Green and Bio Based Solvents Market, By Product (Lactate Esters, Bio-Alcohols, Bio-Diols, Bio-Glycols, Methyl Soyate and D-Limonene), By Application and By Geography (North America, Europe, Asia Pacific, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The green and bio based solvents market was valued at USD 6.87 billion by 2017, growing with 11.3% CAGR during the forecast period, 2018-2025. In terms of volume, the industry was valued 2,980.5 KiloTons in 2017, expanding at 4.5% CAGR during the study period.

Market Dynamics

Green and bio based solvents are made from biomass sources such as forest residue, crops, and aquatic waste materials. The global market will grow on account of surging demand in the major application segments like pharmaceuticals, adhesives, paint, and coatings. A booming real estate industry is also facilitating the increasing demand for adhesives, paints & coatings. Moreover, encouragement of extensive research and development works for breakthroughs in manufacturing technologies and additional feedstock is considered to be an important catalysts that is augmenting the market growth. Raw materials such as corn scratch and soybean oil are experiencing a considerable rise in demand. Hence, the production of biofuels to a great extent will be influenced by the availability of such raw materials. On the other side, mis-conceptions related to the performance and cost of bio-based solvent are the major challenges that the industry faces.

Product Takeaway

The major products are lactate esters, bio-diols, d-limonene, methyl soyate, bio-glycols, and bi-alcohols. Currently, the lactate esters is dominating the overall industry and is also anticipated to undergo the fastesst CAGR. The primary reasons that could be attributed to its minimum production cost, surplus raw materials, convenient availability, and ever-increasing applications. In 2017, the net revenue earned by the lactate ester segment is over USD 1 billion. Likewise, the growth prospect of methyl soyate segment is quite impressive due to its growing demand as a solvent for engine, industrial equipment, and automotive applications. During the forecasted period, the methylsoyate segement is expected to experience a revenue growth of over 11%.

Application Takeaway

On the basis of application, the green and bio based solvents market is categorized into cosmetics, pharmaceuticals, printing inks, adhesives, domestic & industrial cleaners, coatings and paintings. Paint and coating segment is the most dominant owing to the rising concerns related to the environment safety. It is believed that a high amount of Volatile Organic Compounds (VOC) is present in chemical grades industrial solvent like coating solutions and paints. In 2017, this segement earned a significant revenue share compared to other applications. Similarly, the adhesive segment is going to bolster the overall market development owing to the increasing demand from the automobile industry in North America and Asia Pacific region. In terms of revenue, this segment is going to witness the fastest CAGR of over 12% during the study period.

Regional Takeaway

The North America region has the highest growth potential for the green and bio-based solvent. In this region, the end-user industries such as automotive, construction, and building are witnessing substantial growth, which leverages the market too. Growing awareness among consumers for the need of adopting green solvent for environmental is the main reason for increasing use of green solvents in the construction industry in the U.S. and Mexico.

In Asia Pacific countries such as China, Japan, and Brazil, low production cost, the surge in economic growth, industrial development, and technological advancement are supporting the market growth significantly. Moreover, in these countries, the growth in end-user industries like automotive, construction and building have witnessed substantial growth. In the European context, positive changes in the economic and political dynamics of countries like Germany and UK are facilitating moderate market growth. As the construction and automotive segment have recovered post-recession, it will drive the regional growth in the near future.

Key Vendor Takeaway

Some of the stalwart companies in the global green and bio-based solvents are Cremer Oleo GmbH, DuPont, Solvay, Florida Chemical Company, Flotek Industries, Inc., Vertec BioSolvents. Inc., AkzoNobel, Corbion, Cargill Incorporated, Gevo, Huntsman Corporation, Archer Daniels Midland Company, LyondellBasell Industries Holdings, BioAmber, The Dow Chemical Co., BASF SE and so on.

With the ambition of sustaining and strengthening their position in the worldwide market, these companies are prioritizing the formation of strategic alliance, partnerships, and product development. For instance in May 2017, Cargill Incorporated acquired BioBased Technologies’ Agrol and polyols product lines. This acquisition has expanded company’s product offering as well as geographic reach.

Likewise, Flotek Industries, a distributer and developer of down hole drilling, innovative speciality chemicals, and production equipment acquired Florida Chemical Company, Inc, whichspecialized in the production of fragnance-flavor compounds, and d-Limionene. Such approach helps the key players to cope with the fierce competition with local manufacturers and suppliers across the globe.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Lactate Esters

- Bio-Alcohols

- Bio-Diols

- Bio-Glycols

- Methyl Soyate

- D-Limonene

- Others

MARKET, BY APPLICATION

- Industrial & Domestic Cleaners

- Adhesives

- Cosmetics

- Pharmaceuticals

- Printing Inks

- Paints & Coatings

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. GREEN AND BIO BASED SOLVENTS MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. GREEN AND BIO BASED SOLVENTS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. GREEN AND BIO BASED SOLVENTS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. GREEN AND BIO BASED SOLVENTS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. GREEN AND BIO BASED SOLVENTS MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

6.2. Lactate Esters

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Bio-Alcohols

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Bio-Diols

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Bio-Glycols

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6. Methyl Soyate

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.7. D-Limonene

6.7.1. Overview

6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.8. Others

6.8.1. Overview

6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. GREEN AND BIO BASED SOLVENTS MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2017 & 2025 (%)

7.2. Industrial & Domestic Cleaners

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Adhesives

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Cosmetics

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Pharmaceuticals

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Printing Inks

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.7. Paints & Coatings

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.8. Others

7.8.1. Overview

7.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. GREEN AND BIO BASED SOLVENTS MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.6. France

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Germany

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. Rest of Europe

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.4.6. China

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. India

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. Rest of APAC

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Key Manufacturers in Rest of the World

8.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Rest of the World Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.5.5. Rest of the World Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.6. Latin America

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Middle East and Africa

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Cremer Oleo GmbH

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. DuPont

9.2.1. Company Snapshot

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. Solvay

9.3.1. Company Snapshot

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. Florida Chemical Company

9.4.1. Company Snapshot

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. Flotek Industries, Inc.

9.5.1. Company Snapshot

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. Vertec BioSolvents, Inc.

9.6.1. Company Snapshot

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. AkzoNobel

9.7.1. Company Snapshot

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. Corbion

9.8.1. Company Snapshot

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

9.9. Cargill Incorporated

9.9.1. Company Snapshot

9.9.2. Financial Performance

9.9.3. Product Benchmarking

9.9.4. Strategic Initiatives

9.10. Gevo

9.10.1. Company Snapshot

9.10.2. Financial Performance

9.10.3. Product Benchmarking

9.10.4. Strategic Initiatives

9.11. Huntsman Corporation

9.11.1. Company Snapshot

9.11.2. Financial Performance

9.11.3. Product Benchmarking

9.11.4. Strategic Initiatives

9.12. Archer Daniels Midland Company

9.12.1. Company Snapshot

9.12.2. Financial Performance

9.12.3. Product Benchmarking

9.12.4. Strategic Initiatives

9.13. LyondellBasell Industries Holdings

9.13.1. Company Snapshot

9.13.2. Financial Performance

9.13.3. Product Benchmarking

9.13.4. Strategic Initiatives

9.14. BioAmber

9.14.1. Company Snapshot

9.14.2. Financial Performance

9.14.3. Product Benchmarking

9.14.4. Strategic Initiatives

9.15. The Dow Chemical Co.

9.15.1. Company Snapshot

9.15.2. Financial Performance

9.15.3. Product Benchmarking

9.15.4. Strategic Initiatives

9.16. BASF SE

9.16.1. Company Snapshot

9.16.2. Financial Performance

9.16.3. Product Benchmarking

9.16.4. Strategic Initiatives

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

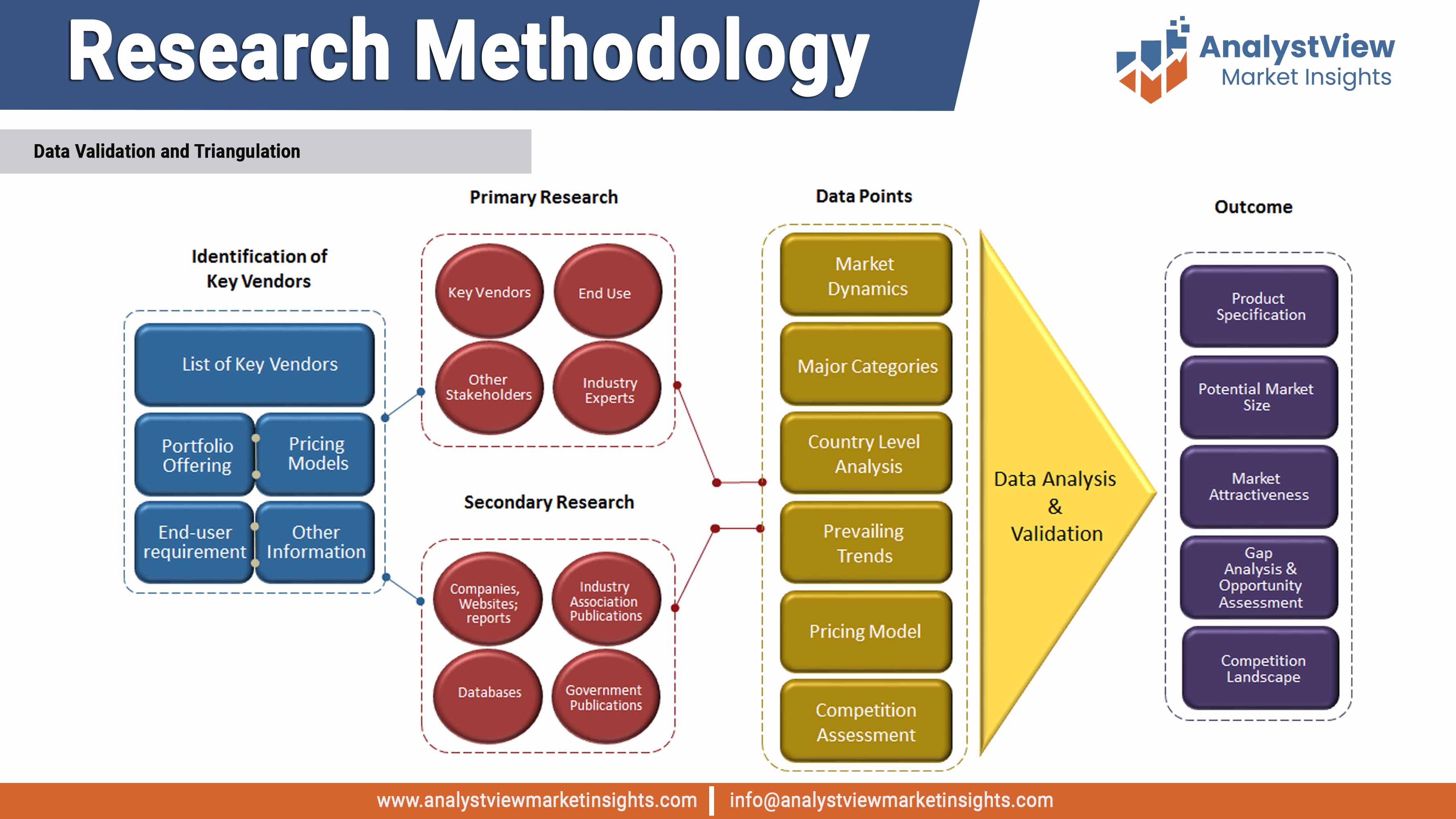

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data Technology

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Green and Bio Based Solvents Market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Green and Bio Based Solvents Market, by Product 2014-2025 (USD Million)

TABLE Green and Bio Based Solvents Market: Application snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Green and Bio Based Solvents Market: regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by region

TABLE Global Green and Bio Based Solvents Market, by region 2014-2025 (USD Million)

TABLE North America Green and Bio Based Solvents Market, by country, 2014-2025 (USD Million)

TABLE North America Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE North America Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE U.S. Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE U.S. Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Canada Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Canada Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Europe Green and Bio Based Solvents Market, by country, 2014-2025 (USD Million)

TABLE Europe Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Europe Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Germany Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Germany Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE U.K. Green and Bio Based Solvents Market, by Technology, 2014-2025 (USD Million)

TABLE U.K. Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE U.K. Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Rest of the Europe Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Rest of the Europe Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Green and Bio Based Solvents Market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Japan Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Japan Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE China Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE China Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Rest of the World Green and Bio Based Solvents Market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Rest of the World Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Latin America Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Latin America Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Green and Bio Based Solvents Market, by Product, 2014-2025 (USD Million)

TABLE Middle East and Africa Green and Bio Based Solvents Market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Green and Bio Based Solvents Market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2017 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Lactate Esters market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Bio-Alcohols market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Bio-Diols market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Bio-Glycols market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Methyl Soyate market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE D-Limonene market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2017 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Industrial & Domestic Cleaners market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Adhesives market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cosmetics market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Pharmaceuticals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Printing Inks market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Paints & Coatings market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Green and Bio Based Solvents Market share and leading players, 2018

FIGURE Europe Green and Bio Based Solvents Market share and leading players, 2018

FIGURE Asia Pacific Green and Bio Based Solvents Market share and leading players, 2018

FIGURE Latin America Green and Bio Based Solvents Market share and leading players, 2018

FIGURE Middle East and Africa Green and Bio Based Solvents Market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)