Molecular Diagnostics Market, By Products (Instruments and Reagent), By Location (Point of care, Self-test, and Central Laboratories), By Application and Geography (North America, Europe, Asia Pacific, And RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The molecular diagnostics market is estimated to represent a global market of USD 5,933 million by 2017 with growth rate of 9.1%.

The molecular diagnostic, a subset of in vitro diagnostics, is a laboratory technique, used to identify the underlying cause of disease condition. It offers a rapid approach for the detection of a wide range of human ailments. Demand for molecular diagnostics is growing at a rapid pace across the globe. This diagnostic test enables to detect specific sequences in genetic material i.e. DNA or RNA associated with the specific disease condition. The diagnosis helps the physician to uncover underlying mechanism of the disease condition. This technique requires easy steps, including, extraction and purification, amplification, and detection of the amplified target using PCR technique. The molecular diagnostic test is a dynamic area of diagnostic technique which has recolonized healthcare industry.

Market Dynamics

Currently, molecular diagnostics captured relatively a small share of the overall diagnostic industry. However, this technique has captured significant attention among scientists as it plays important role in the field of pharmaceutical and biotechnology industries. Nowadays, this technique is routinely used in reference laboratories, hospitals, and blood banks. Continuous innovation in the field of diagnostics is expected to stimulate the development of molecular diagnostics area at rapid pace. For example, increasing automation has enabled molecular tests to be performed at the full scope of healthcare settings.

This advancement has also paved the way for molecular diagnostics to detect various viruses and bacteria which are difficult to culture with traditional techniques. For example, tuberculosis bacillus bacteria can be detected effectively through molecular diagnostic method. Additionally, the emergence of cutting-edge molecular diagnostic technologies for cancer and infectious diseases further boosted the market growth considerably. For example, leading companies are increasingly researching on an application of DNA chip or microarray for a molecular test. This will allow detection of the multitude of pathogens at one point in time. Such advancements are projected to establish the healthy platform for the market growth, leading to driving the industry. However, a high cost of these tests is considered to be one of the major restraining factor. However, faster diagnostic results and more targeted treatment through these tests will reduce the hospitalization cost, decreasing overall healthcare cost.

Products Takeaway

In terms of products, the market is categorized as instruments and reagent. Among which, reagent segment captured the largest share of the total market. Development of new reagents for various diagnostic testing assays is expected to support the market growth to some extent. For example, Bioline offers the variety of molecular reagent for detection and monitoring of various disease condition. Company’s portfolio includes reagents such as ISOLATE II Nucleic Acid Isolation Kits, SensiFAST Real-Time PCR Kits, JetSeq DNA Library Preparation Kit, and many others. Technology segment is divided as In Situ Hybridization, PCR, Mass spectrometry, Chips and microarrays, Sequencing, Transcription Mediated Amplification (TMA), and Others.

Application Takeaway

In terms of application, the market is bifurcated as Infectious Diseases, Blood Screening, Histology, Oncology, Prenatal, Pharmacogenomics, Coagulation, Tissue Typing, and Inherited Diseases. In 2017, infectious disease is the most dominant segment (captured around 52%) and is projected to grow significantly over the future period. The emergence of novel technologies such as point of care molecular assays for the detection of infectious diseases drives the segment growth to great extent. Location segment is categorized as Point of care, Self-test, and Central Laboratories.

Global Molecular Diagnostics Market by Application, 2017 vs 2025

Regional Takeaway

Regional Takeaway

Regionally, North America accounted for the largest share owing to the rising research and development activities coupled with new product approvals. In Europe, presence of high prevalence rates of target diseases coupled with high healthcare expenditures in Western European countries support the industry growth. The growth of this market in developing regions is primarily driven by the rising access to the advanced healthcare facilities coupled with favorable government initiatives.

Key Vendor Takeaway

Companies such as Abbott, bioMérieux, Danaher Corporation, Qiagen, and Roche are profiled in the study. The industry is highly competitive and consolidated in nature, led by few number of key players, accounting for majority of revenue share. For example, Roche Diagnostics, with a market share of around 35%, is considered to be the leading player of the market. The market is witnessing a flurry of mergers & acquisitions among small scale and large scale industries. For example, Hologic acquired Gen-Probe in August, 2012, in an attempt to gain share via market expansion. The market size and forecast for each segment has been provided for the period 2014 to 2025, considering 2015 as the base year. The report also provides the compounded annual growth rate (% CAGR) for the forecast period 2016 to 2025 for every reported segment. The years considered for the study are:

- Historical Year – 2014 & 2015

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, And Suppliers

- Manufacturers

- Hospitals

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT :

The scope of this report covers the market by its major segments, which include as follows: MARKET, BY PRODUCTS

- Instruments

- Reagent

MARKET, BY LOCATION

- Point of care

- Self-test

- Central Laboratories

MARKET, BY APPLICATION

- Infectious Diseases

- Blood Screening

- Histology

- Oncology

- Prenatal

- Pharmacogenomics

- Coagulation

- Tissue Typing

- Inherited Diseases

MARKET, BY REGION

- North America

- Europe

- Asia Pacific

- Rest of the World

MARKET, BY COUNTRY

- Further Breakdown of The North America Market

- U.S.

- Canada

- Further Breakdown of The Europe Market

- Germany

- France

- Rest of Europe

- Further Breakdown of The APAC Market

- India

- China

- Rest of APAC

- Further Breakdown of The Rest of the World Market

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. MOLECULAR DIAGNOSTICS MARKET OVERVIEW

1.1. Study Scope

1.2. Base Year

1.3. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. MOLECULAR DIAGNOSTICS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. MOLECULAR DIAGNOSTICS INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Regulatory Framework Analysis

4.3. Market Attractiveness Analysis

4.4. Value Chain Analysis

5. MOLECULAR DIAGNOSTICS MARKET LANDSCAPE

5.1. Market Share Analysis

6. MOLECULAR DIAGNOSTICS MARKET – BY PRODUCTS:

6.1. Overview

6.2. Instruments

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Reagent

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. MOLECULAR DIAGNOSTICS MARKET – BY PRODUCTS:

7.1. Overview

7.2. Point of care

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Self-test

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Central Laboratories

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. MOLECULAR DIAGNOSTICS MARKET – BY PRODUCTS:

8.1. Overview

8.2. Infectious Diseases

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Blood Screening

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Histology

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Oncology

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6. Prenatal

8.6.1. Overview

8.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.7. Pharmacogenomics

8.7.1. Overview

8.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.8. Coagulation

8.8.1. Overview

8.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.9. Tissue Typing

8.9.1. Overview

8.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. MOLECULAR DIAGNOSTICS MARKET– BY GEOGRAPHY

9.1. Introduction

9.2. North America

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.2.3. U.S.

9.2.3.1. Overview

9.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.2.4. Canada

9.2.4.1. Overview

9.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Europe

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.3. France

9.3.3.1. Overview

9.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.4. Germany

9.3.4.1. Overview

9.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.5. Rest of Europe

9.3.5.1. Overview

9.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Asia Pacific (APAC)

9.4.1. Overview

9.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.3. China

9.4.3.1. Overview

9.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.4. India

9.4.4.1. Overview

9.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.5. Rest of APAC

9.4.5.1. Overview

9.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5. Rest of the World

9.5.1. Overview

9.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.3. Latin America

9.5.3.1. Overview

9.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.4. Middle East and Africa

9.5.4.1. Overview

9.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. KEY VENDOR ANALYSIS

10.1. Abbott

10.1.1. Company Overview

10.1.2. SWOT Analysis

10.1.3. Key Developments

10.2. bioMérieux

10.2.1. Company Overview

10.2.2. SWOT Analysis

10.2.3. Key Developments

10.3. Danaher Corporation

10.3.1. Company Overview

10.3.2. SWOT Analysis

10.3.3. Key Developments

10.4. Qiagen

10.4.1. Company Overview

10.4.2. SWOT Analysis

10.4.3. Key Developments

10.5. Roche

10.5.1. Company Overview

10.5.2. SWOT Analysis

10.5.3. Key Developments

*Client can request additional company profiling as per specific requirements

11. 360 DEGREE ANALYSTVIEW

12. APPENDIX

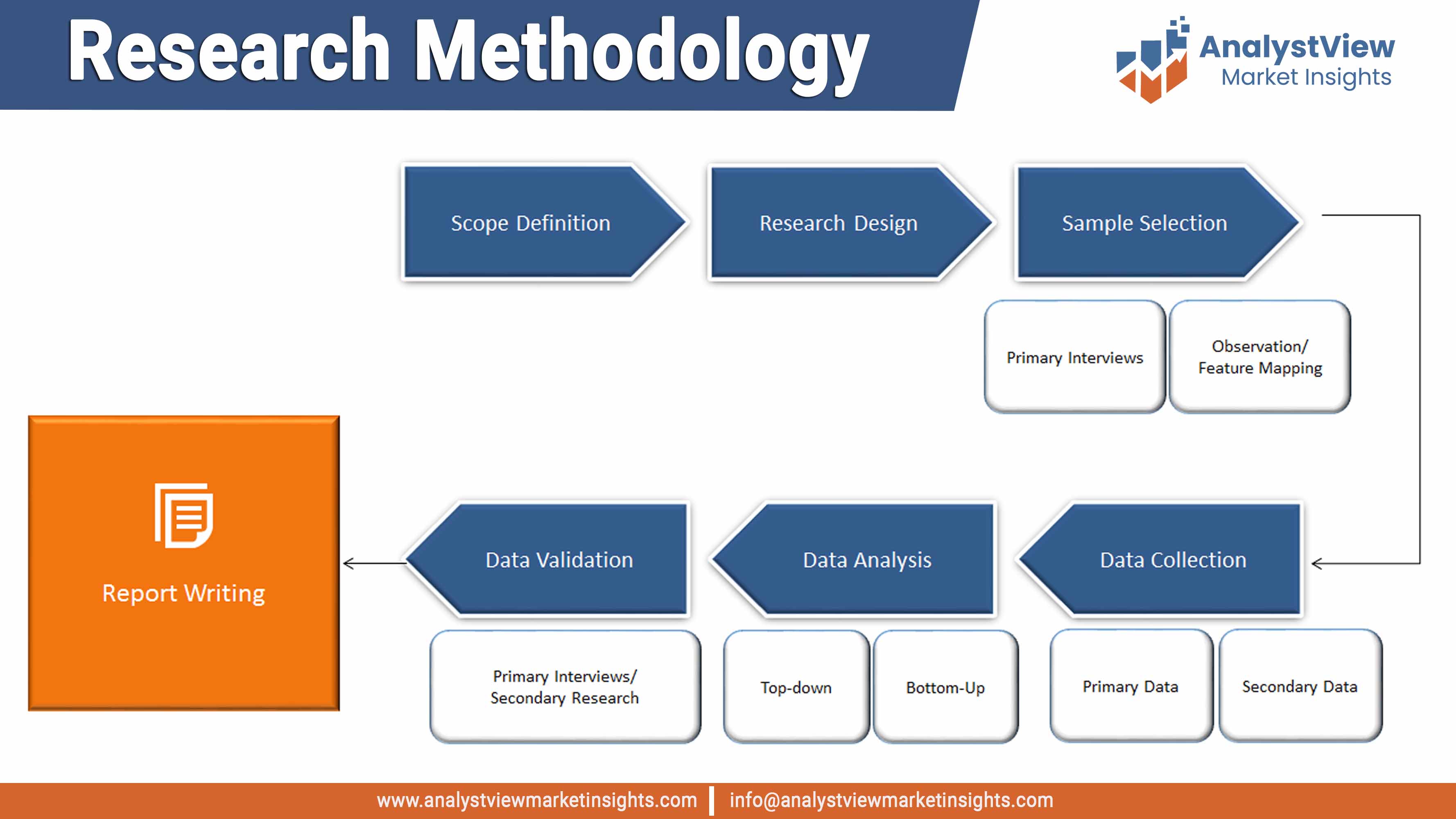

12.1. Research Methodology

12.2. Abbreviations

12.3. Disclaimer

12.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Molecular Diangostics Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

Table 10 Molecular Diangostics Market, by Products, 2014 – 2025 (USD Million)

Table 11 Molecular Diangostics Market, by Location, 2014 – 2025 (USD Million)

Table 12 Molecular Diangostics Market, by Application, 2014 – 2025 (USD Million)

Table 13 Molecular Diangostics Market, by Geography, 2014 – 2025 (USD Million)

Table 14 North America Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 15 U.S. Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 16 Canada Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 17 Europe Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 18 France Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 19 Germany Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 20 Asia Pacific Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 21 China Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 22 India Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 23 Latin America Molecular Diangostics Market, 2014 – 2025 (USD Million)

Table 24 MEA Molecular Diangostics Market, 2014 – 2025 (USD Million)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Value Chain Analysis Analysis

Figure 6 Molecular Diangostics Market, by Products, 2014 – 2025 (USD Million)

Figure 7 Molecular Diangostics Market, by Location, 2014 – 2025 (USD Million)

Figure 8 Molecular Diangostics Market, by Application, 2014 – 2025 (USD Million)

Figure 9 Molecular Diangostics Market, by Geography, 2014 – 2025 (USD Million)