Industrial Control and Factory Automation Market, By Product (MES, SCADA, PAM, PLM, PLC, DCS, and Functional Safety), By Component (Industrial 3D Printing, Industrial Robots, Machine Vision, Control Valves, and HMI), By Industry (Process, and Discrete) and Geography (NA, EU, APAC, LATAM and MEA) Analysis, Share, Trends, Size, & Forecast from 2019 2025

Report Code: AV452

Industry: Semiconductor and Electronics

Publiced On: 2020-12-01

Pages: 198

Format:

REPORT HIGHLIGHT

The industrial control and factory automation market was valued at USD 161.7 billion by 2018, growing with 10.2% CAGR during the forecast period, 2019-2025.

Market Dynamics

Industrial automation is a system of processes that include robotics and information technology used in a way that simplifies manufacturing processes and minimizes errors. These processes include using involving technology to completely do away with human intervention and manual systems. An increase in the demands for automated processes run by robotics will continue to escalate the growth of this industry. Various initiatives undertaken by the government has helped this industry to scale forward exponentially. Consistent focus on having systems that are enabled via technology is the core reason why these industrial automations continue to grow significantly. Factors such as the high investment needed and the lack of competent skilled authority required for this task may act as roadblocks for the growth of this industry.

Product Takeaway

The major product sub-segmentation is classified into Programmable Logic Controller, Supervisory Control and Data Acquisition, Ø Programmable Logic Controller, Distributed Control System, Safety, Manufacturing Execution System, Product Lifecycle Management, and Human Machine Interface. Of these, SCADA, PLC, and DCS are some of the most common systems that collectively dominates the market with regards to industrial automation. The reason industrial automation dominates the market is because these are excellent tools to reduce the production cost, reduce the risk of human error and improve production efficiencies. Productions processes have various critical control points that can hamper the manufacture of the end product or cause serious health hazards. Having automated systems also reduce any hazard that may be caused due to manual or any other careless error.

Component takeaway

The core components in industrial automation include industrial robots, industrial 3d printing, control valves, machine vision, and HMI. Out of these, industrial robots dominate the market share owing to their involvement in major production processes. Automation of systems also result in improving the industrial production capacity for e.g. Automation can be used to improve food production cycles in the food & beverage industry. Simplifying industrial processes in a way that makes a distribution, transportation on the factory floor and increasing production efficiency are all a part of industrial automation.

Application takeaway

The key application segments that are a part of the industrial automation are automotive, chemical and petrochemical, utility, pharmaceutical, food and beverage, and oil and gas. Out of these, the process industries that include the pharmaceuticals, the food and beverage, etc. are elemental in pushing this industry forward in the right direction.

Within the petrochemical industry, the processes involved in mining such as drilling, grinding and spinning can be hazardous in nature. The location of these processes further acts as a road block in smooth processing. Industrial automation comes as a boon to tricky industries such as the petrochemical industry. There are some discrete industries like electrical and electronics, aerospace & defence which are also expected to grow significantly have an increased demand for industrial automation.

Regional Takeaway

Regional Takeaway

The Asia Pacific region generally is one of the fastest-growing region in terms of industrial development. India and China are one of the fastest-growing economies in the world, therefore it creates great systems for industrial growth. The Chinese government project promoting ‘Made in China’ puts the pressure on improving the production capabilities across sectors and industries.

Currently, America and Europe continue to remain one of the largest consumers of industrial automation owing to the economic development in the region. As per data published in the report European roadmap for industrial process automation, 2018, organizations like EFFRA (European factories of future research association are organizations that are industry driven in order to promote and facilitate innovative technologies that will be favourable for the industry. These projects are funded by the European Union thus showing the Europe’s inclination towards industrial automation.

Key Vendor Takeaway

The key market players in the industry are ABB Limited, Siemens ag, Mitsubishi Electric, Schneider Electric, Emerson Electric are top companies. Some of the other companies include Yokogawa Electric Corporation, Siemens AG, and Rockwell Automation. In the year 2016, Emerson came up with a software technology called Micro Motion Advanced Phase that aids to improve the accuracy of the measurement. ABB Limited (June 2018) launched the first of its kind commercial modular enabled process automation solution. This solution is expected to lower industrial costs, reduce process risks and improve the schedule.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2018

- Estimated Year – 2019

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

KEY MANUFACTURERS

- ABB Limited

- Siemens AG

- Mitsubishi Electric

- Schneider Electric

- Emerson Electric

- Wika

- Tegan Innovations

- Win-911 Software

- Chaos Prime

- Yokogawa Electric Corporation

- Siemens AG

- Progea

- Omron

- Pinpoint Information Systems

- Rockwell Automation

MARKET, BY PRODUCT

- Supervisory Control and Data Acquisition (SCADA)

- Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), & Remote Terminal Unit (RTU)

- Distributed Control System (DCS)

- Safety & Manufacturing Execution System (MES), & Manufacturing Operations Management (MOM)

- Product Lifecycle Management (PLM)

- Human Machine Interface (HMI)Diaphragm

- Safety

MARKET, BY COMPONENT

- Industrial Robots

- Industrial 3D Printing

- Control Valves

- Machine Vision

- HMI

MARKET, BY INDUSTRY

- Process Industry

- Paper & Pulp

- Pharmaceuticals

- Electric Power Generation

- Petrochemicals & Fertilizers

- Water and Waste Water Management

- Oil & Gas, Chemical

- Mining & Metals

- Food & Beverages

- Others

- Discrete Industry

- Electrical and Electronics

- Automotive & Transportation

- Aerospace & Defense

- Machine Manufacturing

- Others

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1.INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET OVERVIEW

1.1.Study Scope

1.2.Assumption and Methodology

2.EXECUTIVE SUMMARY

2.1.Market Snippet

2.1.1.Market Snippet by Product

2.1.2.Market Snippet by Component

2.1.3.Market Snippet by Industry

2.1.4.Market Snippet by Region

2.2.Competitive Insights

3.INDUSTRIAL CONTROL AND FACTORY AUTOMATION KEY MARKET TRENDS

3.1.Market Drivers

3.1.1.Impact Analysis of Market Drivers

3.2.Market Restraints

3.2.1.Impact Analysis of Market Restraints

3.3.Market Opportunities

3.4.Market Future Trends

4.INDUSTRIAL CONTROL AND FACTORY AUTOMATION INDUSTRY STUDY

4.1.Porter’s Five Forces Analysis

4.2.Marketing Strategy Analysis

4.3.Growth Prospect Mapping

4.4.Regulatory Framework Analysis

5.INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET LANDSCAPE

5.1.Market Share Analysis

5.2.Key Innovators

5.3.Breakdown Data, by Key manufacturer

5.3.1.Established Player Analysis

5.3.2.Emerging Player Analysis

6.INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET – BY PRODUCT

6.1.Overview

6.1.1.Segment Share Analysis, By Product, 2018 & 2025 (%)

6.2.Supervisory Control and Data Acquisition (SCADA)

6.2.1.Overview

6.2.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3.Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), & Remote Terminal Unit (RTU)

6.3.1.Overview

6.3.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4.Distributed Control System (DCS)

6.4.1.Overview

6.4.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5.Safety & Manufacturing Execution System (MES), & Manufacturing Operations Management (MOM)

6.5.1.Overview

6.5.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6.Product Lifecycle Management (PLM)

6.6.1.Overview

6.6.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.7.Human Machine Interface (HMI)Diaphragm

6.7.1.Overview

6.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.8.Safety

6.8.1.Overview

6.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET – BY COMPONENT

7.1.Overview

7.1.1.Segment Share Analysis, By End Use, 2018 & 2025 (%)

7.2.Industrial Robots

7.2.1.Overview

7.2.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3.Industrial 3D Printing

7.3.1.Overview

7.3.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4.Control Valves

7.4.1.Overview

7.4.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5.Machine Vision

7.5.1.Overview

7.5.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6.HMI

7.6.1.Overview

7.6.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET – BY INDUSTRY

8.1.Overview

8.1.1.Segment Share Analysis, By End Use, 2018 & 2025 (%)

8.2.Process Industry

8.2.1.Overview

8.2.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.3.Paper & Pulp

8.2.3.1.Overview

8.2.3.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.4.Pharmaceuticals

8.2.4.1.Overview

8.2.4.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.5.Electric Power Generation

8.2.5.1.Overview

8.2.5.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.6.Petrochemicals & Fertilizers

8.2.6.1.Overview

8.2.6.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7.Water and Waste Water Management

8.2.7.1.Overview

8.2.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.8.Oil & Gas, Chemical

8.2.8.1.Overview

8.2.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.9.Mining & Metals

8.2.9.1.Overview

8.2.9.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.10.Food & Beverages

8.2.10.1.Overview

8.2.10.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.11.Others

8.2.11.1.Overview

8.2.11.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.Discrete Industry

8.3.1.Overview

8.3.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.3.Electrical and Electronics

8.3.3.1.Overview

8.3.3.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.4.Automotive & Transportation

8.3.4.1.Overview

8.3.4.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.5.Aerospace & Defense

8.3.5.1.Overview

8.3.5.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.6.Machine Manufacturing

8.3.6.1.Overview

8.3.6.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7.Others

8.3.7.1.Overview

8.3.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.Others

8.4.1.Overview

8.4.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET– BY GEOGRAPHY

9.1.Introduction

9.1.1.Segment Share Analysis, By Region, 2018 & 2025 (%)

9.2.North America

9.2.1.Overview

9.2.2.Key Manufacturers in North America

9.2.3.North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.2.4.North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

9.2.5.North America Market Size and Forecast, By Component, 2014 – 2025 (US$ Million)

9.2.6.North America Market Size and Forecast, By Industry, 2014 – 2025 (US$ Million)

9.2.7.U.S.

9.2.7.1.Overview

9.2.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.2.8.Canada

9.2.8.1.Overview

9.2.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.Europe

9.3.1.Overview

9.3.2.Key Manufacturers in Europe

9.3.3.Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.3.4.Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

9.3.5.Europe Market Size and Forecast, By Component, 2014 – 2025 (US$ Million)

9.3.6.Europe Market Size and Forecast, By Industry, 2014 – 2025 (US$ Million)

9.3.7.Germany

9.3.7.1.Overview

9.3.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.8.Italy

9.3.8.1.Overview

9.3.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.9.United Kingdom

9.3.9.1.Overview

9.3.9.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.10.France

9.3.10.1.Overview

9.3.10.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3.11.Rest of Europe

9.3.11.1.Overview

9.3.11.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.Asia Pacific (APAC)

9.4.1.Overview

9.4.2.Key Manufacturers in Asia Pacific

9.4.3.Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.4.4.Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

9.4.5.Asia Pacific Market Size and Forecast, By Component, 2014 – 2025 (US$ Million)

9.4.6.Asia Pacific Market Size and Forecast, By Industry, 2014 – 2025 (US$ Million)

9.4.7.India

9.4.7.1.Overview

9.4.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.8.China

9.4.8.1.Overview

9.4.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.9.Japan

9.4.9.1.Overview

9.4.9.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.10.South Korea

9.4.10.1.Overview

9.4.10.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4.11.Rest of APAC

9.4.11.1.Overview

9.4.11.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.Latin America

9.5.1.Overview

9.5.2.Key Manufacturers in Latin America

9.5.3.Latin America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.5.4.Latin America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

9.5.5.Latin America Market Size and Forecast, By Component, 2014 – 2025 (US$ Million)

9.5.6.Latin America Market Size and Forecast, By Industry, 2014 – 2025 (US$ Million)

9.5.7.Brazil

9.5.7.1.Overview

9.5.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.8.Mexico

9.5.8.1.Overview

9.5.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.9.Argentina

9.5.9.1.Overview

9.5.9.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5.10.Rest of LATAM

9.5.10.1.Overview

9.5.10.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.6.Middle East and Africa

9.6.1.Overview

9.6.2.Key Manufacturers in Middle East and Africa

9.6.3.Middle East and Africa Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

9.6.4.Middle East and Africa Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

9.6.5.Middle East and Africa Market Size and Forecast, By Component, 2014 – 2025 (US$ Million)

9.6.6.Middle East and Africa Market Size and Forecast, By Industry, 2014 – 2025 (US$ Million)

9.6.7.Saudi Arabia

9.6.7.1.Overview

9.6.7.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.6.8.United Arab Emirates

9.6.8.1.Overview

9.6.8.2.Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.KEY VENDOR ANALYSIS

10.1.ABB Limited

10.1.1.Company Snapshot

10.1.2.Financial Performance

10.1.3.Product Benchmarking

10.1.4.Strategic Initiatives

10.2.Siemens AG

10.3.Mitsubishi Electric

10.4.Schneider Electric

10.5.Emerson Electric

10.6.Wika

10.7.Tegan Innovations

10.8.Win-911 Software

10.9.Chaos Prime

10.10.Yokogawa Electric Corporation

10.11.Siemens AG

10.12.Progea

10.13.Omron

10.14.Pinpoint Information Systems

10.15.Rockwell Automation

11.360 DEGREE ANALYSTVIEW

12.APPENDIX

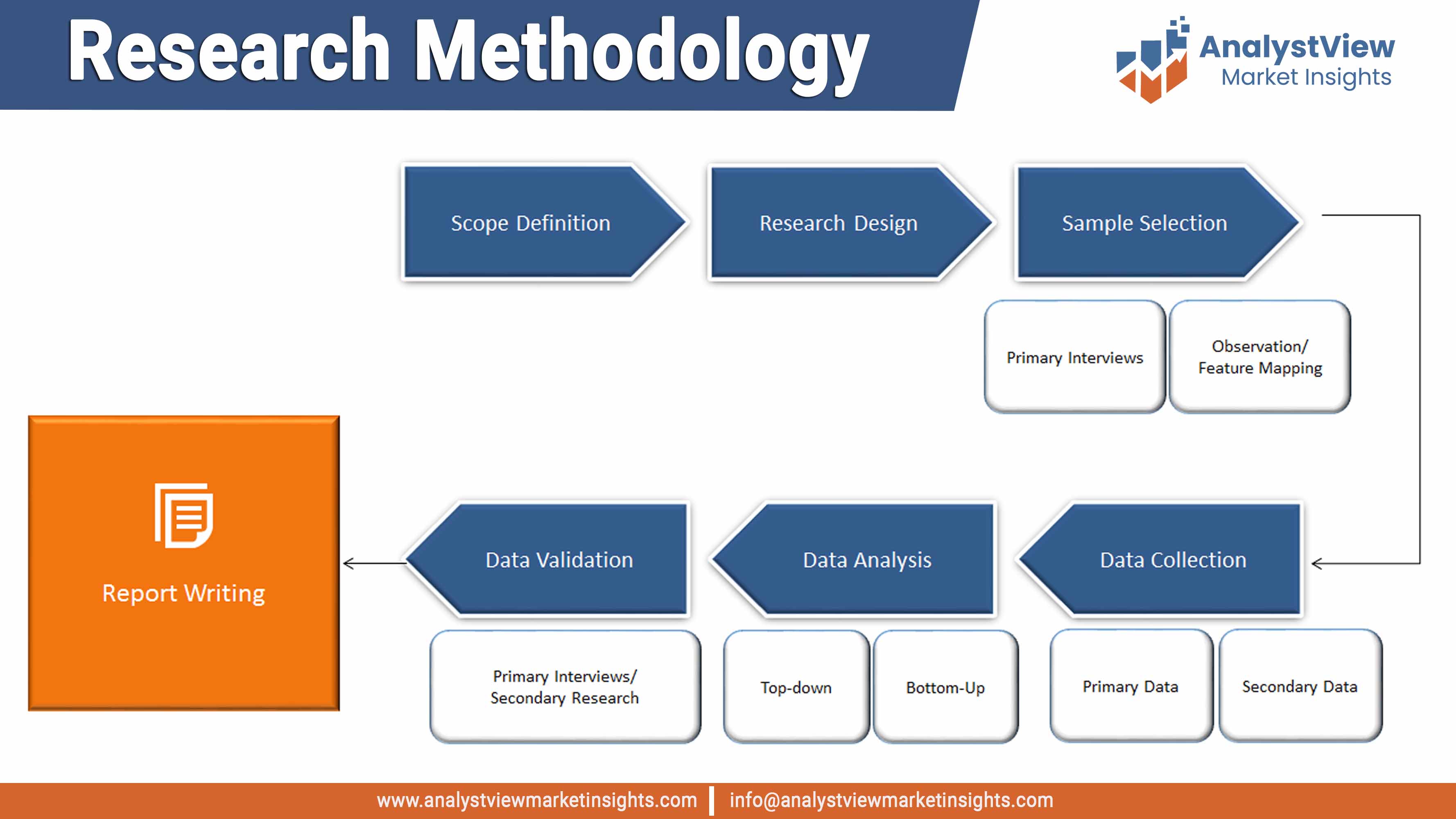

12.1.Research Methodology

12.2.References

12.3.Abbreviations

12.4.Disclaimer

12.5.Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Industrial Control and Factory Automation market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Industrial Control and Factory Automation market, by Product 2014-2025 (USD Million)

TABLE Industrial Control and Factory Automation market: Component snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Component

TABLE Global Industrial Control and Factory Automation market, by Component 2014-2025 (USD Million)

TABLE Industrial Control and Factory Automation market: Industry snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Industry

TABLE Global Industrial Control and Factory Automation market, by Industry 2014-2025 (USD Million)

TABLE Industrial Control and Factory Automation market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Industrial Control and Factory Automation market, by Region 2014-2025 (USD Million)

TABLE North America Industrial Control and Factory Automation market, by Country, 2014-2025 (USD Million)

TABLE North America Industrial Control and Factory Automation market, by Product, 2014-2025 (USD Million)

TABLE North America Industrial Control and Factory Automation market, by Component, 2014-2025 (USD Million)

TABLE North America Industrial Control and Factory Automation market, by Industry, 2014-2025 (USD Million)

TABLE Europe Industrial Control and Factory Automation market, by country, 2014-2025 (USD Million)

TABLE Europe Industrial Control and Factory Automation market, by Product, 2014-2025 (USD Million)

TABLE Europe Industrial Control and Factory Automation market, by Component, 2014-2025 (USD Million)

TABLE Europe Industrial Control and Factory Automation market, by Industry, 2014-2025 (USD Million)

TABLE Asia Pacific Industrial Control and Factory Automation market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Industrial Control and Factory Automation market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Industrial Control and Factory Automation market, by Component, 2014-2025 (USD Million)

TABLE Asia Pacific Industrial Control and Factory Automation market, by Industry, 2014-2025 (USD Million)

TABLE Latin America Industrial Control and Factory Automation market, by country, 2014-2025 (USD Million)

TABLE Latin America Industrial Control and Factory Automation market, by Product, 2014-2025 (USD Million)

TABLE Latin America Industrial Control and Factory Automation market, by Component, 2014-2025 (USD Million)

TABLE Latin America Industrial Control and Factory Automation market, by Industry, 2014-2025 (USD Million)

TABLE Middle East and Africa Industrial Control and Factory Automation market, by country, 2014-2025 (USD Million)

TABLE Middle East and Africa Industrial Control and Factory Automation market, by Product, 2014-2025 (USD Million)

TABLE Middle East and Africa Industrial Control and Factory Automation market, by Component, 2014-2025 (USD Million)

TABLE Middle East and Africa Industrial Control and Factory Automation market, by Industry, 2014-2025 (USD Million)

List of Figures

FIGURE Industrial Control and Factory Automation market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2018 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Supervisory Control and Data Acquisition (SCADA) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), & Remote Terminal Unit (RTU) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Distributed Control System (DCS) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Safety & Manufacturing Execution System (MES), & Manufacturing Operations Management (MOM) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Product Lifecycle Management (PLM) market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Human Machine Interface (HMI)Diaphragm market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Safety market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Component segment market share analysis, 2018 & 2025

FIGURE Component segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Industrial Robots market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Industrial 3D Printing market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Control Valves market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Machine Vision market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE HMI market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Industry segment market share analysis, 2018 & 2025

FIGURE Industry segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Process Industry market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Paper & Pulp market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Pharmaceuticals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Electric Power Generation market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Petrochemicals & Fertilizers market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Water and Waste Water Management market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Oil & Gas market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Chemical market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mining & Metals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Food & Beverages market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Discrete Industry market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Electrical and Electronics market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Automotive & Transportation market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Aerospace & Defense market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Machine Manufacturing market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2018 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Industrial Control and Factory Automation market share and leading players, 2018

FIGURE Europe Industrial Control and Factory Automation market share and leading players, 2018

FIGURE Asia Pacific Industrial Control and Factory Automation market share and leading players, 2018

FIGURE Latin America Industrial Control and Factory Automation market share and leading players, 2018

FIGURE Middle East and Africa Industrial Control and Factory Automation market share and leading players, 2018

FIGURE North America Industrial Control and Factory Automation market share analysis by country, 2018

FIGURE U.S. Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe Industrial Control and Factory Automation market share analysis by country, 2018

FIGURE Germany Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Spain Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Italy Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE UK Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE France Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific Industrial Control and Factory Automation market share analysis by country, 2018

FIGURE India Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Japan Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE South Korea Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Singapore Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of APAC Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America Industrial Control and Factory Automation market share analysis by country, 2018

FIGURE Brazil Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mexico Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Argentina Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of LATAM Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa Industrial Control and Factory Automation market share analysis by country, 2018

FIGURE Saudi Arabia Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE United Arab Emirates Industrial Control and Factory Automation market size, forecast and trend analysis, 2014 to 2025 (USD Million)