Preimplantation Genetic Testing Market, By PGD/PGS (PGD and PGS), By Type (Chromosomal Abnormalities, X-linked Diseases, Embryo Testing, Aneuploidy Screening, and HLA Typing), By Application (Embryo HLA typing for stem cell therapy, IVF Prognosis, Late Onset Genetic Disorders, Inherited Genetic Disease and Others) and By Geography (NA, EU, APAC, LATAM and MEA) Analysis, Share, Trends, Size, & Forecast From 2020 2026

REPORT HIGHLIGHT

Preimplantation genetic testing market was valued at USD 175.3 million by 2019, growing with 9.2% CAGR during the forecast period, 2020-2026

Market Dynamics

Abnormality in the chromosomal number is the prime cause of failure in the pregnancy conceived in natural or by in-vitro fertilization. Especially in the case of IVF, different technologies have introduced to identify that an equal number of chromosomes are present in each of the haploid chromosomal sets. Preimplantation genetic testing (PGT) also known as embryo biopsy is the test performed on the embryo for analyzing the genetic abnormalities prior to its incorporation into the womb in the process of in-vitro fertilization (IVF). It is used for the identification of any possible genetic defect in these embryos in IVF. It is early type of prenatal genetic diagnosis used for investigating prenatal screening of the embryo prior to implantation. PGT is performed for ensuring that the embryo introduced shows high prevalence of healthy and normal pregnancy. PGT has emerged as a useful test for couples with genetic disorders, which have a high probability of transferring into the baby as well.

PGT involves testing monogenetic diseases, the structural arrangement of the chromosome, and abnormal chromosomal numbers. The growth of the PGT market is experiencing growth owing to the rise in the success rate in the in-vitro fertilization. Increasing adoption of IVF technique due to rising issues regarding infertility within both genders, an outcome of an unhealthy lifestyle. Ongoing advancement in the area of IVF, to increase the chance of healthy pregnancy, is driving worldwide industry growth. Also, the rise in genetic disorders is another factor fueling the demand for IVF. According to the World Health Organization (WHO), the prevalence of all single-gene disorders at birth is 10 in 1,000. The aforementioned factors would, in turn, support the market growth to a great extent. On the flip side, the high cost associated with this procedure is expected to pull back the market growth in the future. In addition to this, ethical concerns with PGT is another factor hindering the market growth.

PGD/PGS Takeaway

Among PGD and PGS, PGD accounted for more than 50% of the total market share in 2019. Preimplantation genetic diagnosis (PGD) includes testing of the embryo having either of the parents with some kind of genetic abnormalities. Rise in genetic disorders with higher awareness regarding the inheritance of genetic disorders is driving the demand for PGD testing. Also, the higher efficiency of PGD to detect the genetic disorders in the embryo is also promoting its adoption. Also, different studies have revealed that PGD possesses the ability to diagnose over 2,000 inherited single-gene disorders with accuracy of around 98% in identifying affected and unaffected embryos.

Type Takeaway

Basis on types, the market is divided into chromosomal abnormalities, HLA Typing, embryo testing, X-linked diseases, and aneuploidy screening. In 2019, chromosomal abnormalities gained the highest market share. Increasing the use of PGT for eliminating the risk associated with miscarriage and improve the success of IVF. High incidence of chromosomal incidence in the IVF embryos lowering the success chances of the IVF. Various studies revealed that over 50% of the preimplantation embryos have abnormal chromosomal numbers including polyploidy or aneuploidy. This drives the demand for preimplantation genetic testing market.

Application Takeaway

Application segment is further classified into the IVF prognosis, embryo HLA typing, late-onset genetic disorders, and inherited genetic disease. Out of these, in 2019, the embryo HLA typing category gained the leading position valued at USD 55.9 million. It is important in preventing the transferring of genetic diseases. The adoption of the PGT with HLA typing is increasing at a significant pace owing to an increase in awareness among the couples as radical treatment. HLA typing has emerged as a new method of treatment with higher preference especially for the diseases requiring stem cell transplantation for potential treatment.

Regional Takeaway

On the basis of region, North America and Europe accounted for a significant position in the preimplantation genetic testing market. In North America, the rise in infertility issues especially among the couples suffering from genetic disorders is driving the demand for PGT, for successful pregnancy. As per American Society for Reproductive Medicine, 15% of the couples are infected the fertility wherein around 15%–30% of male factor infertility is owing to genetic abnormalities. Increasing the patient pool with higher adoption of the PGT in Europe is boosting the regional market growth.

Key Vendor Takeaway

Hoffmann-La Roche Ltd., Genea Limited, Illumina, Inc., Quest Diagnostics Incorporated., Natera Inc., CooperSurgical, Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific, Inc., Igenomix, Bioarray S.L., Oxford Gene Technology, Invitae Corporation, PerkinElmer Inc., Reproductive Genetic Innovations, LLC. and California Pacific Medical Center (CPMC) are the key players operating in the preimplantation genetic testing market.

Increasing clinical studies directing towards second-generation preimplantation with unfavorable reproductive and IVF prognosis for improved outcome. Companies are entering into a partnership and new product launches for preimplantation genetic testing. For instance, in 2019, Illumina partnered with the Vitrolife for distribution of pre-implantation genetic testing kit. This kit was specifically designed for monogenic and single gene defects (HumanKaryomap-12) and aneuploidy (PGT-A) (VeriSeq PGS). Likewise, in October 2019, PerkinElmer launched PG-Seq Rapid Non-Invasive Preimplantation Genetic Testing for Aneuploidy (PGT-A) kit.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

GLOBAL PREIMPLANTATION GENETIC TESTING MARKET KEY PLAYERS

- Thermo Fisher Scientific, Inc.

- Igenomix

- Bioarray S.L.

- Quest Diagnostics Incorporated.

- Natera Inc.

- Oxford Gene Technology

- Invitae Corporation

- PerkinElmer Inc.

- Reproductive Genetic Innovations, LLC

- California Pacific Medical Center (CPMC)

- Hoffmann-La Roche Ltd.

- Genea Limited

- Illumina, Inc.

- CooperSurgical, Inc.

- Laboratory Corporation of America Holdings

GLOBAL PREIMPLANTATION GENETIC TESTING MARKET BY PGD/PGS

- Preimplantation Genetic Screening (PGS)

- Preimplantation Genetic Diagnosis (PGD)

GLOBAL PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE

- Aneuploidy Screening

- Chromosomal Abnormalities

- HLA Typing

- X-linked Diseases

- Embryo Testing

- Fresh Embryo (Donor Eggs)

- Fresh Embryo (Own Eggs)

- Frozen Embryo (Donor Eggs)

- Frozen Embryo (Own Eggs)

- Other PGT Types

GLOBAL PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION

- Late-Onset Genetic Disorders

- Inherited Genetic Disease

- Embryo HLA typing for stem cell therapy

- IVF Prognosis

- Others

GLOBAL PREIMPLANTATION GENETIC TESTING MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. PREIMPLANTATION GENETIC TESTING MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by PGD/PGS

2.1.2. Market Snippet by Type

2.1.3. Market Snippet by Application

2.1.4. Market Snippet by Region

2.2. Competitive Insights

3. PREIMPLANTATION GENETIC TESTING KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. PREIMPLANTATION GENETIC TESTING INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. PREIMPLANTATION GENETIC TESTING MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. PREIMPLANTATION GENETIC TESTING MARKET – BY PGD/PGS

6.1. Overview

6.1.1. Segment Share Analysis, By Type, 2019 & 2026 (%)

6.2. Preimplantation Genetic Diagnosis (PGD)

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Preimplantation Genetic Screening (PGS)

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. PREIMPLANTATION GENETIC TESTING MARKET – BY TYPE

7.1. Overview

7.1.1. Segment Share Analysis, By Type, 2019 & 2026 (%)

7.2. Chromosomal Abnormalities

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. X-linked Diseases

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4. Embryo Testing

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4.3. Fresh Embryo (Own Eggs)

7.4.3.1. Overview

7.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4.4. Frozen Embryo (Own Eggs)

7.4.4.1. Overview

7.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4.5. Fresh Embryo (Donor Eggs)

7.4.5.1. Overview

7.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4.6. Frozen Embryo (Donor Eggs)

7.4.6.1. Overview

7.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.5. Aneuploidy Screening

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.6. HLA Typing

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.7. Other PGT Types

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. PREIMPLANTATION GENETIC TESTING MARKET – BY APPLICATION

8.1. Overview

8.1.1. Segment Share Analysis, By Application, 2019 & 2026 (%)

8.2. Embryo HLA typing for stem cell therapy

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. IVF Prognosis

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Late-Onset Genetic Disorders

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. Inherited Genetic Disease

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. Others

8.6.1. Overview

8.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. PREIMPLANTATION GENETIC TESTING MARKET– BY GEOGRAPHY

9.1. Introduction

9.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

9.2. North America

9.2.1. Overview

9.2.2. Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.2.4. North America Market Size and Forecast, By PGD/PGS, 2015 – 2026 (US$ Million)

9.2.5. North America Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

9.2.6. North America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.2.7. U.S.

9.2.7.1. Overview

9.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.2.8. Canada

9.2.8.1. Overview

9.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3. Europe

9.3.1. Overview

9.3.2. Key Manufacturers in Europe

9.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.3.4. Europe Market Size and Forecast, By PGD/PGS, 2015 – 2026 (US$ Million)

9.3.5. Europe Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

9.3.6. Europe Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.3.7. Germany

9.3.7.1. Overview

9.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.8. Italy

9.3.8.1. Overview

9.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.9. United Kingdom

9.3.9.1. Overview

9.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.10. France

9.3.10.1. Overview

9.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.3.11. Rest of Europe

9.3.11.1. Overview

9.3.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4. Asia Pacific (APAC)

9.4.1. Overview

9.4.2. Key Manufacturers in Asia Pacific

9.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.4.4. Asia Pacific Market Size and Forecast, By PGD/PGS, 2015 – 2026 (US$ Million)

9.4.5. Asia Pacific Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

9.4.6. Asia Pacific Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.4.7. India

9.4.7.1. Overview

9.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.8. China

9.4.8.1. Overview

9.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.9. Japan

9.4.9.1. Overview

9.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.10. South Korea

9.4.10.1. Overview

9.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.4.11. Rest of APAC

9.4.11.1. Overview

9.4.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5. Latin America

9.5.1. Overview

9.5.2. Key Manufacturers in Latin America

9.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.5.4. Latin America Market Size and Forecast, By PGD/PGS, 2015 – 2026 (US$ Million)

9.5.5. Latin America Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

9.5.6. Latin America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.5.7. Brazil

9.5.7.1. Overview

9.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5.8. Mexico

9.5.8.1. Overview

9.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5.9. Argentina

9.5.9.1. Overview

9.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.5.10. Rest of LATAM

9.5.10.1. Overview

9.5.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.6. Middle East and Africa

9.6.1. Overview

9.6.2. Key Manufacturers in Middle East and Africa

9.6.3. Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

9.6.4. Middle East and Africa Market Size and Forecast, By PGD/PGS, 2015 – 2026 (US$ Million)

9.6.5. Middle East and Africa Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

9.6.6. Middle East and Africa Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

9.6.7. Saudi Arabia

9.6.7.1. Overview

9.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9.6.8. United Arab Emirates

9.6.8.1. Overview

9.6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

10. KEY VENDOR ANALYSIS

10.1. F. Hoffmann-La Roche Ltd.

10.1.1. Company Snapshot

10.1.2. Financial Performance

10.1.3. Product Benchmarking

10.1.4. Strategic Initiatives

10.2. CooperSurgical, Inc.

10.3. Laboratory Corporation of America Holdings

10.4. Thermo Fisher Scientific, Inc.

10.5. Igenomix

10.6. Bioarray S.L.

10.7. Oxford Gene Technology

10.8. Invitae Corporation

10.9. PerkinElmer Inc.

10.10. Genea Limited, Illumina, Inc.

10.11. Quest Diagnostics Incorporated.

10.12. Natera Inc.

10.13. Reproductive Genetic Innovations, LLC.

10.14. California Pacific Medical Center (CPMC)

11. 360 DEGREE ANALYSTVIEW

12. APPENDIX

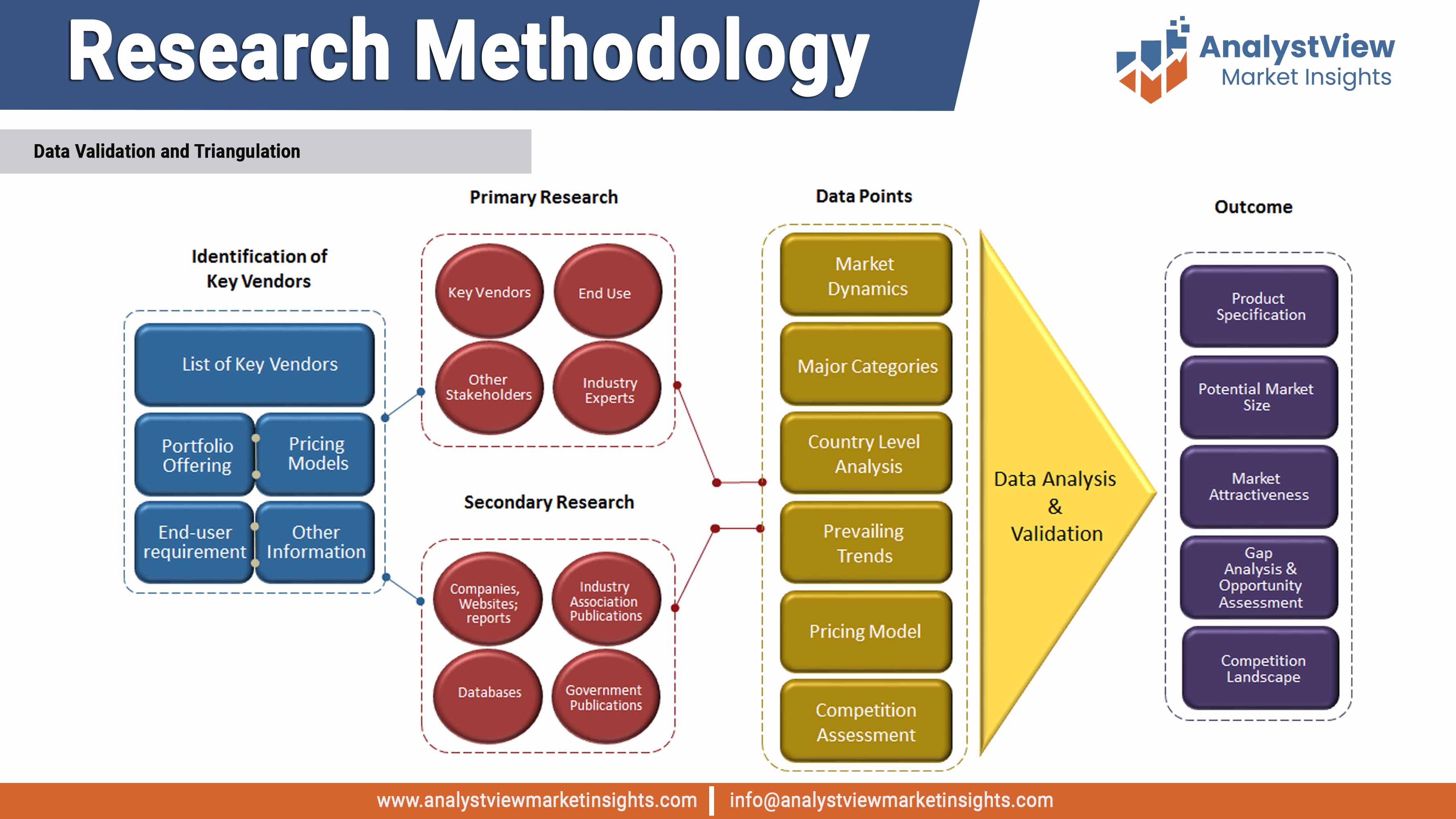

12.1. Research Methodology

12.2. References

12.3. Abbreviations

12.4. Disclaimer

12.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Preimplantation genetic testing market: PGD/PGS Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by PGD/PGS

TABLE Global Preimplantation genetic testing market, by PGD/PGS 2015-2026 (USD Million)

TABLE Preimplantation genetic testing market: Type Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Type

TABLE Global Preimplantation genetic testing market, by Type 2015-2026 (USD Million)

TABLE Preimplantation genetic testing market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Preimplantation genetic testing market, by Application 2015-2026 (USD Million)

TABLE Preimplantation genetic testing market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Preimplantation genetic testing market, by Region 2015-2026 (USD Million)

TABLE North America Preimplantation genetic testing market, by Country, 2015-2026 (USD Million)

TABLE North America Preimplantation genetic testing market, by PGD/PGS, 2015-2026 (USD Million)

TABLE North America Preimplantation genetic testing market, by Type, 2015-2026 (USD Million)

TABLE North America Preimplantation genetic testing market, by Application, 2015-2026 (USD Million)

TABLE Europe Preimplantation genetic testing market, by country, 2015-2026 (USD Million)

TABLE Europe Preimplantation genetic testing market, by PGD/PGS, 2015-2026 (USD Million)

TABLE Europe Preimplantation genetic testing market, by Type, 2015-2026 (USD Million)

TABLE Europe Preimplantation genetic testing market, by Application, 2015-2026 (USD Million)

TABLE Asia Pacific Preimplantation genetic testing market, by country, 2015-2026 (USD Million)

TABLE Asia Pacific Preimplantation genetic testing market, by PGD/PGS, 2015-2026 (USD Million)

TABLE Asia Pacific Preimplantation genetic testing market, by Type, 2015-2026 (USD Million)

TABLE Asia Pacific Preimplantation genetic testing market, by Application, 2015-2026 (USD Million)

TABLE Latin America Preimplantation genetic testing market, by country, 2015-2026 (USD Million)

TABLE Latin America Preimplantation genetic testing market, by PGD/PGS, 2015-2026 (USD Million)

TABLE Latin America Preimplantation genetic testing market, by Type, 2015-2026 (USD Million)

TABLE Latin America Preimplantation genetic testing market, by Application, 2015-2026 (USD Million)

TABLE Middle East and Africa Preimplantation genetic testing market, by country, 2015-2026 (USD Million)

TABLE Middle East and Africa Preimplantation genetic testing market, by PGD/PGS, 2015-2026 (USD Million)

TABLE Middle East and Africa Preimplantation genetic testing market, by Type, 2015-2026 (USD Million)

TABLE Middle East and Africa Preimplantation genetic testing market, by Application, 2015-2026 (USD Million)

List of Figures

FIGURE Preimplantation genetic testing market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE PGD/PGS segment market share analysis, 2019 & 2026

FIGURE PGD/PGS segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Preimplantation Genetic Diagnosis (PGD) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Preimplantation Genetic Screening (PGS) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Type segment market share analysis, 2019 & 2026

FIGURE Type segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Chromosomal Abnormalities market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE X-linked Diseases market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Embryo Testing market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Fresh Embryo (Own Eggs) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Frozen Embryo (Own Eggs) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Fresh Embryo (Donor Eggs) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Frozen Embryo (Donor Eggs) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Aneuploidy Screening market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE HLA Typing market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Other PGT Types market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Application segment market share analysis, 2019 & 2026

FIGURE Application segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Embryo HLA typing for stem cell therapy market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE IVF Prognosis market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Late Onset Genetic Disorders market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Inherited Genetic Disease market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Others market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Regional segment market share analysis, 2019 & 2026

FIGURE Regional segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE North America Preimplantation genetic testing market share and leading players, 2018

FIGURE Europe Preimplantation genetic testing market share and leading players, 2018

FIGURE Asia Pacific Preimplantation genetic testing market share and leading players, 2018

FIGURE Latin America Preimplantation genetic testing market share and leading players, 2018

FIGURE Middle East and Africa Preimplantation genetic testing market share and leading players, 2018

FIGURE North America Preimplantation genetic testing market share analysis by country, 2018

FIGURE U.S. Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Canada Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Europe Preimplantation genetic testing market share analysis by country, 2018

FIGURE Germany Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Spain Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Italy Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE UK Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE France Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of the Europe Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Asia Pacific Preimplantation genetic testing market share analysis by country, 2018

FIGURE India Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE China Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Japan Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE South Korea Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Singapore Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of APAC Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Preimplantation genetic testing market share analysis by country, 2018

FIGURE Brazil Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mexico Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Argentina Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of LATAM Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Preimplantation genetic testing market share analysis by country, 2018

FIGURE Saudi Arabia Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE United Arab Emirates Preimplantation genetic testing market size, forecast and trend analysis, 2015 to 2026 (USD Million)