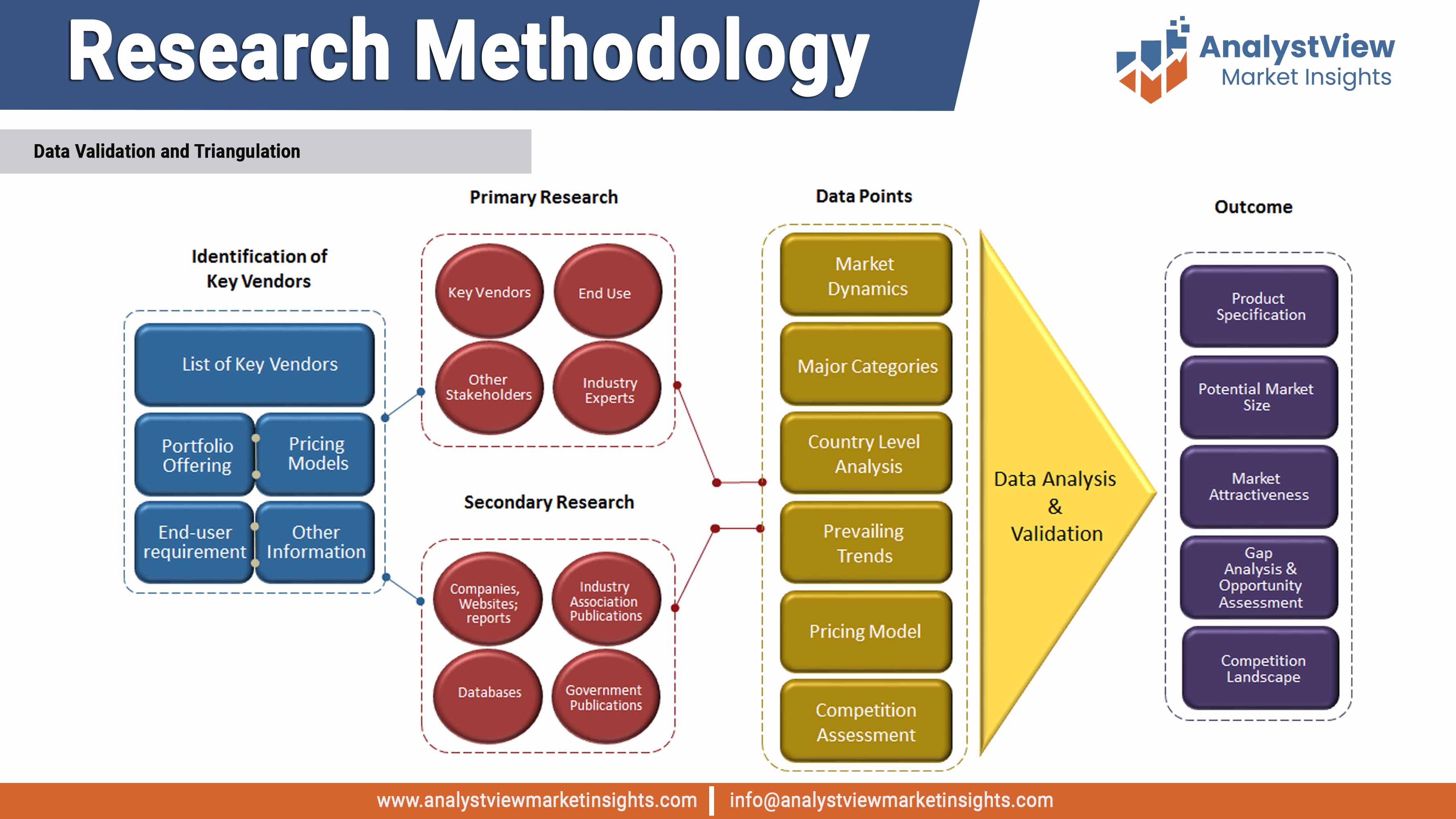

12.1. Research Methodology

12.2. References

12.3. Abbreviations

12.4. Disclaimer

12.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Negative Photoresist Chemicals market: Type snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Type

TABLE Global Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Negative Photoresist Chemicals market: Coating Type snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Coating Type

TABLE Global Negative Photoresist Chemicals market, by Coating Type 2014-2025 (USD Million)

TABLE Negative Photoresist Chemicals market: End Use snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by End Use

TABLE Global Negative Photoresist Chemicals market, by End Use 2014-2025 (USD Million)

TABLE Negative Photoresist Chemicals market: Regional Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Negative Photoresist Chemicals market, by Region 2014-2025 (USD Million)

TABLE North America Negative Photoresist Chemicals market, by Country, 2014-2025 (USD Million)

TABLE North America Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE North America Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE North America Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE U.S. Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE U.S. Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE U.S. Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Canada Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Canada Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Canada Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Europe Negative Photoresist Chemicals market, by country, 2014-2025 (USD Million)

TABLE Europe Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Europe Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Europe Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Germany Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Germany Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Germany Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE U.K. Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE U.K. Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE U.K. Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Rest of the Europe Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Rest of the Europe Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Rest of the Europe Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Asia Pacific Negative Photoresist Chemicals market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Asia Pacific Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Asia Pacific Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Japan Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Japan Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Japan Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE China Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE China Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE China Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Rest of the World Negative Photoresist Chemicals market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Rest of the World Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Rest of the World Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Latin America Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Latin America Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Latin America Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

TABLE Middle East and Africa Negative Photoresist Chemicals market, by Type, 2014-2025 (USD Million)

TABLE Middle East and Africa Negative Photoresist Chemicals market, by Coating Type, 2014-2025 (USD Million)

TABLE Middle East and Africa Negative Photoresist Chemicals market, by End Use, 2014-2025 (USD Million)

List of Figures

FIGURE Negative Photoresist Chemicals market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Type segment market share analysis, 2017 & 2025

FIGURE Type segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Thinner market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Developer market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rinse market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Stripper market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Coating Type segment market share analysis, 2017 & 2025

FIGURE Coating Type segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Spray market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Spin market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Dip market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE End use segment market share analysis, 2017 & 2025

FIGURE End use segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Silicon wafers market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Printer writing boards market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Photolithography market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Negative Photoresist Chemicals market share and leading players, 2018

FIGURE Europe Negative Photoresist Chemicals market share and leading players, 2018

FIGURE Asia Pacific Negative Photoresist Chemicals market share and leading players, 2018

FIGURE Latin America Negative Photoresist Chemicals market share and leading players, 2018

FIGURE Middle East and Africa Negative Photoresist Chemicals market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)