Blood Culture Tests Market, By Product (Instrument, Consumables, and Services), By Technique (Automated and Conventional), By Technology, By Application, By End-Use and Geography (North America, Europe, Asia Pacific, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The blood culture test market is estimated to represent a global market of USD 3,021 million by 2017 with growth rate of 8.1%.

Blood culture tests are widely used to detect the presence of foreign invaders, i.e. fungi or bacteria in blood samples. These cultures are collected for testing in order to check the cause of various infections inpatient. As per the article published in the Journal of Clinical Microbiology, every year, more than 20 million blood cultures are ordered in the U.S. alone.

Market Dynamics

Technological advancements are expected to be a major factor driving the market growth. Advancement in technologies has helped this field to provide better accuracy, reliability in disease diagnosis and to avoid unnecessary healthcare costs. For instance, an introduction of an automated microbial detection system, BacT ALERT 3D (bioMérieux) allows immediate bottle recognition with a low false positive rate and rapid response rate. This system is easy to use, save time, and prevent major test errors. Similarly, development of technologies targeted real-time PCR technique, and peptide nucleic acid fluorescent in situ hybridization (PNA-FISH) plays a strategic role in fostering the change of blood culture industry towards better health outcomes.

In addition, rising number of hospital admissions has led to rise in the incidence of hospital-acquired infections. For example, according to the World Health Organization (WHO), hospital-acquired infection is the most frequent adverse event in healthcare delivery across the globe. The organization stated that of the 100 hospitalized patients, 10 in developing and 7 in developed region acquire at least one healthcare-associated infection every year. Thus, the demand for effective and advanced blood testing techniques appear to be growing at strong growth rate for the treatment and diagnosis of various infectious diseases, augmenting the market growth. On contrary, the market has been stifled by some key barriers to growth. The foremost among these is the strict regulatory requirements and a high cost for some laboratory methods.

Product Takeaway

In terms of products, the market is categorized into instrument, consumables, and services. Consumables segment accounted for the largest share of the total market, captured more than 56% in 2017. This segment is further classified into Media, Assay kits and reagents, and Accessories. Whereas, instrument segment is divided into laboratory equipment and automated blood culture systems. Depending upon technique, the market is segmented as conventional and automated. With the convergence of various scientific and technological breakthroughs, the pace of automated blood culture test segment is accelerating.

Global Blood Culture Test Market by Product, 2017 vs 2025

Technology Takeaway

Technology segment is categorized into Molecular, Culture-based and Proteomic. Some of the molecular technologies covered under this segment are a microarray, PCR, and PNA-FISH, The application segment is classified as Fungal Infections, Bacterial Infections, and others. Reference Laboratories, Hospitals, and others are considered under end-user segment.

Regional Takeaway

Regionally, the global industry is dominated by the North America market. In 2017, this region is accounted for more than 42% share of the total industry. The growth of the regions is primarily attributed to the increasing incidence of infectious diseases coupled with the growing demand. On contrary, currently, this industry in developing regions such as the Asia Pacific and Latin America is small but rapidly expanding.

Key Vendor Takeaway

Companies such as Thermo Fisher Scientific, bioMérieux, Abbott, Alere, and Bruker are profiled in the study. Majority of these companies were witnessed to have an extensive product offering coupled with strong regional presence. The key player is profiled based on attributes such as company overview, financial performance, SWOT analysis, and key developments.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Hospitals

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Instrument

- Laboratory Equipment

- Automated Blood Culture

- Consumables

- Media

- Assay kits and Reagents

- Accessories

- Services

MARKET, BY TECHNIQUE

- Conventional

- Automated

MARKET, BY TECHNOLOGY

- Molecular

- Culture-based

- Proteomic

MARKET, BY APPLICATION

- Fungal Infections

- Bacterial Infections

- Others

MARKET, BY END USE

- Reference Laboratories

- Hospitals

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. BLOOD CULTURE TEST MARKET OVERVIEW

1.1. Study Scope

1.2. Base Year

1.3. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. BLOOD CULTURE TEST KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. BLOOD CULTURE TEST INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Market Attractiveness Analysis

4.3. Value Chain Analysis

5. BLOOD CULTURE TEST MARKET LANDSCAPE

5.1. Market Share Analysis

6. BLOOD CULTURE TEST MARKET – BY PRODUCTS:

6.1. Overview

6.2. Instrument

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.3. Laboratory Equipment

6.2.3.1. Overview

6.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.2.4. Automated Blood Culture

6.2.4.1. Overview

6.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Consumables

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3.3. Media

6.3.3.1. Overview

6.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3.4. Assay kits and Reagents

6.3.4.1. Overview

6.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3.5. Accessories

6.3.5.1. Overview

6.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Services

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. BLOOD CULTURE TEST MARKET – BY TECHNIQUE:

7.1. Overview

7.2. Conventional

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Automated

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. BLOOD CULTURE TEST MARKET – BY TECHNOLOGY:

8.1. Overview

8.2. Molecular

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Culture-based

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Proteomic

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. BLOOD CULTURE TEST MARKET – BY TECHNOLOGY:

9.1. Overview

9.2. Fungal Infections

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Bacterial Infections

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Others

9.4.1. Overview

9.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. BLOOD CULTURE TEST MARKET – BY TECHNOLOGY:

10.1. Overview

10.2. Reference Laboratories

10.2.1. Overview

10.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3. Hospitals

10.3.1. Overview

10.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4. Others

10.4.1. Overview

10.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11. BLOOD CULTURE TEST MARKET– BY GEOGRAPHY

11.1. Introduction

11.2. North America

11.2.1. Overview

11.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.2.3. U.S.

11.2.3.1. Overview

11.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.2.4. Canada

11.2.4.1. Overview

11.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.3. Europe

11.3.1. Overview

11.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.3.3. France

11.3.3.1. Overview

11.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.3.4. Germany

11.3.4.1. Overview

11.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.3.5. Rest of Europe

11.3.5.1. Overview

11.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.4. Asia Pacific (APAC)

11.4.1. Overview

11.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.4.3. China

11.4.3.1. Overview

11.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.4.4. India

11.4.4.1. Overview

11.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.4.5. Rest of APAC

11.4.5.1. Overview

11.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.5. Rest of the World

11.5.1. Overview

11.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.5.3. Latin America

11.5.3.1. Overview

11.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11.5.4. Middle East and Africa

11.5.4.1. Overview

11.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

12. KEY VENDOR ANALYSIS

12.1. Thermo Fisher Scientific

12.1.1. Company Overview

12.1.2. SWOT Analysis

12.1.3. Key Developments

12.2. BioMérieux

12.2.1. Company Overview

12.2.2. SWOT Analysis

12.2.3. Key Developments

12.3. Abbott

12.3.1. Company Overview

12.3.2. SWOT Analysis

12.3.3. Key Developments

12.4. Alere

12.4.1. Company Overview

12.4.2. SWOT Analysis

12.4.3. Key Developments

12.5. Bruker

12.5.1. Company Overview

12.5.2. SWOT Analysis

12.5.3. Key Developments

*Client can request additional company profiling as per specific requirements

13. 360 DEGREE ANALYSTVIEW

14. APPENDIX

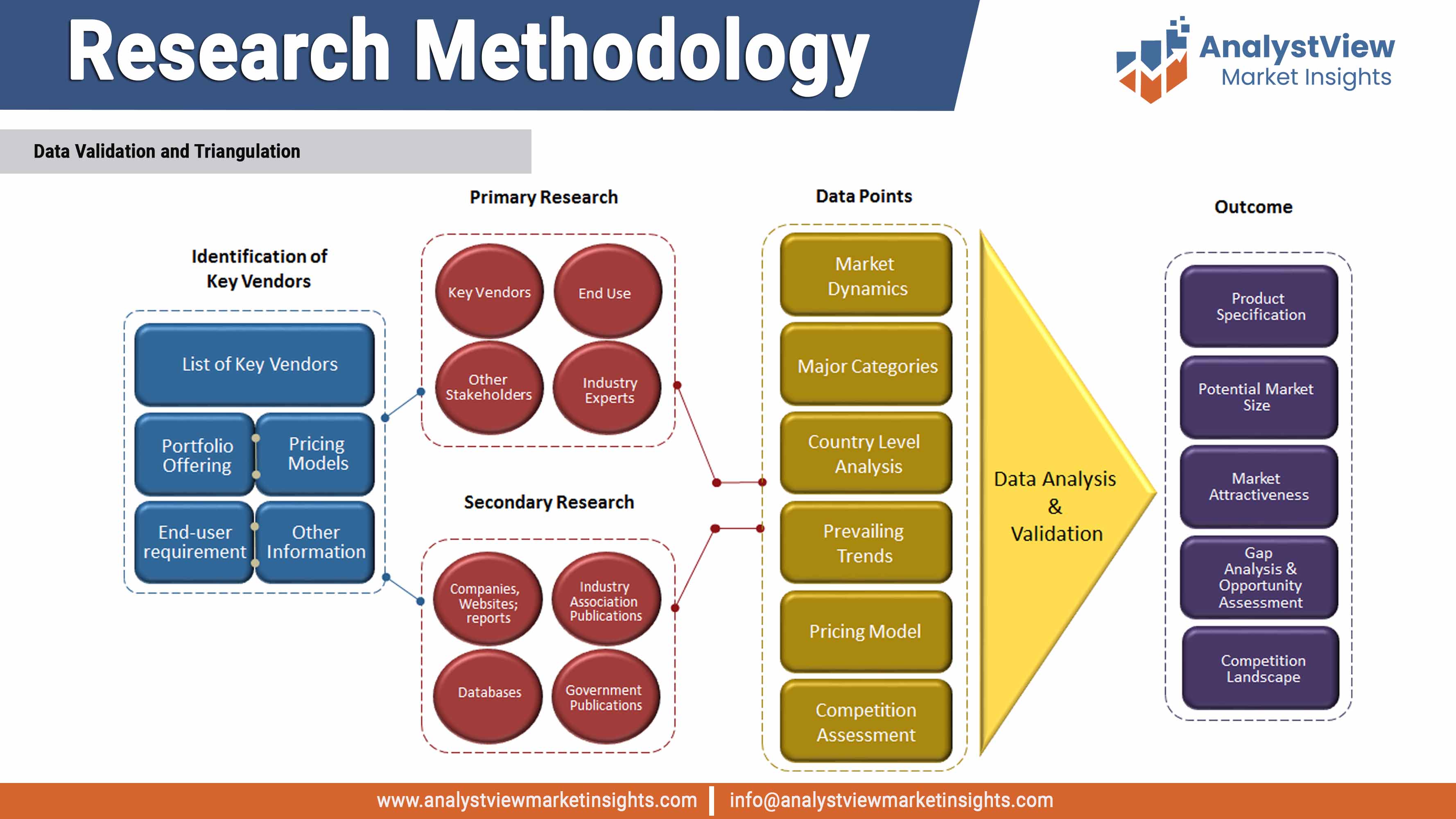

14.1. Research Methodology

14.2. Abbreviations

14.3. Disclaimer

14.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Blood Culture Test Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

Table 10 Blood Culture Test Market, by Product, 2014 – 2025 (USD Million)

Table 11 Blood Culture Test Market, by Technique, 2014 – 2025 (USD Million)

Table 12 Blood Culture Test Market, by Technology, 2014 – 2025 (USD Million)

Table 13 Blood Culture Test Market, by Application, 2014 – 2025 (USD Million)

Table 14 Blood Culture Test Market, by End Use, 2014 – 2025 (USD Million)

Table 15 Blood Culture Test Market, by Geography, 2014 – 2025 (USD Million)

Table 16 North America Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 17 U.S. Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 18 Canada Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 19 Europe Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 20 France Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 21 Germany Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 22 Asia Pacific Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 23 China Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 24 India Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 25 Latin America Blood Culture Test Market, 2014 – 2025 (USD Million)

Table 26 MEA Blood Culture Test Market, 2014 – 2025 (USD Million)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Value Chain Analysis Analysis

Figure 6 Blood Culture Test Market, by Product, 2014 – 2025 (USD Million)

Figure 7 Blood Culture Test Market, by Technique, 2014 – 2025 (USD Million)

Figure 8 Blood Culture Test Market, by Technology, 2014 – 2025 (USD Million)

Figure 9 Blood Culture Test Market, by Application, 2014 – 2025 (USD Million)

Figure 10 Blood Culture Test Market, by End Use, 2014 – 2025 (USD Million)

Figure 11 Blood Culture Test Market, by Geography, 2014 – 2025 (USD Million)