Epigenetics Market, By Product (Services, Kits, Instrument, Reagents, Enzymes, and Instruments), By Technology (Histone Methylation, DNA Methylation, Histone Acetylation, MicroRNA Modification, Large non coding RNA, and Chromatin Structures), By Application (Non-oncology, and Oncology), and By Geography (EU, NA, APAC, LATAM, and MEA) Analysis, Size, Share, Trends, & Forecast from 2020-2026

REPORT HIGHLIGHT

Epigenetics market was valued at USD 6.87 billion by 2019, growing with 22.4% CAGR during the forecast period, 2020-2026

Epigenetics is defined as an extension of genetics as well as developmental biology that involves the study of physiological and cellular trait variations initiated by environmental or external stimuli. Epigenetics deals with alterations in gene expression, caused by particular base pairs in RNA & DNA, which are “turned on” or “turned off”, through chemical reactions differing to being affected by alterations in the nucleotide sequence. Epigenetics changes are influenced by different factors including disease state, surrounding environment, age, lifestyle, and others.

Market Dynamics

The growing prevalence of cancer & other chronic diseases and increasing geriatric population are the major factors driving the growth of the global epigenetics market. According to the World Health Organization (WHO), around 9.6 million deaths were recorded in 2018 all across the globe due to cancer. Besides, the presence of organizations such as the National Institute of Health (NIH), the National Cancer Institute (NIC), and the International Human Epigenome Consortium (IHEC) is progressively influencing the growth of the overall market.

In addition, the increasing need to understand epigenetic modifications and the development of therapeutic solutions are anticipated to motivate these organizations to fund R&D programs, which will create lucrative growth opportunities in the overall market during the forecast period. However, high costs associated with manufacturing and prohibitive costs of molecular diagnostics are expected to hinder the market growth in the coming future.

Product Takeaway

Based on the products, the global epigenetics market is segmented into kits, reagents, enzymes, instruments, and services. Of these, the reagents segment dominated the overall market in 2019 as DNA and histone modifiers are the major types of reagents utilized for epigenetics. Buffers, nucleic acid analysis, electrophoresis, primers, histones, PCR, and antibodies are some of the common epigenetic reagents. The presence of the number of technology platform facilitates the analysis at gene, cellular levels of protein, which boosts innovation in the worldwide marketplace.

On the other hand, the kits product segment is anticipated to grow at the highest CAGR in the projected timeframe. The kits segment is further sub-segmented into whole genomic amplification kit, ChIP-sequencing kit, RNA sequencing kit, and bisulfite conversion kit. The growth of this segment is because various biotechnology companies manufacture ready-to-use kits for detecting epigenetic modifications. In addition, the epigenetic diagnostics kits are used for the diagnosis of disorders owing to epigenetic modifications during treatment and in early stages to check therapeutics efficacy.

Technology Takeaway

On the basis of technology, the overall market for epigenetics is categorized into histone methylation, DNA methylation, histone acetylation, microRNA modification, large non – coding RNA, and chromatin structures. Among these, the DNA methylation segment accounted for the majority of market share in 2019 and is estimated to grow at a significant rate during the forecast period. DNA methylation leads to inhibition of transcription as it is the covalent addition in the cytosine ring of a methyl group. In addition, technological advancements are increasingly enabling assessment of locus, which is a specific DNA methylation on a wide scale of the genome.

On the other hand, the histone acetylation segment is anticipated to be the fastest-growing market throughout the forecast due to its enhanced efficacy owing to the introduction of new mechanisms. Moreover, histone acetylation is involved in the control of cellular procedures such as chromatin transcription & dynamics, gene silencing, the progression of the cell cycle, apoptosis, differentiation, DNA replication, DNA repair, nuclear import, and neuronal repression.

Application Takeaway

Based on the application, the worldwide epigenetics market is categorized into non-oncology and oncology. The oncology segment is further sub-segmented into solid and liquid tumors. Whereas, the non-oncology segment is further sub-segmented into metabolic, inflammatory, cardiovascular, and infectious diseases.

The oncology segment accounted for major market share in terms of revenue in 2019 owing to the growing prevalence of cancer all over the worldwide coupled with increasing cases of deaths due. In addition, potential commercialization and introduction of novel products are predicted to propel the segmental market growth during the forecast period. On the other hand, the non-oncology segment is projected to register the highest growth during the period of forecast owing to the rigorous R&D initiatives undertaken by biopharmaceutical companies and private institutions for identification of epigenetic markers. In addition, epigenetic modifications are being proved to be the base of various non-oncology disorders such as infectious diseases, neurodegenerative disorders, and metabolic disorders.

Regional Takeaway

Depending on the region, the global industry is divided into North America, Latin America, Asia Pacific, Middle East & Africa, and Europe. The North America region is anticipated to account for the largest market share during the forecast period. The governments in this region are boosting ongoing R&D activities on epigenetics by funding them. In addition, the presence of advanced and continual developments in the healthcare facilities in diagnostic processes are stimulating regional market growth.

Along with this, the Asia Pacific market for epigenetics is projected to grow at the fastest rate during the period of forecast owing to growing awareness regarding early diagnosis, increasing disposable income, availability of effective treatment, and high unmet clinical needs of patients in this region. Also, this region is considered as the most attractive destination for market players owing to the consistent increase in different types of cancer cases among the patient population.

COVID-19 Impact

The coronavirus has spread aggressively to develop into a global pandemic that involves more than 170 countries. This unprecedented situation has affected lives across the political, economic, and social sphere. The primary focus of researchers and biopharmaceutical industries is epigenetics, which aids in vaccine development because the coronavirus has no available cure.

Thus, a breakthrough at this time may benefit pharmaceutical industries’ stock prices including the epigenetics market. Advancements through research in the understanding of the viral chromatin modification in lytic viruses have significantly opened a new window for host-virus interactions and viral antagonism, including genetic factors. This would, in turn, boost the worldwide epigenetics market growth significantly over the future period.

Key Vendor Takeaway

The major players operating in the global epigenetics industry include Roche Diagnostics, Eisai Co. Ltd., Thermo Fisher Scientific, Inc., Novartis AG, Illumina, Inc., Qiagen, Merck Sharp & Dohme Corp, Abcam Plc, Diagenode Diagnostics, Activ Motif, Zymo Research Corporation, Syndax, Cell Centric, Valirx, and Oncolys BioPharma Inc. These players are adopting several strategies such as acquisitions, mergers, and novel product developments to hold a strong market position.

For instance, in February 2018, QIAGEN launched its novel therascreen PITX2 RGQ PCR Kit in Europe, which is the first clinically validated assay of DNA methylation that helps in predicting the response of particular high-risk breast cancer patients.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

GLOBAL EPIGENETICS MARKET KEY PLAYERS

- Roche Diagnostics

- Eisai Co. Ltd.

- Thermo Fisher Scientific, Inc.

- Novartis AG

- Illumina, Inc.

- Qiagen

- Merck Sharp & Dohme Corp

- Abcam Plc

- Diagenode Diagnostics

- Activ Motif

- Zymo Research Corporation

- Syndax

- Cell Centric

- Oncolys BioPharma Inc.

GLOBAL EPIGENETICS MARKET, BY PRODUCT

- Kits

- Whole Genomic Amplification Kit

- ChIP Sequencing Kit

- RNA Sequencing Kit

- Bisulfite Conversion Kit

- Others

- Reagents

- Instruments

- Services

- Enzymes

GLOBAL EPIGENETICS MARKET, BY TECHNOLOGY

- Histone Methylation

- DNA Methylation

- Histone Acetylation

- MicroRNA Modification

- Large Non-coding RNA

- Chromatin Structures

GLOBAL EPIGENETICS MARKET, BY APPLICATION

- Non-oncology

- Metabolic Diseases

- Inflammatory Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Others

- Oncology

- Liquid Tumors

- Solid Tumors

GLOBAL EPIGENETICS MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. EPIGENETICS MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Technology

2.1.4. Market Snippet by Region

2.2. Competitive Insights

3. EPIGENETICS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. EPIGENETICS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. EPIGENETICS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. EPIGENETICS MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2019 & 2026 (%)

6.2. Kits

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.2.1. Whole Genomic Amplification Kit

6.2.2.1.1. Overview

6.2.2.1.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.2.2. ChIP Sequencing Kit

6.2.2.2.1. Overview

6.2.2.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.2.3. RNA Sequencing Kit

6.2.2.3.1. Overview

6.2.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.2.4. Bisulfite Conversion Kit

6.2.2.4.1. Overview

6.2.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.2.5. Others

6.2.2.5.1. Overview

6.2.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Reagents

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4. Instruments

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5. Services

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6. Enzymes

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. EPIGENETICS MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2019 & 2026 (%)

7.2. Oncology

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.2.2.1. Liquid Tumors

7.2.2.1.1. Overview

7.2.2.1.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.2.2.2. Solid Tumors

7.2.2.2.1. Overview

7.2.2.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Non-oncology

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.2.1. Metabolic Diseases

7.3.2.1.1. Overview

7.3.2.1.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.2.2. Inflammatory Diseases

7.3.2.2.1. Overview

7.3.2.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.2.3. Cardiovascular Diseases

7.3.2.3.1. Overview

7.3.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.2.4. Infectious Diseases

7.3.2.4.1. Overview

7.3.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.2.5. Others

7.3.2.5.1. Overview

7.3.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. EPIGENETICS MARKET – BY TECHNOLOGY

8.1. Overview

8.1.1. Segment Share Analysis, By Technology, 2019 & 2026 (%)

8.2. Histone Methylation

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. DNA Methylation

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Histone Acetylation

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. MicroRNA Modification

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. Large Non-coding RNA

8.6.1. Overview

8.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.7. Chromatin Structures

8.7.1. Overview

8.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. EPIGENETICS MARKET– BY GEOGRAPHY

9.1. Introduction

9.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

9.2. North America

9.2.1. Overview

9.2.2. Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.2.4. North America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

9.2.5. North America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.2.6. North America Market Size and Forecast, By Technology, 2015 – 2026 (US$ Million)

9.2.7. U.S.

9.2.7.1. Overview

9.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.2.8. Canada

9.2.8.1. Overview

9.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3. Europe

9.3.1. Overview

9.3.2. Key Manufacturers in Europe

9.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.3.4. Europe Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

9.3.5. Europe Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.3.6. Europe Market Size and Forecast, By Technology, 2015 – 2026 (US$ Million)

9.3.7. Germany

9.3.7.1. Overview

9.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.8. Italy

9.3.8.1. Overview

9.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.9. United Kingdom

9.3.9.1. Overview

9.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.10. France

9.3.10.1. Overview

9.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.11. Rest of Europe

9.3.11.1. Overview

9.3.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4. Asia Pacific (APAC)

9.4.1. Overview

9.4.2. Key Manufacturers in Asia Pacific

9.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.4.4. Asia Pacific Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

9.4.5. Asia Pacific Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.4.6. Asia Pacific Market Size and Forecast, By Technology, 2015 – 2026 (US$ Million)

9.4.7. India

9.4.7.1. Overview

9.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.8. China

9.4.8.1. Overview

9.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.9. Japan

9.4.9.1. Overview

9.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.10. South Korea

9.4.10.1. Overview

9.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.11. Rest of APAC

9.4.11.1. Overview

9.4.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5. Latin America

9.5.1. Overview

9.5.2. Key Manufacturers in Latin America

9.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.5.4. Latin America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

9.5.5. Asia Pacific Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.5.6. Latin America Market Size and Forecast, By Technology, 2015 – 2026 (US$ Million)

9.5.7. Brazil

9.5.7.1. Overview

9.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5.8. Mexico

9.5.8.1. Overview

9.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5.9. Argentina

9.5.9.1. Overview

9.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5.10. Rest of LATAM

9.5.10.1. Overview

9.5.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.6. Middle East and Africa

9.6.1. Overview

9.6.2. Key Manufacturers in Middle East and Africa

9.6.3. Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.6.4. Middle East and Africa Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

9.6.5. Middle East and Africa Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.6.6. Middle East and Africa Market Size and Forecast, By Technology, 2015 – 2026 (US$ Million)

9.6.7. Saudi Arabia

9.6.7.1. Overview

9.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.6.8. United Arab Emirates

9.6.8.1. Overview

9.6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

10. KEY VENDOR ANALYSIS

10.1. Roche Diagnostics

10.1.1. Company Snapshot

10.1.2. Financial Performance

10.1.3. Product Benchmarking

10.1.4. Strategic Initiatives

10.2. Eisai Co. Ltd.

10.3. Thermo Fisher Scientific, Inc.

10.4. Novartis AG

10.5. Illumina, Inc.

10.6. Qiagen

10.7. Merck Sharp & Dohme Corp

10.8. AbCam Plc

10.9. Diagenode Diagnostics

10.10. Activ Motif

10.11. Zymo Research Corporation

10.12. Syndax

10.13. Cell Centric

10.14. Valirx

10.15. Oncolys BioPharma Inc.

11. 360 DEGREE ANALYSTVIEW

12. APPENDIX

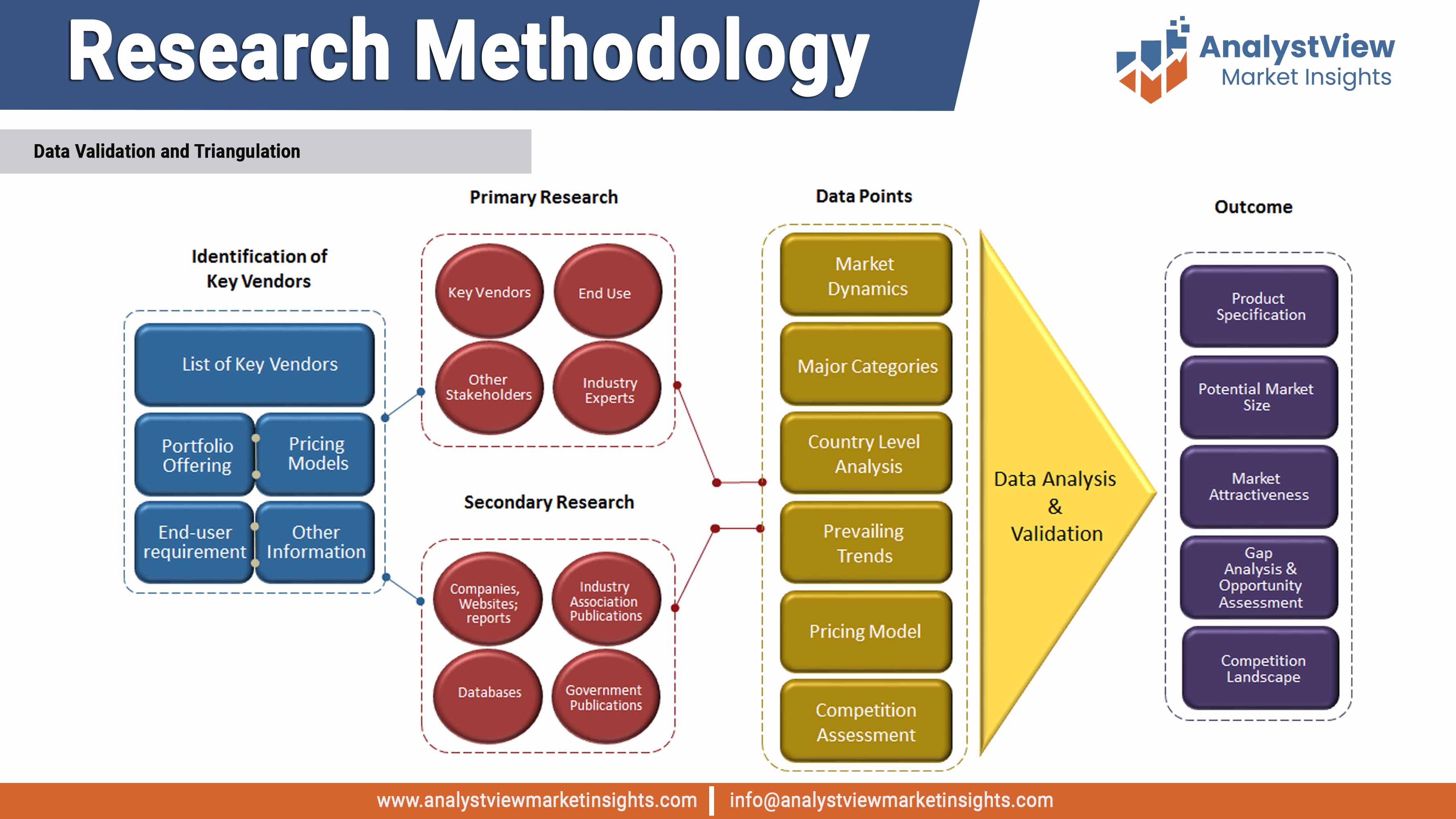

12.1. Research Methodology

12.2. References

12.3. Abbreviations

12.4. Disclaimer

12.5. Contact Us